(Reuters) - Taiwanese chip maker TSMC posted a 76.4% rise in second-quarter net profit on Thursday on sustained demand for semiconductors amid a continued global shortage.

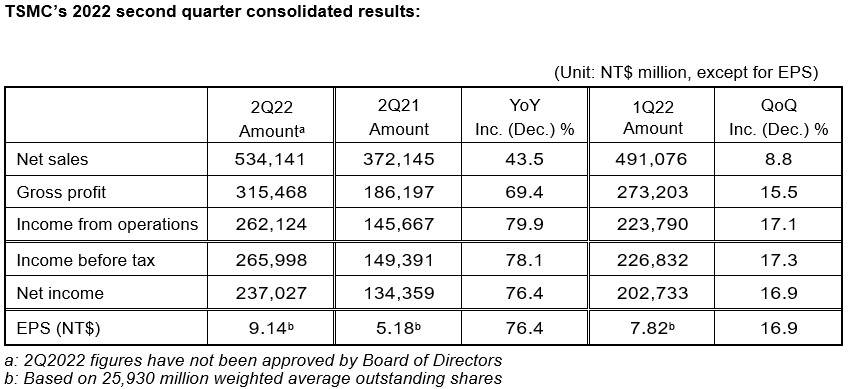

Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the world's largest contract chipmaker and a major Apple Inc supplier, saw net profit for April-June rise to T$237.0 billion ($7.94 billion) from T$134.4 billion a year earlier.

That was ahead of the T$219.13 billion average of 19 analyst estimates compiled by Refinitiv.

Revenue for the quarter climbed 36.6% to $18.16 billion, versus TSMC's prior estimated range of $17.6 billion to $18.2 billion.

TSMC's profitability has been boosted by a global chip shortage that was sparked by a demand surge as people worked and studied from home at the height of the COVID-19 pandemic. The shortage has complicated or cut production at manufacturers of devices such as smartphones and laptops as well as vehicles.

The Taiwanese firm, whose clients also include chip majors such as Qualcomm Inc (QCOM.O), has talked of a "mega-trend" in the industry brought about by demand for high-performance computing chips for 5G networks and artificial intelligence, as well as increased use of chips in gadgets and vehicles.

The company has said its chip capacity would remain tight this year, amid a crunch that has kept order books full and allowed chipmakers to charge premium prices.

Shares of TSMC have fallen about 23% so far this year, giving it a market value of $408.3 billion. The stock rose 1% on Thursday, compared with a 0.8% gain for the benchmark index (.TWII).