S&P 500 futures ticked down 0.08% after New York Federal Reserve President John Williams threw cold water on rate cut optimisim for early next year.

The policymaker told CNBC is was “premature” to be thinking about a March interest rate cut. Contracts on the US gauges lost steam paring back from early gains. Meanwhile, a measure of New York state factory activity came in well below estimates, signaling a slowdown in activity.

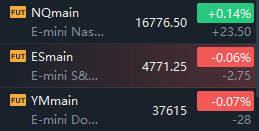

Market Snapshot

At 8:51 a.m. ET, Dow e-minis were down 28 points, or 0.07%, S&P 500 e-minis were down 2.75 points, or 0.06%, and Nasdaq 100 e-minis were up 23.5 points, or 0.14%.

Pre-Market Movers

Costco Wholesale — Costco shares added 2.7% after the wholesale retailer posted quarterly numbers that beat analyst expectations. The company also announced a special dividend of $15 per share.

Lennar —The homebuilder slipped 2.4% despite posting fourth-quarter results that topped Wall Street analyst expectations. New orders also surpassed estimates, but Lennar posted lower-than-expected gross margins on homebuilding.

Solar stocks — A handful of solar stocks rose on Friday after Jefferies initiated coverage with buy ratings, citing declining solar equipment costs and incentives from the Inflation Reduction Act. First Solar jumped 3.5%, while Sunrun and Enphase Energy popped 4.4% and 5.1%, respectively.

Darden Restaurants — Shares of the Olive Garden owner slipped 1% on mixed quarterly results. Darden posted adjusted earnings of $1.84 per share, topping the $1.74 expected by analysts polled by LSEG. Revenue came in at $2.73 billion, slightly short of the $2.74 billion expected.

Scholastic — Shares of the publisher and distributor of children’s book tanked about 12% after posting a year-over-year decline in revenue. Scholastic also trimmed its full-year guidance.

Quanex Building Products — Shares of the original equipment manufacturer were down over 8% despite a fourth-quarter earnings beat. Quanex reported adjusted earnings of 95 cents on revenue of $295.5 million, topping the 70 cents per share on $291.0 million that analysts polled by FactSet had expected. The company failed to give “premature” guidance and said it would revisit it next year when it reported first-quarter earnings.

Tractor Supply — Shares slipped 2.1% after Bank of America downgraded the retailer to underperform from neutral. The bank said demand and pricing challenges would pressure earnings and investor sentiment.

Colgate-Palmolive — Shares added 1% after being upgraded by Bank of America Securities to buy from neutral. The bank said it expects Colgate-Palmolive to see U.S. volume and market share turning positive, above-average emerging markets growth and margin expansion.

Market News

Palantir Gets "Unexpected" $115 Million Add-On to Army Vantage Contract

Palantir has received a one-year extension to its previous four-year contract for the U.S. Army's Vantage data management program worth up to $115 million. The annual rate is about in line with the annualized rate of what had been a four-year $458 million contract.

The Army announced the extension on Thursday on the Defense Department website.

Palantir, which provides data analytics and artificial intelligence software to both commercial and government clients, said in a statement that the Vantage program "is a cornerstone in the U.S. Army's transformative efforts to leverage data as a strategic asset."

Jeff Bezos Plays down AI Dangers and Says a Trillion Humans Could Live in Huge Cylindrical Space Stations

Jeff Bezos has said AI is more likely to save humanity than make it go extinct, while claiming he would like to see the human population grow to one trillion and live in huge cylindrical space stations away from Earth.

In an interview with podcaster Lex Fridman, the Amazon $(AMZN)$ founder and former CEO rejected the idea humans should colonize other planets, and instead said he believes building out gigantic O'Neill space colonies is the only way to achieve such population growth.