U.S. stock-index futures rose as softer oil prices and a weaker dollar signaled fears about inflation and the pace of monetary tightening are fading.

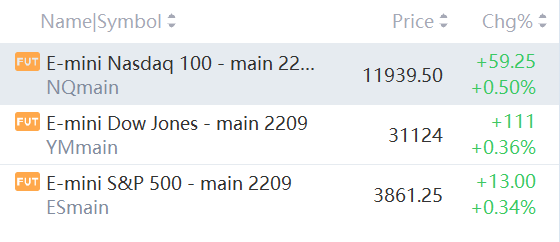

Futures on the S&P 500 and Nasdaq 100 indexes advanced 0.34% and 0.5%, respectively after the underlying gauges capped the first three-day rally since May on Wednesday. Asian semiconductor shares rallied after Samsung Electronics Co. reported a better-than-forecast revenue jump. The US two- and 10-year yield curve steepened by 1 basis point though it remained inverted for a third day.

Investors have been whipsawed in the past two weeks between concern over runaway inflation and the potential for a US recession. Even though the minutes of the Federal Reserve’s last meeting showed policymakers’ resolve to continue hiking rates, oil-price declines are calming investors over the pace of tightening needed.

“Global equities bounce as pressure points such as rates, oil and the dollar begin to ease,” Stephen Innes, managing partner at SPI Asset Management, wrote in a note. “Momentum has swung higher, with tech-heavy benchmarks outperforming after Samsung’s revenue was better than feared.”

Samsung’s revenue jump assuaged fears about weakening consumer demand and soaring material costs. That sparked a rally in chipmakers, helping MSCI Inc.’s Asia-Pacific share index add more than 1%.