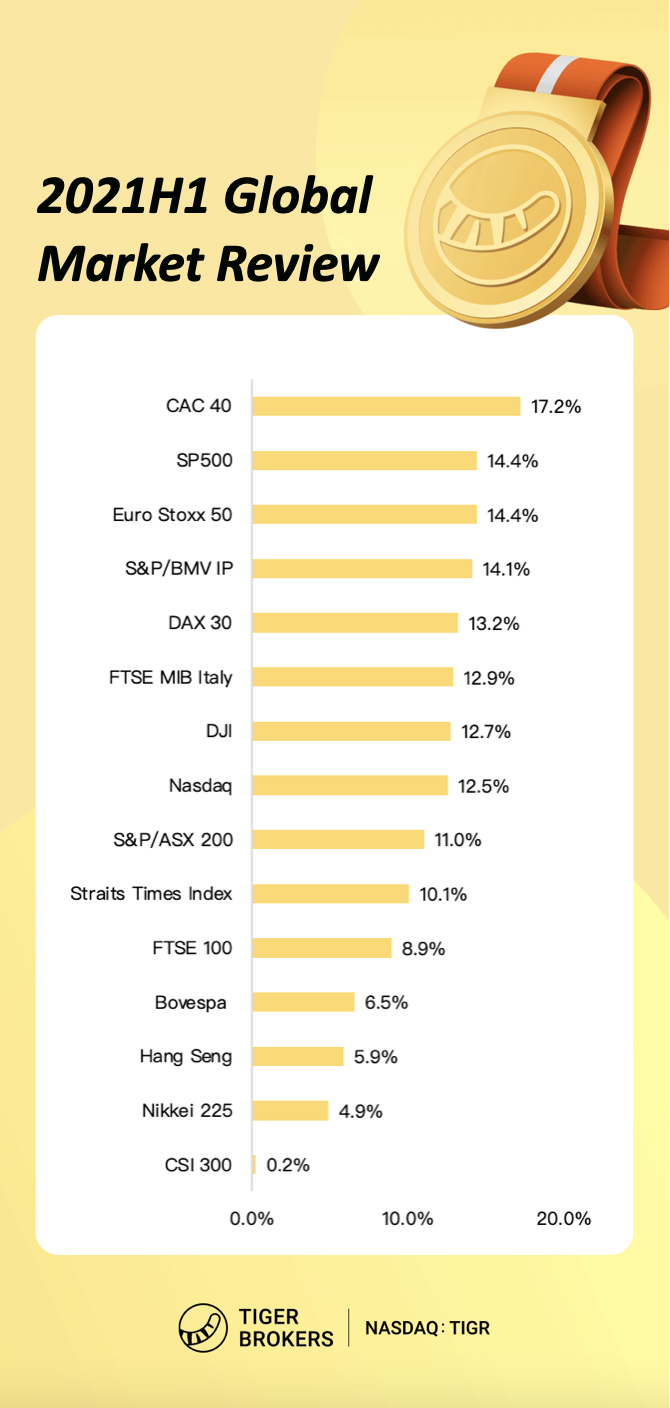

(July 1) The global market officially ended in the first half of the year. On the whole, the French CAC 40 index took the lead with an increase of 17.2%; the S&P 500 index and the Eurozone Stoxx 50 index increased by 14.4% Tied for second place; followed by the Mexico Composite Index and the German DAX 30 Index, with gains of 14.1% and 13.2%, respectively.

U.S. stock indexes hit record high, energy stocks are winners

U.S. stocks in the first half of the year generally showed a trend of volatility and upward movement. The three major indexes jointly set a new record high. The S&P 500 index rose by 14.41% in the first half of the year, which has outperformed the index's average annual growth rate of 11% in the past two decades, and far outpaced the 4% increase in the first half of last year; the Nasdaq index rose by 12.54 % in the first half of the year, the Dow Jones index rose 12.73%.

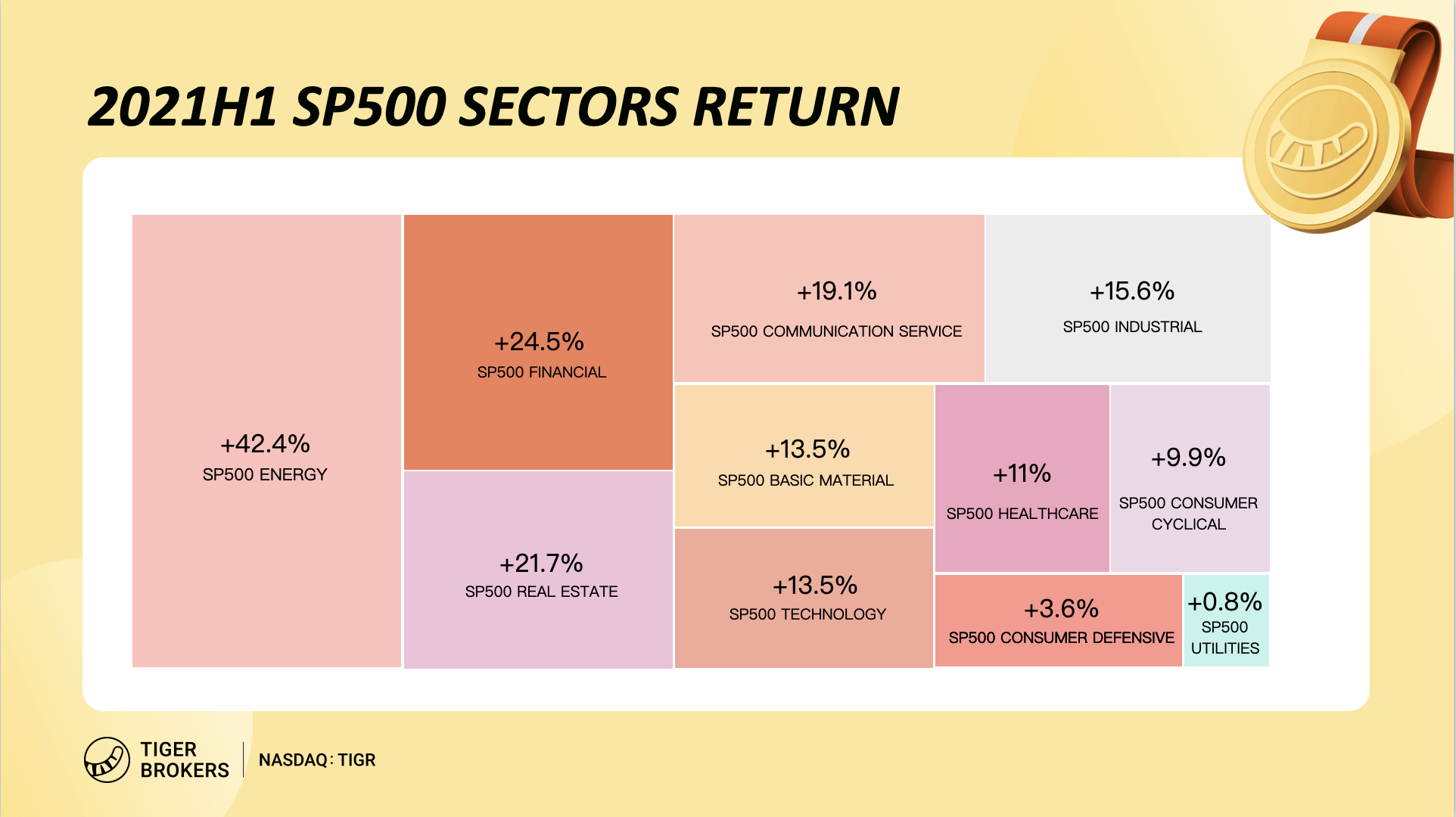

From the perspective of sectors and individual stocks, "economic recovery" and "increasing inflation" are the two main factors that dominated the U.S. stock market in the first half of the year. Under the influence of these two main factors, energy stocks, finance stocks and real estate stocks outperformed other sectors.

In the first half of this year, with the gradual promotion of the global vaccinations against the new crown, China took the lead in getting out of the shadow of the epidemic, and many European and American countries have gradually begun to loosen their blockades. With the recovery of global economy and the rebound in demand for commodities, especially the rapid rise in energy demand, Brent crude oil is the best performing asset in the first half of the year, with a yield of 44.32%.

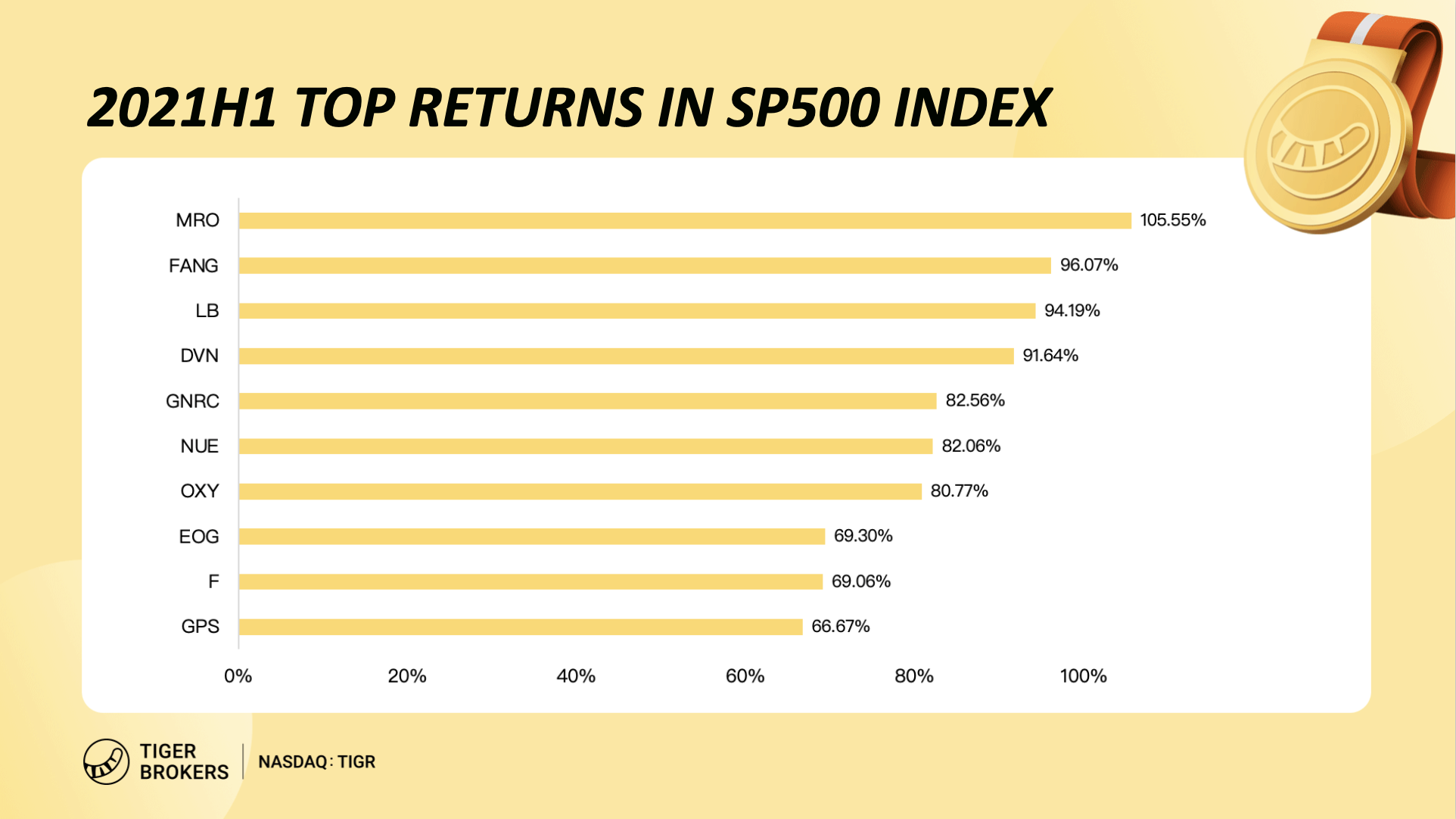

Benefiting from the explosion of demand, US energy stocks are also the top performers. Among the S&P 500 constituent stocks, five of the top ten gainers are energy stocks. Among them, Marathon Petroleum ranked first with a half-year increase of 105.55%. The other four are Diamondback Energy, Devon Energy, Occidental Petroleum and EOG Energy, with increases of 96.07%, 91.64%, 80.77% and 69.30% respectively.

In addition, among the constituent stocks of the Dow, energy stocks are also among the top performers. Chevron ranked fourth with an increase of 27.32%, and Caterpillar ranked eighth with an increase of 20.74%. Among the constituent stocks of the Dow, the performance of bank stocks is also remarkable.

Bank stocks performed very well during the epidemic, with the help of legislators and the Federal Reserve. Three of the top five companies in the Dow's gainers are bank stocks. Among them, Goldman Sachs ranked first with increaing 44.97%; American Express ranked second with a 37.55% increase, and JPMorgan Chase ranked fifth with a 24.01% increase.