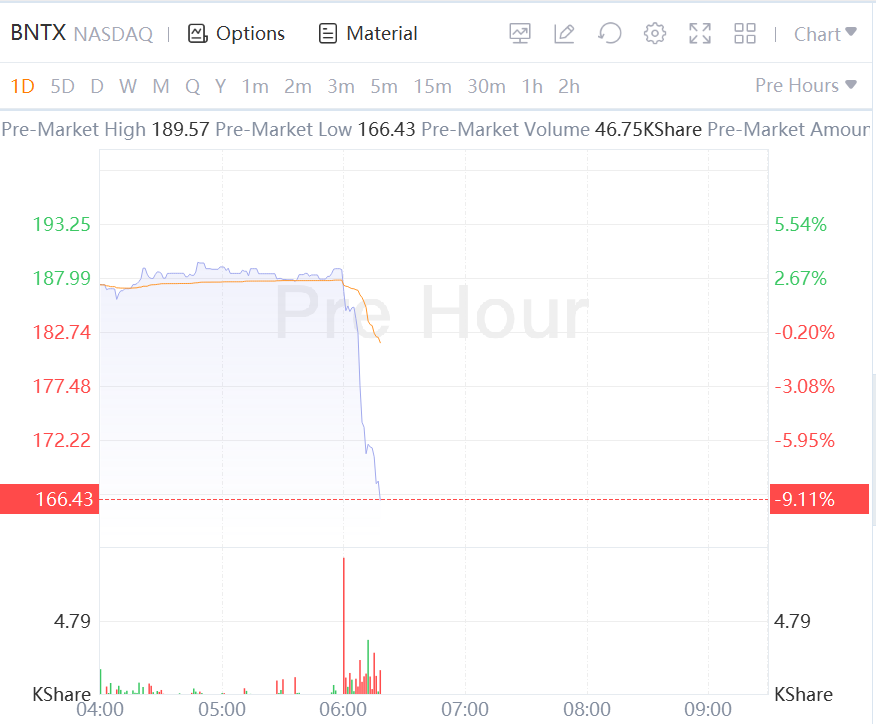

The U.S.-listed shares of Germany-based BioNTech sank 9.11% in premarket trading Monday, after the biotechnology company and Pfizer Inc. partner in developing a COVID-19 vaccine reported second-quarter profit and revenue that fell below expectations but affirmed its full-year COVID-19 revenue outlook.

Second quarter revenues of €3.2 billion, net profit of €1.7 billion and fully diluted earnings per share of €6.45 ($6.872) as well as first half 2022 revenues of €9.6 billion, net profit of €5.4 billion and fully diluted earnings per share of €20.69 ($18.922)

Reiterates BioNTech COVID-19 2022 vaccine revenue guidance of €13 billion to €17 billion

Preparing for potential launch of two variant-adapted bivalent COVID-19 vaccines containing the original strain and Omicron BA.1 or BA.4/5 spike protein as recommended by U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA) and other regulators; expect to be able to begin delivering Omicron-adapted vaccines as early as October 2022, subject to regulatory approval

Signed agreement with U.S. government to provide additional 105 million doses of COVID-19 vaccine with option for another 195 million doses

Received U.S. Emergency Use Authorization (EUA) for COVID-19 vaccine in children six months through four years of age and for a booster dose in children five through 11 years of age

Continued pipeline expansion with initiation of two new Phase 1 clinical trials (BNT116 and BNT142) to18 clinical-stage oncology programs in 23 ongoing clinical trials; BNT211, first-in-class CAR-T program targeting CLDN6, receives EMA Priority Medicines (PRIME) designation