U.S. stock index futures edged lower on Thursday, a day after the S&P 500 and the Nasdaq hit record closing highs.

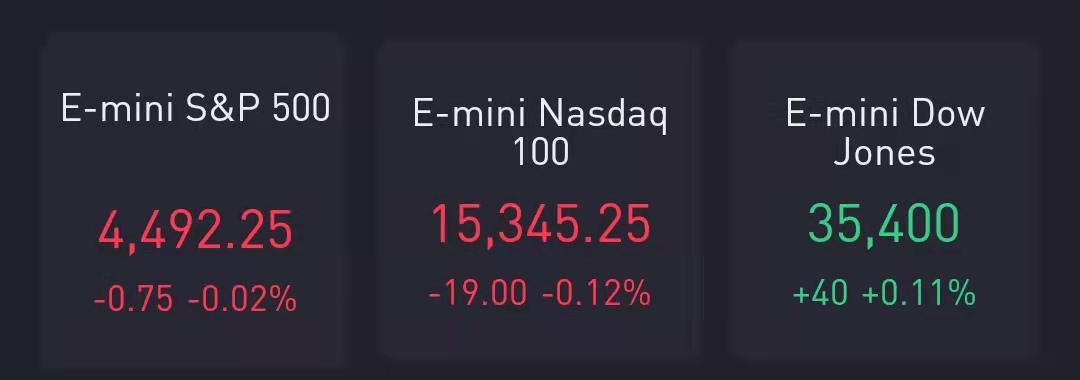

At 8:33 a.m. ET, Dow e-minis were up 40 points, or 0.11%, S&P 500 e-minis were down 0.75 points, or 0.02%, and Nasdaq 100 e-minis were down 19 points, or 0.12%.

Initial claims for unemployment insurance were little changed over the past week, hovering around pandemic-era lows as the jobs market shows further signs of healing.

First-time filings totaled 353,000 for the week ended Aug. 14, a slight increase from the previous week's 349,000, the Labor Department reported Thursday. That was slightly worse than the 350,000 Dow Jones estimate.

A separate economic reading showed that gross domestic product increased at a 6.6% annualized pace in the second quarter, according to the second estimate Thursday from the Commerce Department. That was ahead of the 6.5% initial estimate but a notch below the 6.7% Dow Jones estimate.

Peloton Interactive,Gap and Dell Technologies are scheduled to post results after markets close.

Stocks making the biggest moves premarket:

Coty(COTY) – The cosmetics maker’s shares added 5.1% in the premarket after it said it expects a return to annual sales growth this year. Coty’s adjusted loss for its latest quarter was 9 cents per share, 3 cents wider than expected, but sales did come in above Wall Street forecasts.

Dollar General(DG) – The discount retailer beat estimates by 10 cents with adjusted quarterly earnings of $2.69 per share and revenue slightly above forecasts. Comparable store sales fell 4.7%, less than the 5.1% drop expected by analysts surveyed by StreetAccount. However, Dollar General did forecast lower-than-expected earnings for the full year, and its shares fell 4.2% in premarket trading.

Dollar Tree(DLTR) – Dollar Tree shares fell 5.7% in premarket trading after the discount retailer posted a mixed quarter. Revenue fell below Street forecasts, while earnings of $1.23 per share did beat the consensus estimate of $1.00.

J.M. Smucker(SJM) – The food producer earned an adjusted $1.90 per share for its latest quarter, 4 cents above estimates, with revenue slightly above Wall Street projections. However, Smucker cut its full-year forecast, noting higher input costs and supply chain disruption. Shares lost 3.1% in the premarket.

Abercrombie & Fitch(ANF) – The apparel retailer’s shares slid 4% in the premarket, as revenue fell below analyst forecasts. Abercrombie did report an adjusted profit of $1.70 per share, compared with a 77-cent consensus estimate.

Salesforce.com(CRM) – Salesforce earned an adjusted $1.48 per share for the second quarter, beating the 92 cents consensus estimate, with revenue also topping Wall Street forecasts. Salesforce also issued an upbeat outlook as companies continue to shift applications to the cloud. Shares rose 2.6% in premarket trading.

Ulta Beauty(ULTA) – Ulta shares rallied 6.2% in the premarket after it more than doubled the $2.59 consensus estimate with a quarterly profit of $4.56 per share. The cosmetics retailer’s revenue beat estimates as well, and it raised its full-year outlook as an overall improvement in the beauty industry continues.

Williams-Sonoma(WSM) – Williams-Sonoma surged 13.6% in premarket trading following top and bottom-line beats as well as a raised outlook and a 20% dividend increase. The housewares retailer reported an adjusted quarterly profit of $3.24 per share compared with the $2.61 consensus estimate, as the pandemic-induced focus on homes and home decor continued.

Box(BOX) – Box beat estimates by 2 cents with an adjusted quarterly profit of 21 cents per share, while the cloud storage company’s revenue also came in above analyst forecasts. Box also raised its full-year revenue guidance, saying it continues to benefit from the “megatrend” of digital transformation. However, shares fell 1.7% in premarket action

Snowflake(SNOW) – Snowflake lost an adjusted 4 cents per share for its latest quarter, narrower than the 15-cent loss anticipated by Wall Street, while the database software company’s revenue came in above consensus. Sales more than doubled from a year ago, but its overall loss widened compared with a year earlier. Snowflake jumped 5% in premarket trading.

Pure Storage(PSTG) – Pure Storage soared 13.4% in the premarket after it nearly tripled the 5-cent consensus estimate with adjusted quarterly earnings of 14 cents per share. The cloud storage company’s revenue also topped Street projections as subscription revenue rose 31% from a year ago.

Autodesk(ADSK) – Autodesk shares tumbled 7.5% in premarket trading, as quarterly revenue was merely in line with estimates and its current-quarter earnings guidance disappointed investors. Autodesk did beat estimates by 8 cents for its latest quarter with adjusted quarterly earnings of $1.21 per share.

Western Digital(WDC) – Western Digital is in talks for a possible $20 billion merger with Japanese chipmaker Kioxia, according to multiple reports. Talks are said to have heated up in recent weeks, and a deal could be reached as early as mid-September, according to people familiar with the matter. Western Digital rose 1.1% in the premarket.