Amazon, the global e-commerce and web services company, will report Q1 FY23 earnings on Thursday, April 27 after the market closes.

Analysts expect Amazon to post revenue of $124.63 billion, Adjusted net profit of $6.03 billion, and adjusted EPS of $0.438 for the quarter, according to Bloomberg consensus.

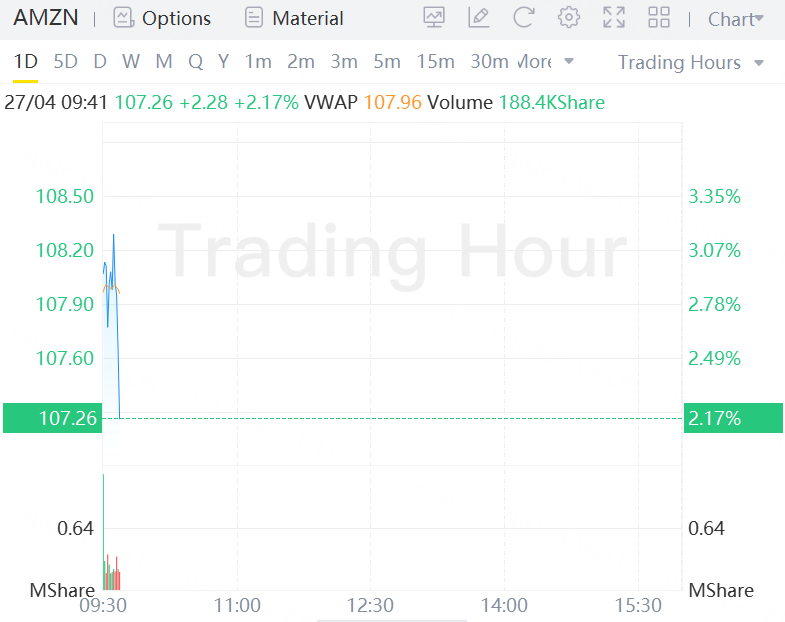

Amazon stock gains over 2% in morning trading ahead of earnings.

A Heightened Focus On Cost Savings

After the second round of job cuts, Arun Sundaram, senior equity analyst at CFRA, maintained a buy rating on Amazon stock.

"While some may view these job cuts as a sign of a gloomier macro outlook, especially as it relates to cloud computing and digital advertising, we believe investors will appreciate Amazon's heightened focus on cost savings and free cash flow," Sundaram wrote in a note to clients.

The most recent layoff announcements, in March, came after Amazon announced fourth-quarter results on Feb. 2. The company beat on revenue but missed on earnings, as its typically strong cloud computing unit failed to rescue the e-commerce giant.

The cloud unit showed that revenue decelerated. AWS sales jumped 20% to $21.4 billion, but that was below expectations and a deceleration from 27% growth in the prior quarter

Oppenheimer analyst Jason Helfstein said more cost-cutting efforts are needed. "We believe more layoffs are necessary for e-commerce to become meaningfully profitable," he said in his note to clients.

2 Key Metrics:Amazon Web Services & Free Cash Flow

The first metric is Amazon Web Services' top line growth and the second metric is Amazon's free cash flow.

If there is a way for Amazon to surprise regarding Q1'23 earnings it would likely relate to Amazon Web Services which is Amazon's growth engine. The company has seen a serious ramp in revenues in the last two years, with growth accelerating during the pandemic. But the segment's top line growth has started to slow down in the second half of FY 2022 as companies have become more careful about spending money in a high-inflation world.

Amazon Web Services' top line growth slowed to 20% in Q4'22, down from 40% in the year-earlier period. While 20% is still a great growth rate, the market should ready itself for a further slowdown in growth in Q1'23 as the macro picture did not improve and the financial crisis may have further added uncertainty to an already weakening economy.

Turning to free cash flow.

Since Amazon still suffers from a slowdown in the e-Commerce economy following a major pandemic boom, the e-Commerce is likely to report yet another quarter of negative free cash flow. Like its operating income trend, Amazon has taken a free cash flow hit in FY 2022 as the company has seen weakening operating cash flow growth and continues to invest aggressively in new products and services. The result has been a steep decline in free cash flow which declined 28% year over year in Q4'22. With that said, should Amazon surprise, against all odds, with strong free cash flow, shares of Amazon may revalue higher post-earnings.

Amazon Jumps Into Artificial Intelligence

On April 13, Amazon jumped into the booming field of generative artificial intelligence, the technology behind ChatGPT. Amazon stock climbed on the news, as did other AI companies.

Alphabet and Microsoft (MSFT) previously announced plans to bring ChatGPT to the public. Meanwhile, Amazon's cloud computing unit, Amazon Web Services, plans to target corporate customers.

AWS will also expand access to custom-made chips. They say the chips can run AI software more efficiently and cheaper than competitors can.

"Machine learning has been a technology with high promise for several decades. But it's only been the last five to 10 years that it's started to be used more pervasively by companies," Chief Executive Andy Jassy said in his letter to shareholders.

Machine learning is a form of artificial intelligence.

Jassy went on to say: "We will continue to invest substantially in these models across all of our consumer, seller, brand and creator experience."