Mid-term elections

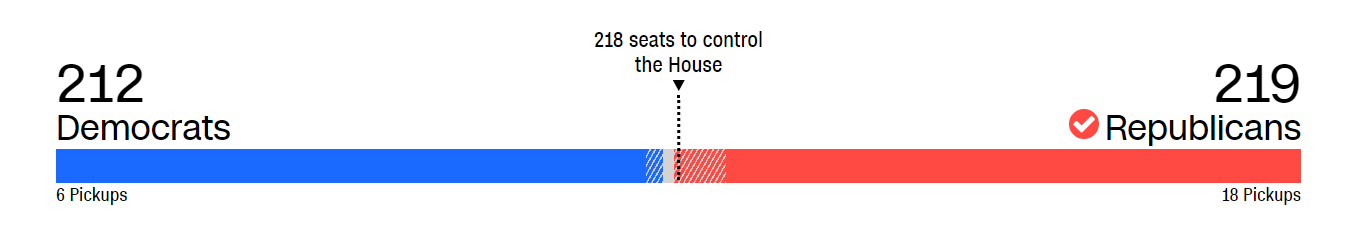

As of November 20th, although the votes in the mid-term elections in the United States have not been fully counted, the result is confirmed, Republicans regained control of the House of Representatives by 219: 212 (higher than 218 votes), while the Democrats continued to lock the Senate (50 seats, plus one vote for the vice president). The divided Congress has confirmed.

Despite winning the House of Representatives, the Republicans did not have a "Red Wave", weaker than the market expected. There may be many reasons, including the error of previous polls and the influence of mail-in votes. But it has already turned out to be, Republicans are difficult to form an absolute dominance in Congress.

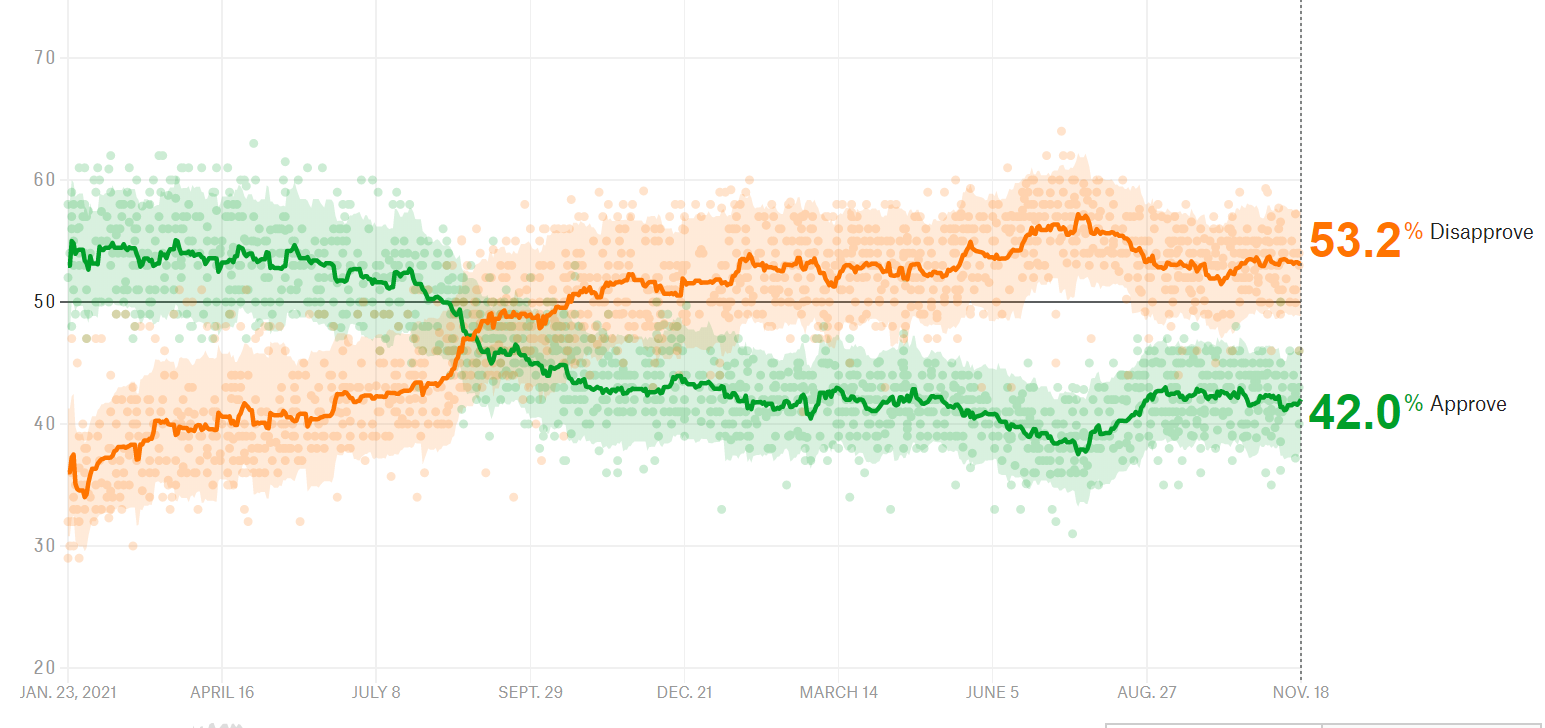

Democrats, it is obvious that due to the impact of the previous pandemic and the high inflationary pressure before the election, not only the House of Representatives was lost, but also President Biden's continued low support rate.

What are the direct economic consequences?

Obviously, Republicans have louder voice in fiscal policy (The U.S. Constitution states that all tax-related acts, appropriation acts, or authorizations to spend federal funds should be proposed by the House of Representatives, while the Senate has no authority to do so). Therefore, the risk of debt ceiling of US National Government Debt is also increasing, and the possibility of government shutdown is increasing again. Up to now, the scale of United States's National Government Debt has reached 31.3 trillion US dollars, approaching the legal debt ceiling of 31.4 trillion US dollars.

Possible government expenditure cases include:

- The $1.9 trillion fiscal stimulus act in March 2021

- The $550 billion infrastructure act in November 2021

- The $1.75 trillion "Build Back Better" that has not yet been passed

- The Chips and Science Act passed in August 2022

- Inflation Reduction Act of 2022

- The Public Service Loan Forgiveness (PSLF) program, which was temporarily blocked.

The affected industries range from manufacturing, financial technology, to non-essential consumer goods.$SPDR Dow Jones Industrial Average ETF Trust(DIA)$$Caterpillar(CAT)$$SoFi Technologies Inc.(SOFI)$

On the other hand, Democrats dominate the appointment of officials, nominations of judges and foreign affairs (The Senate has the right to confirm members of the President's Cabinet and Supreme Court justices, and diplomatic agreements reached by the President of the United States with other countries need to be approved by the Senate before they can have legal effect).

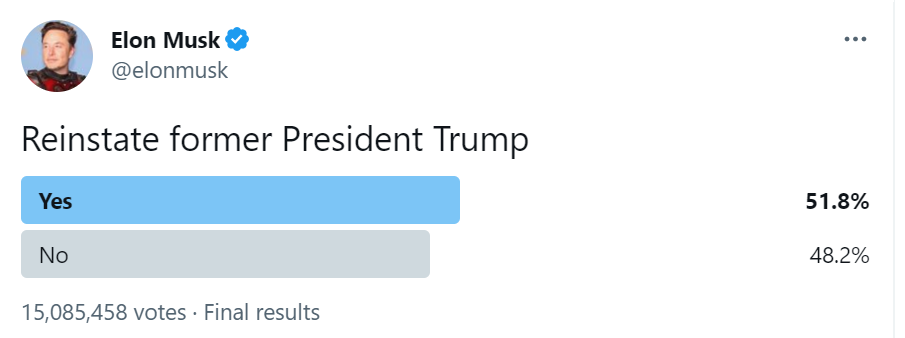

In other words, the Democratic nominee for justice, It may bring a blow to Trump, who will run for president in the future. At the same time, the Democratic Party's foreign policy will continue to be implemented (such as the alliance formed between the United States and other countries), and the previous geographical uncertainty will not be weakened. In addition, the investigation of former President Trump may make the situation more tense.

Federal Reserve Officials Speeches

First of all, Powell only started his second term in May this year, so he is not under pressure to change. Therefore, the Fed's monetary policy as a whole can remain coherent (that is, Powell firmly believes in it).

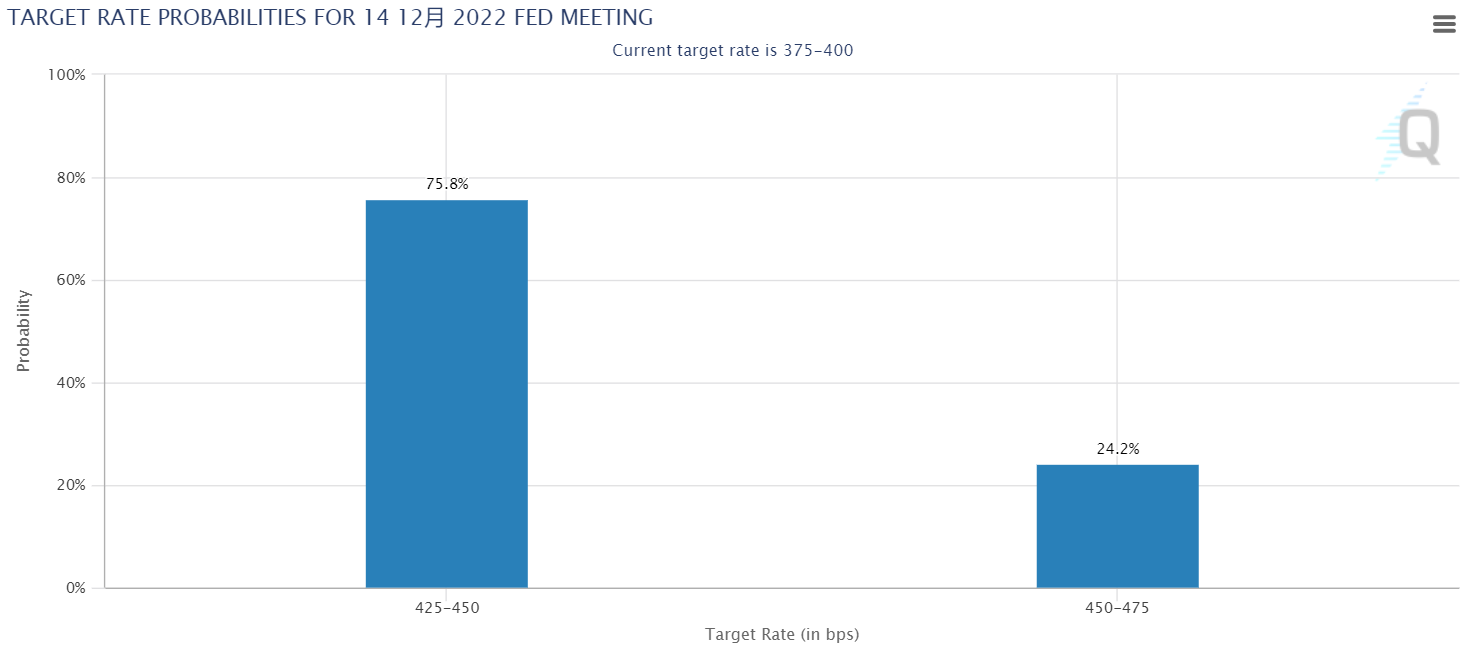

CPI inflation cooled in October, and the market reacted strongly to it. According to the Federal Reserve's monetary policy observation tool, the probability of raising interest rates by 50 basis points in December reached 75%, but it was slightly lower than last week's 80%. Because Fed officials, unlike most market observations, are still cautious. The attitude of Fed officials who speak frequently is generally eagle.

Federal Reserve Governor Christopher Waller(Hawkish)Said on Thursday

Don't expect September employment or inflation data later this month to change any Fed officials' thinking about the need for another big rate hike in November, which, despite seeing some progress in the economy to dampen demand, supports continued rate hikes, with financial markets overreacting to October's slowdown in inflation.

St. Louis Fed Chairman James Bullard (Hawkish) Said,

According to Taylor's rule, the federal funds rate should rise to at least 5%-5.25%.

Esther George, chairman of the Kansas Fed(Dovish)Said,

Although the supply chain has been repaired, the labor force (shortage) will still support inflation. History shows that inflation is difficult to fall back unless it is a recession;

Even Mary Daly, chairman of the San Francisco Federal Reserve,(Dovish)It is also believed that,

We have not seen substantial further progress, we are still looking for substantial further progress, and it is far from time to talk about stopping raising interest rates.

The market believes that the Fed is "once bitten by a snake, twice shy", and the fault tolerance space is very small. After misjudging the rise of inflation last year, we can no longer underestimate inflation. In addition, at present, only commodity inflation has dropped, while service inflation is still very strong.

However, as we said last time, it is difficult to say how much of the service inflation program is "thanks to the Federal Reserve".

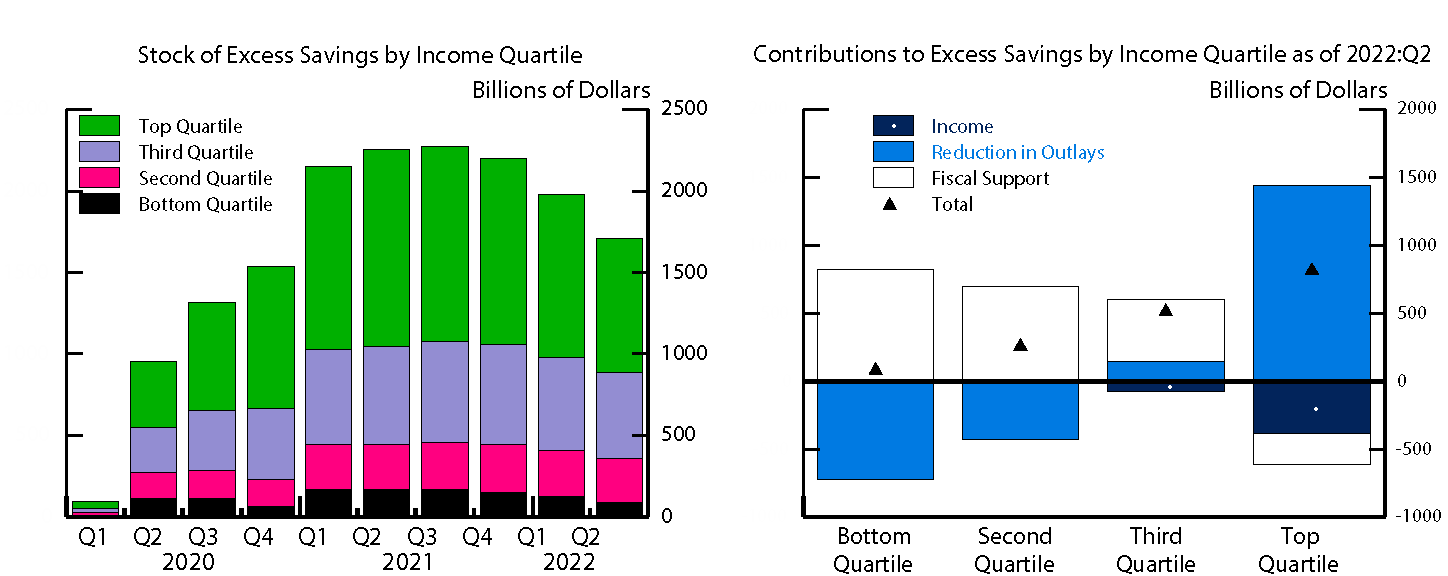

Finally, from the data level, the retail sales data in October was better than expected, indicating that the consumption kinetic energy rebounded, which made the Fed afraid to take it lightly. Part of this is the reason why excess saving is still high. As of the middle of this year, there are still about 1 trillion dollars. In terms of income groups, the relative level of excess savings of low-and middle-income groups is still relatively high. They hold a total of about 350 billion US dollars of excess savings, with an average of about 5,500 US dollars per household. In 2019, these families held an average of about 8,000 US dollars in their trading accounts. Liquidity from excess savings still increases their liquid assets by about two-thirds, providing a "cushion" for US consumer spending.

However, according to the current situation that major companies begin to lay off employees, it may not last long.

Comments