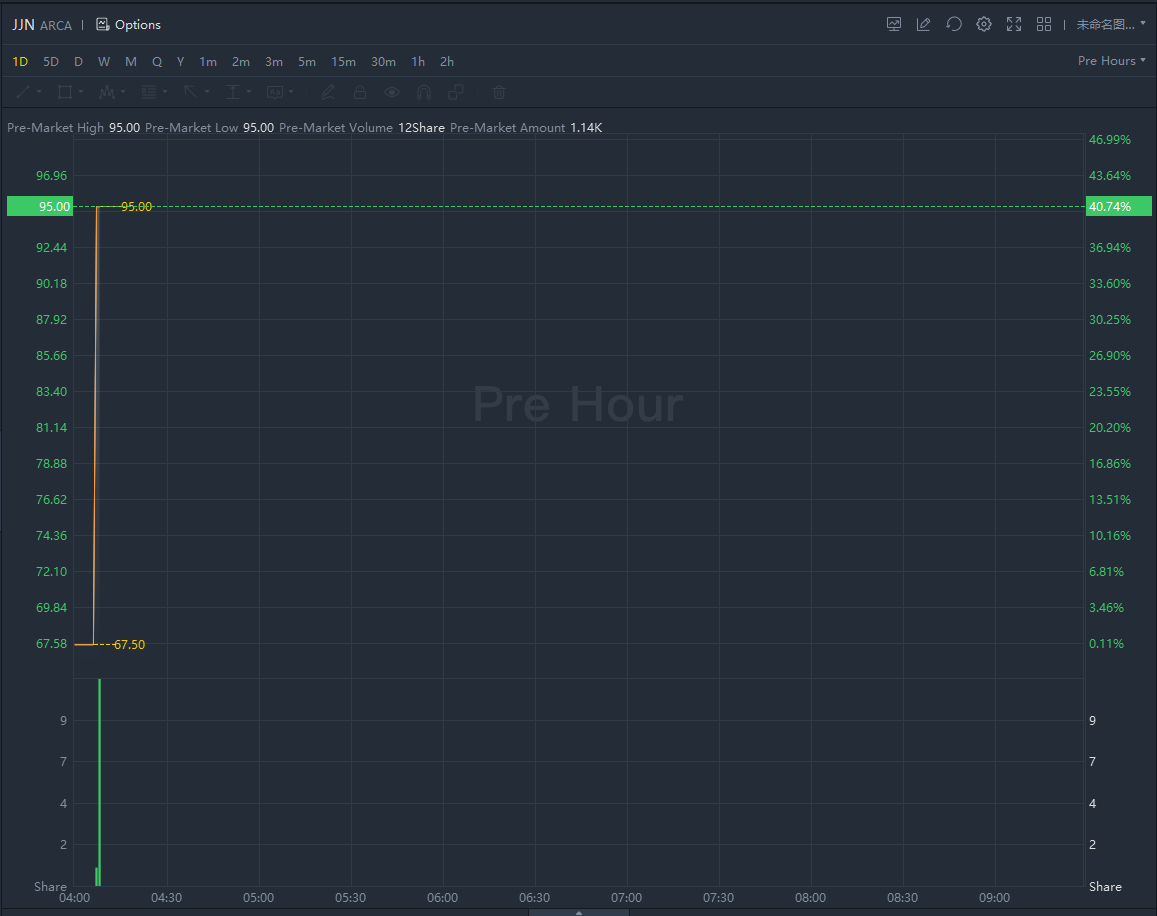

Nickel ETN surgerd over 40% amid a short squeeze.

The London Metal Exchange has suspended trading in its nickel contract after the price doubled on Tuesday and soared to a record above $100,000 a tonne amid a vicious short squeeze.

The 145-year-old exchange said it was evident the “evolving situation in Russia and Ukraine” had affected the nickel market and given the extreme price moves in Asian trading hours had taken the decision to halt trading on “orderly market grounds”.

“The LME will actively plan for the reopening of the nickel market, and will announce the mechanics of this to the market as soon as possible,” it said in a statement.

The conflict in Ukraine has caused huge volatility in commodity markets because of Russia’s position as a big supplier of energy, metals and food stuffs, but until now trading has continued in all major contracts.

The price of LME’s benchmark three-month nickel contract doubled in Asian trading on Tuesday and briefly rose above $100,000 a tonne following a jump of more than 70 per cent on Monday.