Market Overview

Wall Street closed slightly higher on Tuesday (December 20) after four sessions of declines, but investors fretted about weak holiday shopping and rising bond yields added pressure after the Bank of Japan's (BoJ) surprise tweak of monetary policy.

Regarding the options market, a total volume of 31,058,885 contracts was traded, down 9% from the previous trading day.

Tesla Inc shares tumbled 8% after at least three brokerages cut the electric vehicle maker's target price on growing concerns of demand weakness and risk from Chief Executive Elon Musk's struggles at Twitter. Option contracts related to Tesla stock showed the highest volume of bearish activities.

Top 10 Option Volumes

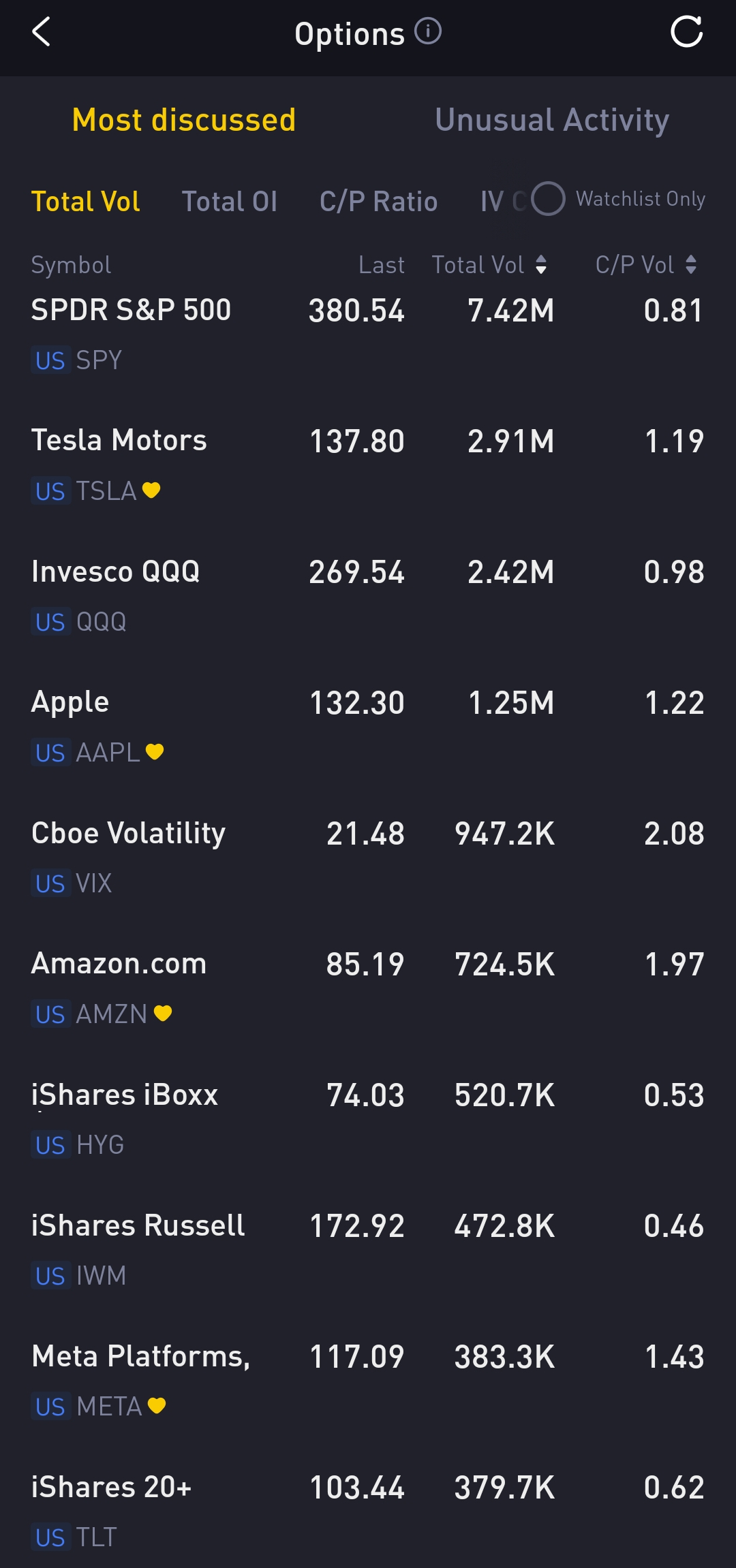

Top 10: SPY, TSLA, QQQ, AAPL, VIX, AMZN, HYG, IWM, META, TLT

Options related to equity index ETFs are still popular choices for investors, with 7.42 million SPDR S&P500 ETF Trust and 2.42 million Invest QQQ Trust ETF options contracts trading on Tuesday.

Total trading volume for SPY and QQQ are down 10.5% and 3%, respectively, from the previous day. 55% of SPY trades bet on bearish options.

Source: Tiger Trade APP

Tesla Inc shares tumbled 8% on Tuesday after at least three brokerages cut the electric vehicle maker's target price on growing concerns of demand weakness and risk from Chief Executive Elon Musk's struggles at Twitter.

Source: Tiger Trade APP

Perhaps lost in all the drama over Tesla's share price slide and the Twitter headlines, the electric vehicle giant is only two weeks away from reporting on Q4 deliveries. Tesla is seen having a chance to hit 450K to 465K deliveries for the quarter with Giga Berlin and Giga Austin contributing. If Tesla could hit 475K deliveries, the company could re-charge the bull argument by achieving its broad target for 50% production growth.

There were 2.91 million Tesla options trading on Tuesday, of which call options accounted for 54%. Particularly high volume was seen for the $150 strike call option expiring December 23, 2022, with 138,425 contracts trading on Tuesday.

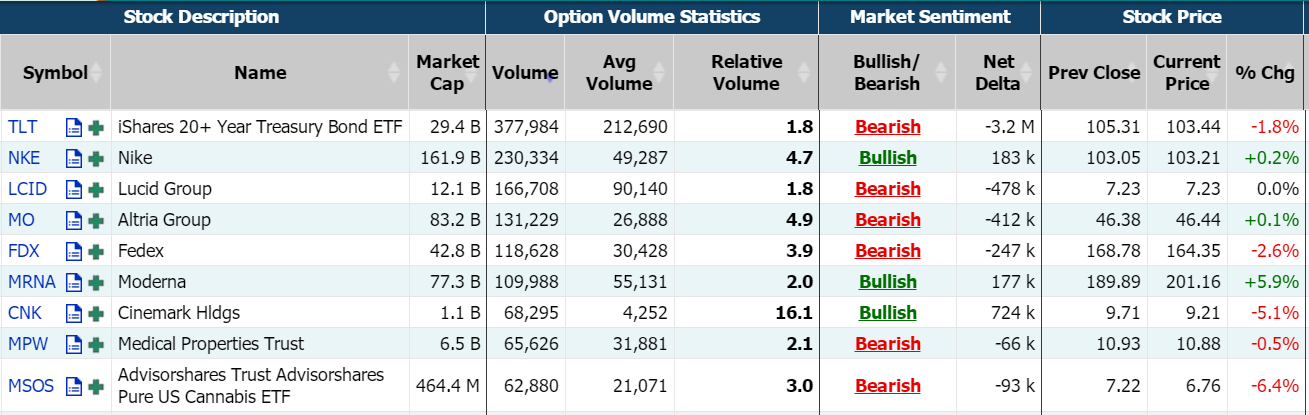

Unusual Options Activity

$FedEx Corp(FDX) closed down 2.6% ahead of its quarterly report. But shares in the delivery company, which spooked the entire market in September by pulling its financial forecast, were last up more than 3% in volatile after the bell trading following its fiscal second-quarter report and 2023 guidance.

There were 118,628 FedEx options trading on Tuesday. Put options account for 57% of FedEx's current open interest. Particularly high volume was seen for the $150 strike put option expiring December 23, 2022, with 11,025 contracts trading on Tuesday.

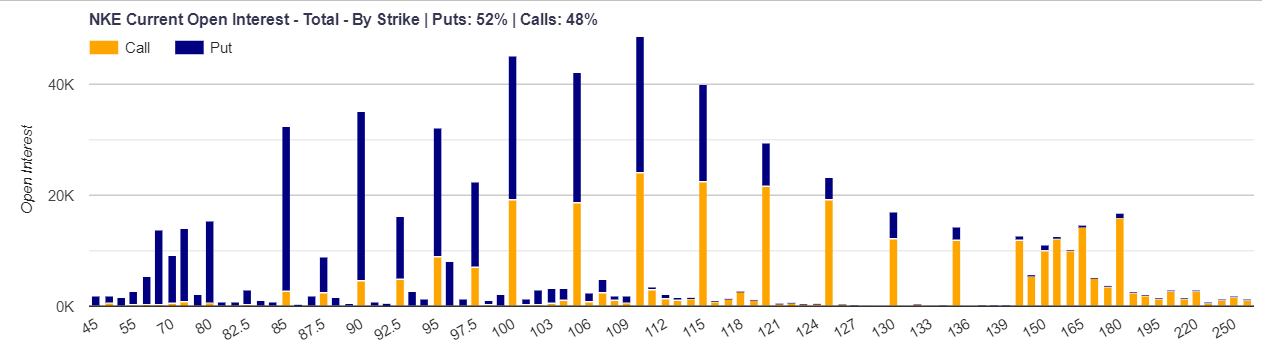

Nike closed up slightly 0.2% ahead of its quarterly report. But Shares of the company rose 12.8% in extended trading after Nike Inc beat Wall Street estimates for quarterly revenue on Tuesday, as persistent demand for its sneakers and sportswear in North America and Europe helped offset a sales slump in China, its most profitable market. Analysts have said the company's efforts to offer steeper discounts and increase promotional activity in an attempt to get rid of excess inventory may help Nike boost sales and attract recession-wary shoppers.

There were 230,334 Nike options trading on Tuesday. Put options account for 52% of Nike's current open interest. Particularly high volume was seen for the $90 strike put option expiring December 23, 2022, with 11,660 contracts trading on Tuesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: EQRX, CNK, UBER, F, VXX, LYFT, T, TEVA, ENVX, VKTX

Top 10 bearish stocks: TSLA, AAPL, MU, AMZN, AAL, PLTR, NU, DB, SOFI, LCID

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club