U.S. equity-index futures rallied as dip buyers emerged from the ruins of Monday’s rout, even though sentiment remained fragile over concerns about inflation and economic growth.

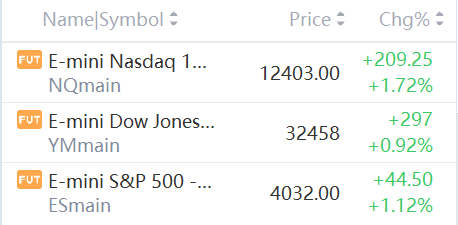

Futures on the Nasdaq 100 Index jumped 1.7% a day after valuations on the equity gauge plummeted to the lowest in two years. S&P 500 contracts rose more than 1%. Haven demand eased, with the dollar halting a three-day advance and Treasuries falling across the curve.

Traders are caught between stubbornly high inflation that erodes asset values and central-bank tightening that threatens to slow economic growth, or even push some nations into recession. Recent U.S. data suggesting the Federal Reserve will stay on an aggressive rate-hike path have sparked the latest bout of risk-off trades.

“For now, investors need to be prepared for continued volatility,” Solita Marcelli, Americas chief investment officer at UBS Global Wealth Management, wrote in a note. She added “sentiment is bearish” but not capitulating.

Investors’ attention now turns to the U.S. April consumer-price index print on Wednesday. They will be looking for clues on whether inflation is nearing a peak, or increases the threat of a 75 basis-point rate hike by the Fed, rather than the 50 basis-point move the markets seem to have made peace with.

In the latest policy comments, Fed Bank of Atlanta President Raphael Bostic said he favors continuing to raise rates by half-point moves rather than anything larger. He said the odds for a 75-basis-point hike are low but added he’s taking nothing off the table.