If you look at the comparison of 2008 and the current US stocks, the current stocks are making a final climb towards the top and would dive after the FOMC resolution result was announced.

- But the question is, What technical and fundamental factors can support the US stocks to repeat the same curve?

The answer is no, or even the opposite.

As far as I can see, although there will be a double dip in US stocks after the rebound, it is still very likely that $S&P 500(.SPX)$will build a bottom in the current area around 3600 points and rebound after the mid-term elections in the US.

1. Market status: At the bottom of panic, there is still a wall of worry

According to a well-known bear market theory,

the market often priced in all negative expectations ahead of schedule, and starts to fluctuate to the bottom after a large decline.

When market becomes stable, stocks will slowly try to break through and then encounter selling pressure at a position. This position can be called the wall of worry. Although the bad news has been priced in, it has not completely landed.

This classic theory is perfect for observing the current $S&P 500(.SPX)$.

In the above technical diagram, you need to pay attention to two key points

1. S&P has just broken through the downward trend of the daily line, forming a small short covering trend as the last two times.

2. 4100 points above the current position is the resistance level of the long-term downward trend. There is a high probability that S&P will peak here and start a double dip.

2. Fed meeting within expectations? Friday is key to S&P Rebound

The outcome of Fed meeting is exactly what we expected before:

Powell implied that Fed may slow rate hike path and accelerate the interest rate cut expected by the market.

Although it is overall hawkish: for example, the overall interest rate hike curve was raised again, and will remain high for a long time.

But it's within expectation. S&P retreated but did not fall below the key support of the 20-day MA.

The trend on Friday is very critical. If it can stabilize on the 20-day moving average, it means that the rebound is not over.

Fed slows down the pace, but lift the end point because it aims to exchange time for space.

Reasons:

Strong dollar cannot end in the near future, and the approaching election and the demand for a soft landing in the market after the election, the inevitable way is to raise interest rates slowly and cut interest rates quickly.

However, the Asia-Pacific market is hard to predict. The Asia-Pacific has always been much more sensitive than US stocks in its response to the strong US dollar.

In particular, the yen and RMB fall synchronously. In short, if the US dollar can't fall, it will be difficult for Hang Seng and A shares to rise. Hang Seng has started to fall back at present, so you can try more on dips, but you have to stop the profit as soon as possible at a high level.

3. Why this is the bottom of the US stock market?

1) According to the statistics of the US stock market since World War II, the bear market bottomed out the most in October, with the Dow, S&P and Nasdaq bottoming out 8, 7 and 6 times respectively, far exceeding other months.

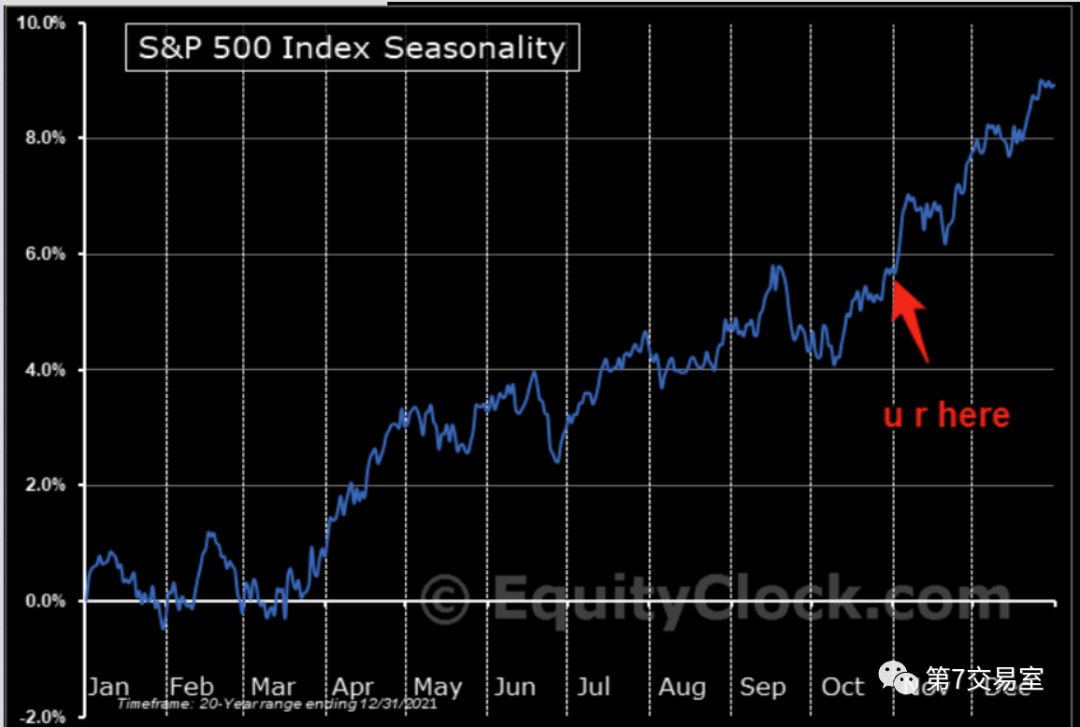

2) From the long-term S&P seasonal trend, the future trend is likely to be upward

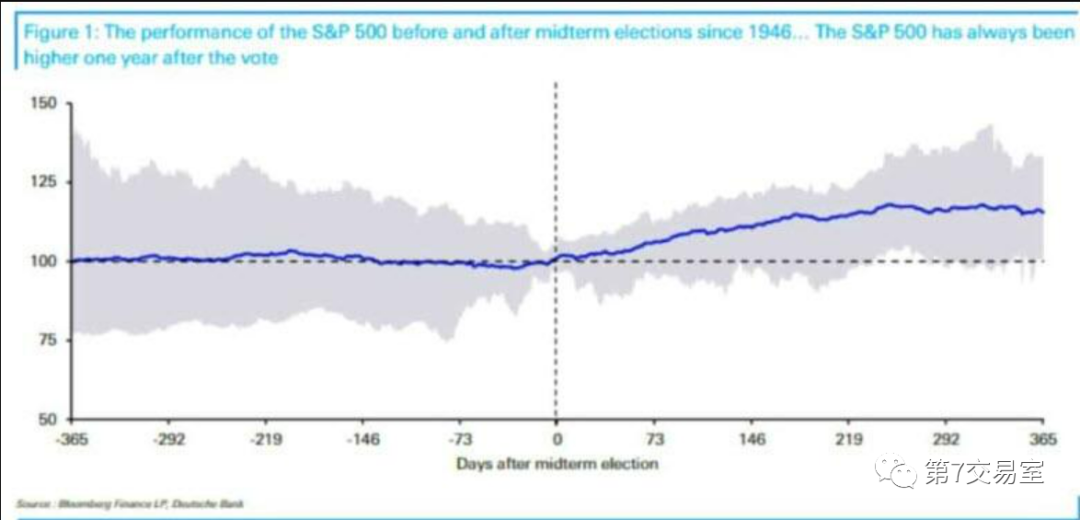

It is even more obvious if the trend of S&P in the year before and after the mid-term elections in the United States since 1946 runs into an interval chart

3) The average trend of the long-term market bottomed out after the mid-term elections, and then slowly rose to start a new bull market

4) Powell's rate hikes slow down after the midterm

The reason is very simple. After the election, the new government will push for administrative actions, save the market and the economy, and issue bonds with funds. It is unlikely that the financial environment is too tight and the economic environment is too laissez-faire.

After mideterm, the urgency of the Fed's interest rate hike is not so great;

Before the election, Powell will have to balance inflation and interest rate hike because of the Democratic Party's oppression, so as not to make the expectation of recession too obvious.

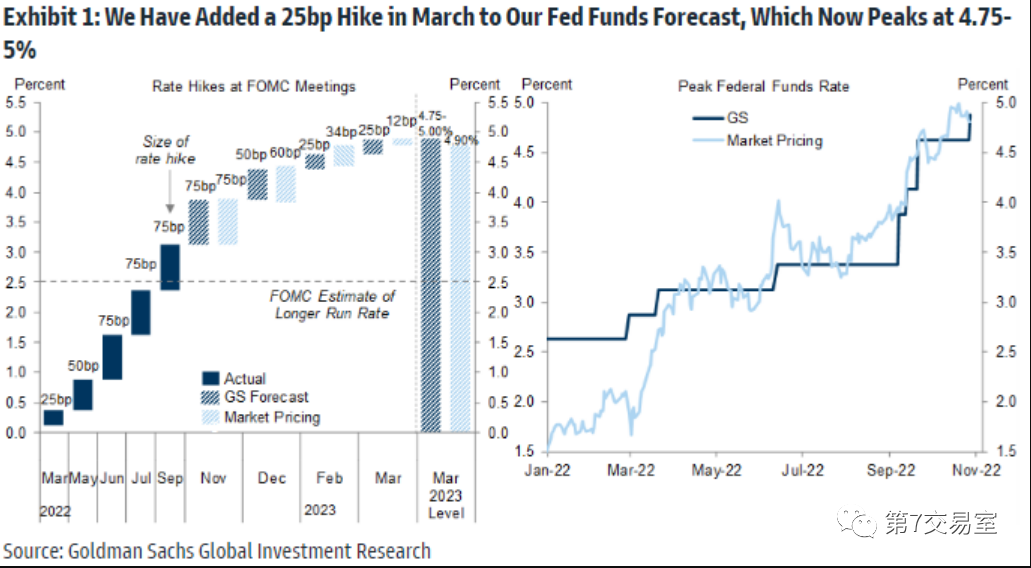

The financial report and the economic data is mixed. At present, the market expects the Fed to raise interest rates to reach a tight balance around the peak of 4.7% this year.

Goldman Sachs believes that the path of raising interest rates is likely to be like this:

75 basis points in November, 50 basis points in December, 25 basis points in February and 25 basis points in March next year.

US will continue to harvest global hot money with strong dollars; but it will slow down the steps in the future and leave the new government more room to reduce inflation and save the market.

As a last resort, we can only keep interest rates at a high level for a longer time by raising interest rates slowly and cutting interest rates quickly.

Bottome Line

1. Around 3500 points of $S&P 500(.SPX)$ will probably be the bottom of this bear market. The recession may not be as terrible as we thought before, and we will enter a mild recession or stagflation period, and the current decline in US stocks may be enough.

2. Although more external risks still exist, for the near future, whether the market will fall below the 20-day MA after Powell's speech is the top priority of the future trend. If it is not broken, the market will rebound.

$E-mini Nasdaq 100 - main 2212(NQmain)$ $E-mini S&P 500 - main 2212(ESmain)$ $E-mini Dow Jones - main 2212(YMmain)$ $Gold - main 2212(GCmain)$ $Light Crude Oil - main 2212(CLmain)$

Comments