U.S. stocks climbed on Friday, led by bank shares and economic reopening plays as investors cheered data showing subdued inflation.

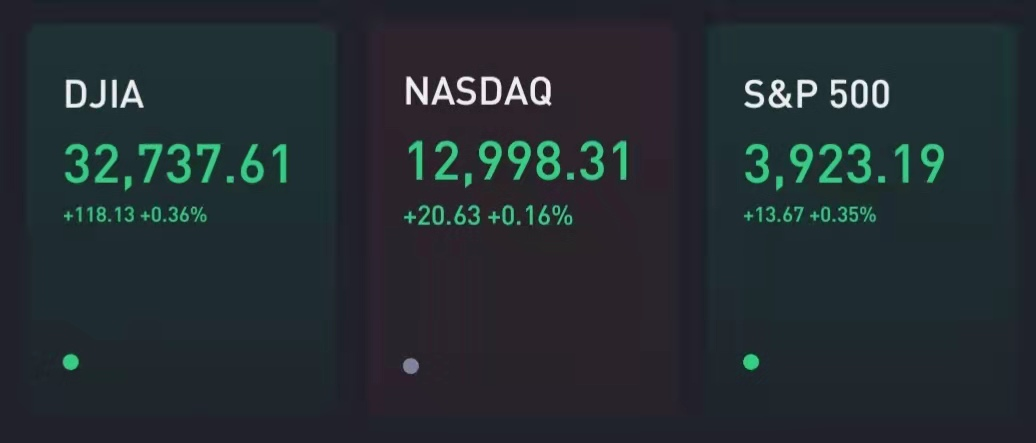

The Dow Jones Industrial Average gained 118 points. The S&P 500 rose 0.4%, while the Nasdaq Composite climbed 0.2%.

Bank stocks rose after the Fed announced that banks could resume buybacks and raise dividends starting at the end of June. The central bank originally said it would lift pandemic era restrictions in the first quarter, but even the delayed move gives investors more clarity.

Shares of JPMorgan rose 1.5%, while Bank of America advanced 2%. Goldman Sachs gained 1%.

Classic reopening plays built on the momentum from the previous session. American Airlines climbed 1%, while Royal Caribbean, Carnival and Norwegian Cruise Line all climbed more than 1%.

The core personal consumption expenditure price index, which strips out volatile food and energy prices, rose 0.1% month over month, matching expectations from economists polled by Dow Jones. Year over year, the gauge climbed 1.4%, slightly lower than a 1.5% estimate.

The move in futures comes after stocks bounced in afternoon trading on Thursday, with the Dow swinging more than 500 points as cyclical trades gained steam. The strong close broke a recent trend of poor finishes on Wall Street and trimmed the market’s week-to-date losses. The Dow and S&P 500 are now down less than 0.1% for the week, while the Nasdaq Composite is in the red by 1.8%.

“If you’re positioned the way we are, which is for a cyclical recovery and being overweight the value sectors, certainly you can’t run a victory lap here. But it is nice to see, after the last six days, that some of the trends that have been in place for the better part of six months seem to be reasserting themselves,” Jason Trennert, CEO of Strategas Research Partners, said on CNBC’s “Closing Bell.”