Bed Bath & Beyond stock took off over 20% despite outsize loss.

Net sales declined 33% compared with the year-ago quarter, Bed Bath said, as fewer people visited its stores and management battled with shortages of inventory as the company pivots away from private brands and shifts back toward favoring national brands.

“At the beginning of the third quarter, we initiated a turnaround plan anchored on serving our loyal customers, following a period when our merchandise and strategy had veered away from their preferences,” said CEO Sue Gove in a statement. “Although we moved quickly and effectively to change the assortment and other merchandising and marketing strategies, inventory was constrained and we did not achieve our goals.”

Same-store sales declined by 32%, while analysts’ estimates called for a decline of 25.9%. Adjusted gross margin was 22.8%, down from 35.9% in the same quarter a year ago.

Bed Bath’s management said selling, general and administrative expenses came in at $583.6 million, down from $698 million a year ago. The company said it was on track to deliver $500 million in cost savings for fiscal 2022, which ends in February, including by closing 150 stores by the end of the fiscal year.

Management released a list of just under 130 stores that would be closing in the coming weeks across various states. Bed Bath is also planning on cutting an additional $80 million to $100 million in costs across the company, including overall expenses and headcount.

Those strategies are critical given that the company continues to burn through cash. For the third quarter, Bed Bath reported negative cash flow of $307.6 million.

Last year was the most volatile on record for Bed Bath & Beyond as management changes, earnings misses, and meme-stock craziness kept shares on a roller-coaster ride. And last week, the struggling retailer warned it was considering filing for bankruptcy after calling off a debt exchange announced in the fall.

On Tuesday, management reaffirmed that they were considering “all strategic alternatives” to accomplish their goals for the company. Those alternatives may include bankruptcy, the company said last week, when management said there were concerns over the company’s ability to continue. Bed Bath didn’t repeat that on Tuesday, but it scrapped its usual question and answer with analysts during a call with investors and didn’t give an update on the financial outlook.

“It’s clear to us that ‘behind the scenes’ conversations are pointing in the direction of bankruptcy,” wrote Wells Fargo analyst Zachary Fadem in a research note on Tuesday. “Considering last week’s update, today was a ‘nothing-burger;’ but we’re cutting numbers and reiterating our Underweight view with a potential bankruptcy filing in sight.”

Following last week’s announcement, Fadem cut his price target in half to $1 from $2.

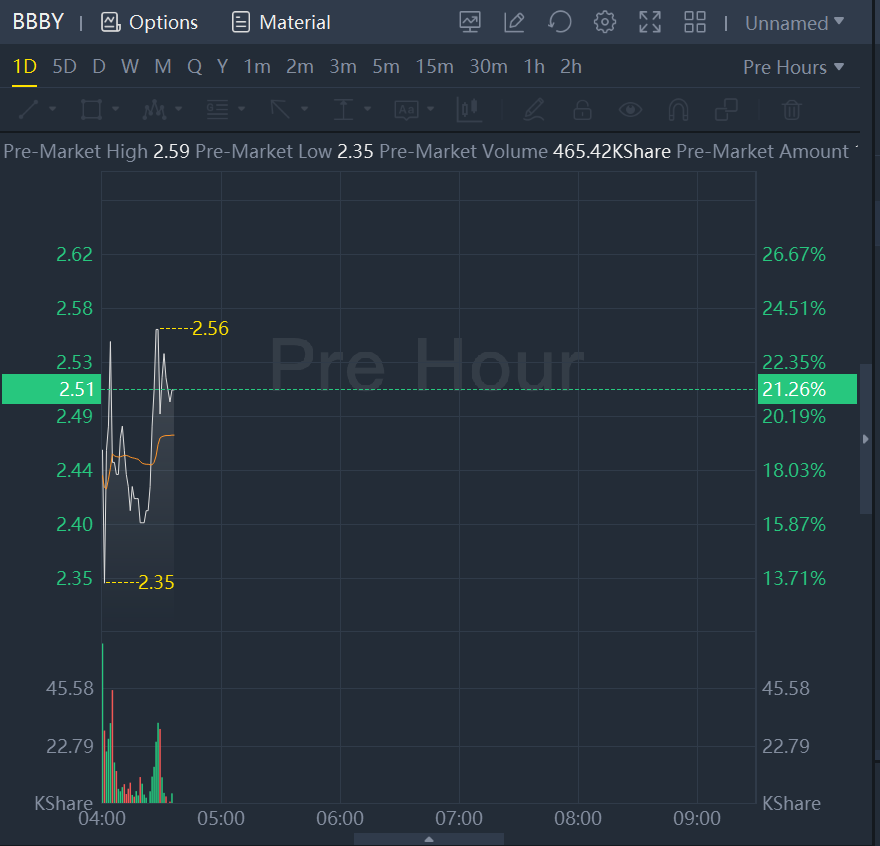

The market didn’t seem to share Fadem’s pessimism. Shares of Bed Bath & Beyond were up about 28% to $2.07 on Tuesday and gained another 13% in aftermarket trading.

As evidenced last year, the stock is prone to large swings, largely because investors have bet aggressively that the price will fall. Nearly half of the stock available for trading is sold short, making the shares vulnerable to sudden swings as those positions are closed out.

Postings on social media sites popular among retail traders pointed to an upswing in interest in the shares, some indicating hope that gains in the stock will force short sellers to close their positions. That could bring even more gains.

“Loved sucking that money from shorts,” one post read. “The surprise on their face when it hits them again will be priceless.”