U.S. stock futures struggled for direction on Wednesday, leaving Wall Street potentially on course for a third consecutive day of losses, as investors fret that soaring inflation is damaging the world’s biggest economy and battering corporate profits.

On U.S. economic data, the first-quarter GDP was revised to show 1.6% decline, compared with the prior 1.5% drop.

Market Snapshot

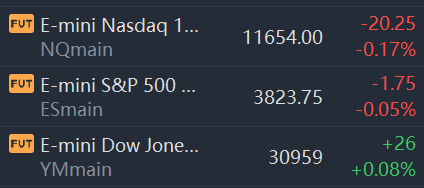

At 8:59 a.m. ET, Dow e-minis were up 26 points, or 0.08%, S&P 500 e-minis were down 1.75 points, or 0.05%, and Nasdaq 100 e-minis were down 20.25 points, or 0.17%.

Pre-Market Movers

General Mills(GIS) – General Mills reported adjusted quarterly earnings of $1.12 per share, 11 cents above estimates, with revenue that also topped Wall Street forecasts. The stock rose 1.6% in the premarket, even as the food producer forecast full-year profit below Street estimates amid rising costs and shifting consumer preferences toward cheaper brands.

Carnival(CCL) – The cruise line operator’s shares slid 7.8% in premarket trading after Morgan Stanley cut the price target to $7 per share from $13. Morgan Stanley said the price could potentially go to zero in the face of another demand shock, given Carnival’s debt levels. Rival cruise line stocks fell in sympathy, withRoyal Caribbean(RCL) down 4% andNorwegian Cruise Line(NCLH) falling 4.6%.

Bed Bath & Beyond(BBBY) – The housewares retailer announced the departure of CEO Mark Tritton, saying it was time for a leadership change. Independent director Sue Gove will serve as interim CEO while the search for a permanent replacement is conducted. Separately, the company reported a wider-than-expected quarterly loss. Bed Bath & Beyond plummeted 14.85% in premarket action.

McCormick(MKC) – The spice maker’s stock slumped 7.3% in premarket trading after the company reported lower-than-expected quarterly results and cut its full-year outlook. McCormick said it is seeing a negative impact from factors like higher costs, supply chain issues and unfavorable foreign currency trends.

Pinterest(PINS) – Pinterest co-founder Ben Silbermann stepped down as CEO and will transition to the newly created post of executive chairman. He’ll be replaced by Bill Ready, who had been president of commerce at Google. The image-sharing company’s stock rose 2.5% in the premarket.

Nio(NIO) – Nio is denying a report by short-seller Grizzly Research that accuses the electric car maker of exaggerating its financial results. Nio said the report is without merit and contains numerous errors. Nio slumped 7% in premarket trading.

Upstart Holdings(UPST) – The cloud-based lending company’s shares tumbled 9.6% in the premarket after Morgan Stanley downgraded it to “underweight” from “equal-weight.” Morgan Stanley cites a number of factors, including deteriorating underwriting performance.

Tesla(TSLA) – Tesla is closing a Silicon Valley office and laying off 200 workers, according to people familiar with the matter who spoke to the Wall Street Journal. Tesla is in the midst of an ongoing effort to reduce headcount and cut costs. Its stock lost 1.6% in premarket action.

Walt Disney(DIS) – Walt Disney extended the contract of CEO Bob Chapek for three years, saying he has weathered many difficulties during his tenure and emerged in a position of strength.

Market News

Fed's Mester Backs 75 Bps Hike in July If Economic Conditions Remain the Same

Federal Reserve Bank of Cleveland President Loretta Mester said Wednesday that if economic conditions remain the same when theU.S. centralbank meets to decide its next monetary policy move in July, she will be advocating for a 75 basis point hike to interest rates.

The Fed’s path of monetary tightening has become a key driver of market activity in recent months as the central bank looks to act aggressively to rein in soaring inflation, while acknowledging the risk that steeper interest rate rises will increase the likelihood of an economic recession.

Goldman Sachs Sees Losses From Consumer Push Exceeding $1.2 Billion This Year

WhenGoldman Sachs Group Inc.executives set out to woo investors in early 2020, they offered a promising outlook for their novelty Main Street business. The unit would go from a money-suck to break-even in 2022.

The Wall Street titan’s internal projections show the consumer business losses accelerating to more than $1.2 billion this year, according to people with knowledge of the matter. The second-quarter burn rate in the unit is in line with those forecasts -- and the number may grow if a souring economy forces the firm to take more lending-loss provisions, the people said.

Palantir, Raytheon Tapped To Deliver Prototypes For Army’s TITAN Data Platform

The Army has awarded a pair of deals toPalantir Technologies[PLTR] andRaytheon Intelligence and Space[RTX] to deliver prototypes for the Tactical Intelligence Targeting Access Node (TITAN) program, before the service downselects to one vendor for production.

After both companies participated in the first phase of TITAN to work through their designs for the future intelligence ground station, each has now received a $36 million, 14-month deal to build prototypes for evaluation and testing.

Bitcoin briefly drops below $20,000 again as pressure continues to mount on crypto market

Bitcoinfell below $20,000 on Wednesday as a number of factors from macroeconomic worries to issues with cryptocurrency companies continue to weigh on the market.

The world’s largest cryptocurrency was trading down more than 4% at around $20,056.48 at 07:36 a.m. ET, according to CoinDesk data. Earlier on Wednesday, bitcoin fell as low as $19,841.