U.S. stock index futures rose on Friday after a selloff in the previous session driven by hawkish comments from a Federal Reserve official that stoked fears of more aggressive rate interest hikes from the central bank.

Market Snapshot

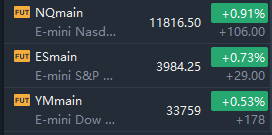

At 7:50 a.m. ET, Dow e-minis were up 178 points, or 0.53%, S&P 500 e-minis were up 29 points, or 0.73%, and Nasdaq 100 e-minis were up 106 points, or 0.91%.

Pre-Market Movers

Foot Locker(FL) – Foot Locker shares soared 14% in the premarket after beating top and bottom line estimates for its latest quarter. The apparel and footwear retailer also raised its full-year forecast and reported an unexpected rise in comparable store sales.

JD.com(JD) – The China-based e-commerce company reported better-than-expected quarterly results as Covid-related lockdowns in China prompted more consumers to shop online. JD.com shares jumped 5.2% in premarket trading.

Gap(GPS) – Gap shares rallied 5.1% in premarket trading after an unexpected return to profitability and better-than-expected sales. The apparel retailer is in the midst of a turnaround effort that has involved scaling down inventories and streamlining its brand portfolio.

Williams-Sonoma(WSM) – Williams-Sonoma slumped 8.1% in the premarket after the housewares retailer said it would not reiterate or update its outlook through fiscal 2024 due to economic uncertainty. Williams-Sonoma reported better-than-expected sales and profit for its latest quarter.

Ross Stores(ROST) – The discount retailer’s shares soared 16.9% in premarket trading after reporting better-than-expected quarterly results and an increased forecast, even in the face of higher prices and holiday season promotions.

Palo Alto Networks(PANW) – Palo Alto surged 9.2% in premarket action after it beat Wall Street’s top and bottom line estimates for the latest quarter. The cybersecurity company also issued slightly improved guidance as companies increase spending on network security.

Applied Materials(AMAT) – Applied Materials beat top and bottom line estimates for its latest quarter and the maker of semiconductor manufacturing equipment also issued upbeat current quarter guidance. Shares gained 4.4% in the premarket.

Farfetch(FTCH) – Farfetch reported a wider-than-expected quarterly loss with sales that also came in below analyst forecasts. The online luxury platform operator’s stock slumped 9.7% in off-hours trading.

Market News

JD Reports Higher Quarterly Sales, Defying China Downturn Fears

JD.com Inc. reported higher sales last quarter after shoppers kept spending at China’s second-largest online retailer despite an economic downturn.

Sales rose 11% from a year earlier to 243.5 billion yuan ($34.2 billion) in the quarter ending in September, the company said in a statement on Friday. That compared to the average forecast of 243.1 billion yuan from analysts surveyed by Bloomberg. The Beijing-based company logged net income of 6 billion yuan, improving on a 2.8 billion yuan loss the previous year with cost-cutting efforts.

Tesla Recalls About 30,000 Model X Cars Over Airbag Issue

Tesla Inc has recalled nearly 30,000 Model X cars over an issue that may cause the front passenger air bag to deploy incorrectly, according to a company letter filed with the regulator.

Calibration of a restraint control module, or a set of sensors, may cause the front passenger air bag to deploy incorrectly during some low speed crashes, the National Highway Traffic Safety Administration (NHTSA) said in a letter dated Nov. 17.

Amazon CEO Andy Jassy Says Layoffs Will Extend Into Next Year

Amazon chief executive Andy Jassy said that layoffs under way at the tech company, which will extend into next year, are the most difficult decision he has made since taking over from Jeff Bezos last year.

Mr. Jassy, in a note to employees made public, said positions are being eliminated across Amazon’s devices and books businesses. The company is cutting jobs across its corporate ranks that could affect 10,000 employees, or 3% of corporate staff, The Wall Street Journal has reported.

Fed to Lift Rates By 50 Basis Points, but Peak Policy Rate May Be Higher

The Federal Reserve will downshift in December to deliver a 50-basis-point interest rate hike, but economists polled by Reuters say a longer period of U.S. central bank tightening and a higher policy rate peak are the greatest risks to the current outlook.

U.S. consumer price inflation unexpectedly fell below 8% last month, bolstering already well-established market expectations the Fed would go for smaller rate hikes going forward after four consecutive 75-basis-point increases.