KEY POINTS

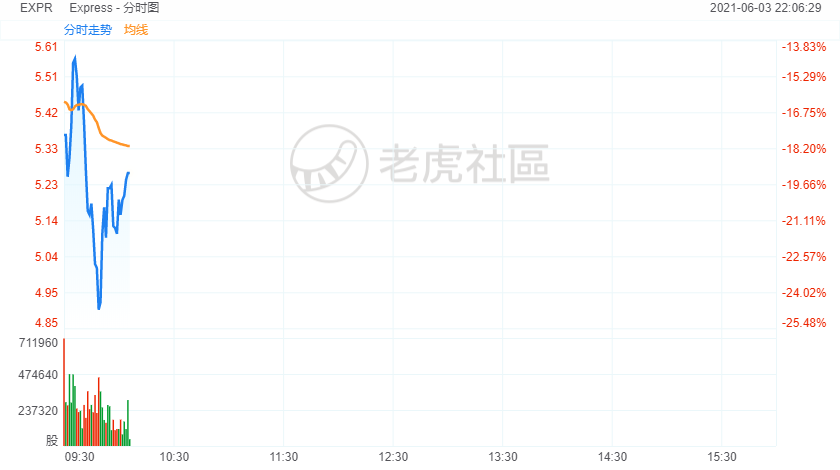

- Shares of the retailer Express tumbled Thursday, after the clothing retailer announced plans to sell up to 15 million shares.

- Express announced an “at-the-market” equity offering, which could represent more than 22% of its shares outstanding.

- Earlier Thursday morning, Express’ stock had jumped after the retailer reported better-than-expected fiscal first-quarter results.

Shares of the retailer Express tumbled more than 22% Thursday, after the clothing retailer announced plans to sell up to 15 million shares.

Express announced an “at-the-market” equity offering, which could represent more than 22% of its shares outstanding. This type of offering means the newly issued stock will be sold from time to time at market prices. Its advantage is that it gives Express control over when it will offer the stock and how much stock it will offer.

The huge sell-off comes after the stock shot up more than 35% Wednesday, as part of a meme stock trading frenzy that has also boosted shares of AMC Entertainment,GameStop,BlackBerry and Bed Bath & Beyond.

Express shares had rallied nearly 110% over the past month. The so-called meme stocks, generally shunned by Wall Street, are being cheered by retail investors on online forums like Reddit’s WallStreetBets.

MKM Partners Managing Director Roxanne Meyer told clients that daily trading volumes of Express shares are still well above historic levels, fueled by Reddit speculation.

Earlier Thursday morning, Express’ stock had jumped after the retailer reported better-than-expected fiscal first-quarter results. It said its business hit an inflection point after Easter, as more consumers were vaccinated and states began lifting Covid-related restrictions. It also saw people return to its stores buying occasion-based and work-related apparel merchandise.

Express said in the release announcing its equity offering that it plans to use the net proceeds from its stock sale for general corporate purposes, which could include repaying debts or investing in e-commerce.

Last year, in the thick of the Covid pandemic, Express was on many analysts’ watch lists as a retailer that could be heading for bankruptcy. But the company managed to come up with additional financing, outside of a court restructuring, to keep its business afloat and outlast the health crisis.

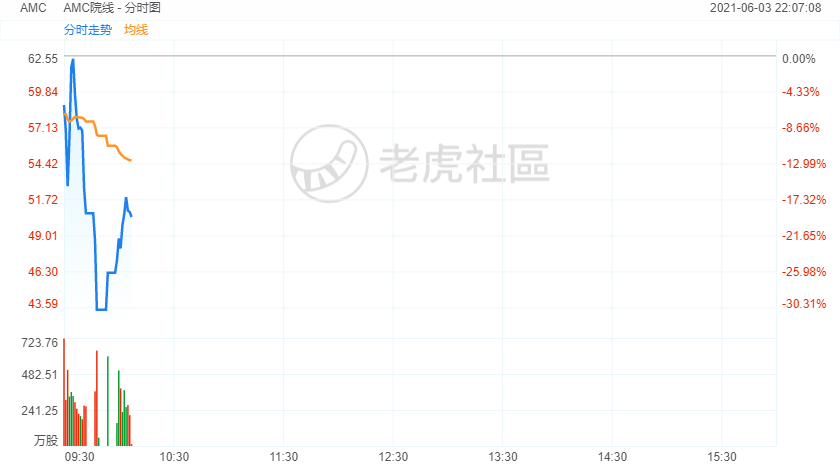

AMC also said Thursday it plans to sell more than 11 million shares, sending shares of the movie theater chain tumbling.

Shares of Express are up more than 615% year to date.