U.S. stocks climbed on Tuesday as enthusiasm about the economic reopening lifted the S&P 500 to near a record.

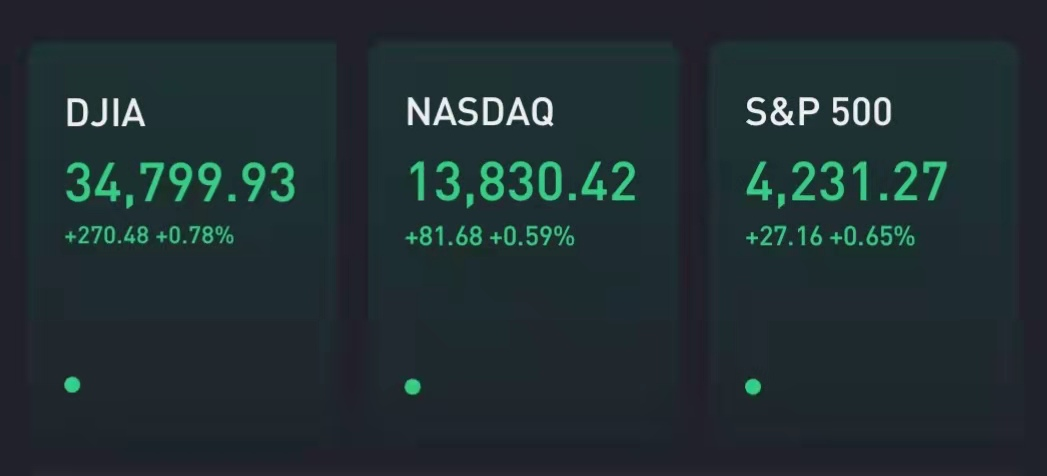

The Dow Jones Industrial Average rose 270 points, or 0.8%. The S&P 500 gained 0.7%, putting the benchmark close to its record. On Friday, the S&P 500 closed just 0.8% away from an all-time high.

The Nasdaq Composite gained 0.6%.

The gains came as Covid cases continue to decline in the U.S. as vaccination rates rise. In a major milestone, more than half the U.S. population has received at least one dose of a Covid vaccination, according to CDC data posted Sunday. More than 62% of adults have received at leased one dose, the CDC said. There were just 12,663 new cases on Saturday, according to the CDC, the lowest since March 2020.

Stocks linked to a reopening economy led the gains in the premarket. Share of Carnival Corp and Norwegian Cruise Line Holdings jumped more than 2% apiece. American Airlines and United airlines gained more than 1.5% each.

Boeing gained 3.2% after one analyst recommended investors discount near-term hurdles for the aircraft maker and buy the stock while it's still below where it traded in early 2020.

Energy stocks gained as U.S. oil futures jumped nearly 3% to above $68 a barrel. Exxon, Chevron and Marathon Petroleum gained in premarket trading as the summer travel season kicked off.

Meme stock AMC Entertainment was jumping again after selling $230.5 million in new stock to an investor. The shares were up 14% after doubling last week.

The moves in overnight trading come after the blue-chip Dow and the S&P 500 gained 1.93% and 0.55% in May, respectively, to mark their fourth consecutive positive month. The small-cap Russell 2000 rose 0.11% in May to post its eighth positive month in a row — its longest monthly win streak since 1995.

The Nasdaq gained 2.06% last week to post its best weekly performance since April. However, the tech-heavy composite lost 1.53% in May, breaking a 6-month win streak.

The stock market was closed Monday for Memorial Day.

A key inflation gauge — the core personal consumption expenditures index — rose 3.1% in April from a year earlier, faster than the forecasted 2.9% increase. Despite the hotter-than-expected inflation data,treasury yields fell on Friday.

“Overall, given the market’s reaction to [Friday]’s PCE release, investor concerns about inflation may have been exaggerated — or perhaps already priced in,” Chris Hussey, a managing director at Goldman Sachs, said in a note.

“Consensus may be building that the inflation we are seeing today is ‘good’ inflation — the kind of rise in prices that accompanies accelerating growth, not a monetary policy mistake,” Hussey said.

Investors are awaiting the Federal Reserve’s meeting scheduled for June 15-16. Key for the markets is whether the Fed begins to believe that inflation is higher than it expected or that the economy is strengthening enough to progress without so much monetary support.

May’s employment report, set to be released on Friday, will provide a key reading of the economy. According to Dow Jones, economists expect to see about 674,000 jobs created in May, after the much fewer-than-expected 266,000 jobs added in April.

Zoom Video Communications and Hewlett Packard Enterprise are set to report quarterly earnings results on Tuesday after the bell.