Tesla Inc. made its second round of price cuts in China this week, further fueling concerns of reigniting a price war.

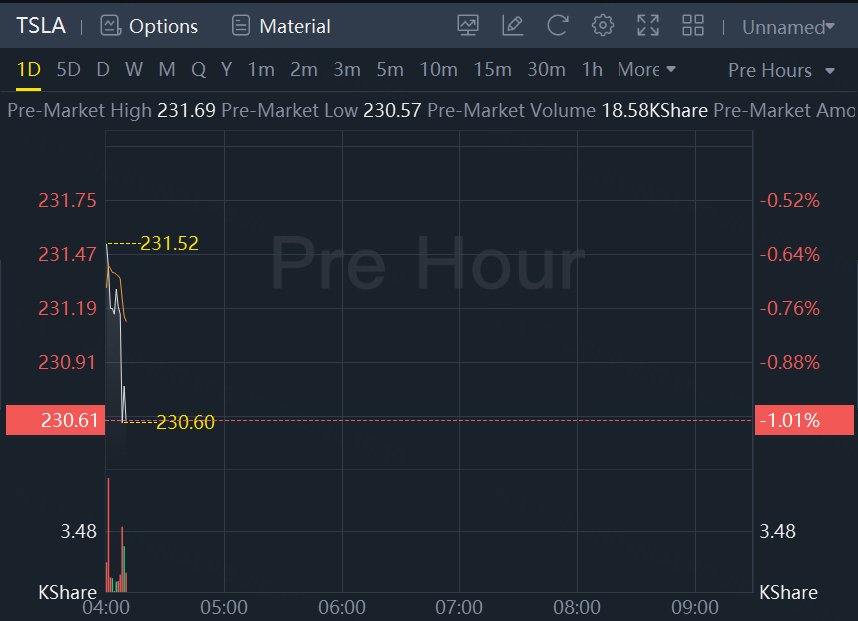

Tesla shares dropped 1% in premarket trading Wednesday.

The automaker reduced the price of existing stock of its premium Model S sedan and Model X sport utility vehicle by as much as 70,000 yuan ($9,600) to 754,900 yuan and 836,000 yuan respectively, according to a company statement published on its official WeChat account on Wednesday.

The move comes just two days after Tesla marked down the Long Range and Performance versions of the Model Y SUV by 14,000 yuan and extended an insurance subsidy for the base version of the Model 3 sedan, keeping the perk in place through the end of next month.

The cuts may further accelerate a price war in the world’s biggest auto market, and put pressure on rival premium carmakers like BMW AG and Mercedes-Benz Group AG to follow suit. Besides the price cuts, other incentives including free fast charging credits and trials of Tesla’s enhanced autopilot system for referrals remain in place.

Tesla’s shipments from its China plant plunged 31% in July to the lowest level this year. The automaker announced last month that global production would drop in the third quarter due to downtime for factory upgrades, without offering specifics. It’s expected to start making a revamped version of the Model 3 sedan soon.

Tesla Chief Executive Officer Elon Musk warned last month that the carmaker would have to keep cutting prices if interest rates continued to rise. Several rounds of discounting already have taken a toll on the company’s automotive gross profit margin, which fell to a four-year low in the second quarter.