Jan 25 (Reuters) - Tesla Inc beat Wall Street targets for fourth-quarter revenue and profit on Wednesday despite a sharp decline in vehicle profit margins, and it sought to reassure investors that it can cut costs and continue to generate cash as competition intensifies in the year ahead.

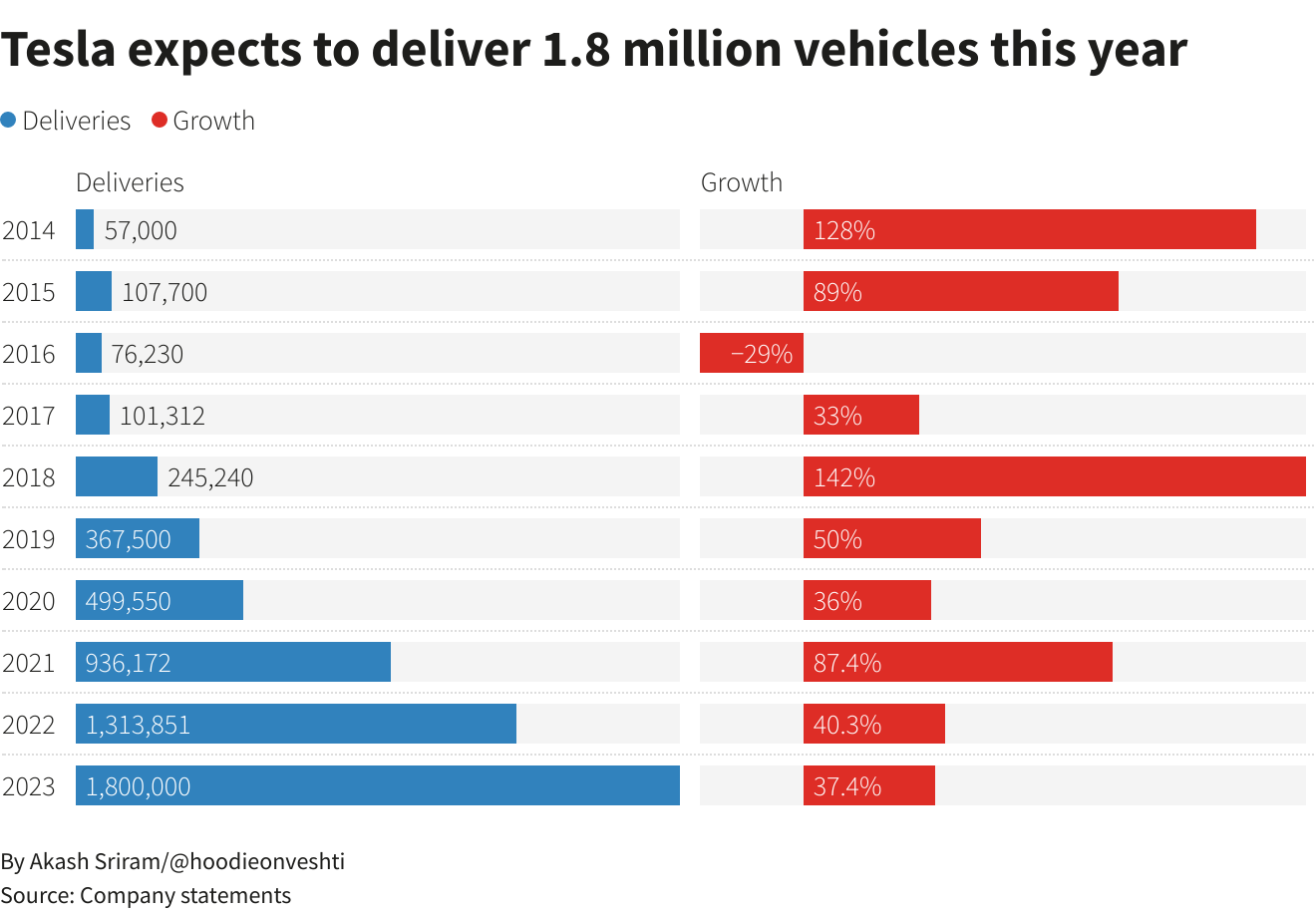

Tesla forecast a 37% rise in car volume for the year, to 1.8 million vehicles, slowing the pace of growth from last year even as it made aggressive price cuts.

Tesla's sales prospects after a huge price cut early this year, facing a weak global economy, are a key focus for investors. The company has a long-term target of a compounded 50% annual rise.

Acknowledging concerns about the uncertain economic environment and rising interest rates, Tesla said it is "accelerating our cost reduction roadmap and driving towards higher production rates" in the near term.

"In any scenario, we are prepared for short-term uncertainty," it added.

Tesla has outperformed the industry and increased sales and profit to records in recent years, weathering the pandemic and global supply-chain issues better than rivals. But its recent, steep global price cuts mark a move toward stimulating growth at the expense of profit margins, underscoring softening demand.

“Tesla’s demand outlook is a whole lot more bullish than practically any other automaker," said Garrett Nelson, analyst at CFRA Research, calling the quarter "solid."

“Margin fell a little short. I think what we're seeing is inflationary impact and higher raw material costs," he added.

Tesla shares rose 1% in extended trading. The company's stock posted its worst drop last year, hit by demand worries and CEO Elon Musk's acquisition of Twitter, which fueled investor concerns he would be distracted from running Tesla.

Margins generally are expected to be under further pressure from its aggressive price cuts. Tesla, which had made a series of price increases since early 2021, reversed course and offered discounts in December in the United States, followed by price cuts of as much as 20% this month.

The company said revenue was $24.32 billion for the three months ended Dec. 31, compared with analysts' average estimate of $24.16 billion, according to IBES data from Refinitiv.

Tesla said its automotive operation margin was 25.9% in the fourth quarter, the lowest in two years.

Tesla offered discounts in its top markets during the quarter after strong orders had allowed the company to maintain and even raise prices in recent years. CEO Elon Musk said in December "radical interest rate changes" had affected the affordability of all cars.

The EV maker handed over to customers a record 405,278 vehicles in the fourth quarter, even as the company missed its 50% annual growth target.

Net profit for the quarter was $3.69 billion, or $1.07 per share, compared with $2.32 billion, or 68 cents per share, a year earlier. Adjusted earnings per share of $1.19 topped the Wall Street analyst average of $1.13.

Tesla's full-year profit was bolstered by $1.78 billion in regulatory credits, up 21% from a year ago.

Its year-end cash hoard of $22.2 billion, and up to $7 billion in funds available in a new credit facility the company disclosed on Wednesday, give it ammunition to fight the price war it started earlier this month.

Tesla reinforced its balance sheet by securing access to up to $7 billion through a new credit facility. Tesla ended 2022 with just over $22 billion in cash and cash equivalents.

"Tesla’s plans to rapidly scale up output will only stimulate profit growth if demand is there to meet it. Even a small cooling of demand will have significant implications for the bottom line," said Sophie Lund-Yates, an analyst at Hargreaves Lansdown.