CrowdStrike Holdings Inc. shares rose in the extended session Thursday after the cybersecurity company’s quarterly results and outlook topped Wall Street estimates.

CrowdStrike CRWD,shares gained 3% after hours, following a 2.1% decline in the regular session to close at $216.

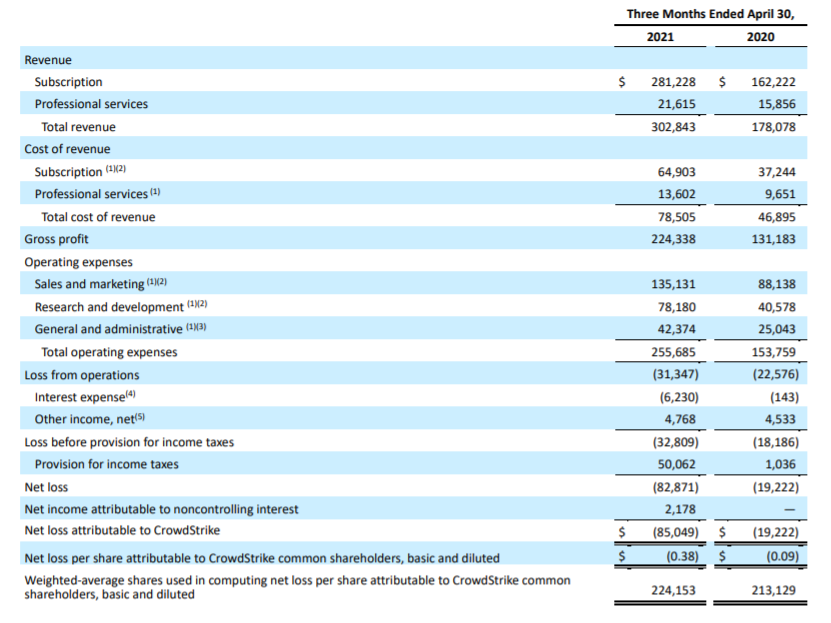

Revenue rose to $302.8 million from $178.1 million in the year-ago quarter.

Analysts surveyed by FactSet had forecast CrowdStrike to report earnings of 5 cents a share on revenue of $291.5 million, based on the company’s outlook of 5 cents to 6 cents a share on revenue of $287.8 million to $292.1 million.

“We believe the robust demand environment driven by secular trends, such as digital and security transformation, cloud adoption and a heightened threat environment, provides a runway for long-term sustainable growth,” said George Kurtz, CrowdStrike co-founder and chief executive, in a statement.

Annual recurring revenue, a software-as-a-service metric that shows how much revenue the company can expect based on subscriptions, increased 74% to $1.19 billion for the quarter, while the Street expected $1.12 billion.

CrowdStrike expects adjusted fiscal second-quarter earnings of 7 cents to 9 cents a share on revenue of $318.3 million to $324.4 million, while analysts forecast earnings of 6 cents a share on revenue of $310.6 million, according to FactSet.

As of Thursday’s close, the stock is up 120% over the past 12 months, compared with a 34% rise by the S&P 500 index SPX,-0.36%, a 41% gain for the tech-heavy Nasdaq Composite Index COMP,-1.03%, and a 29% gain by the ETFMG Prime Cyber Security ETF HACK,-1.10%.