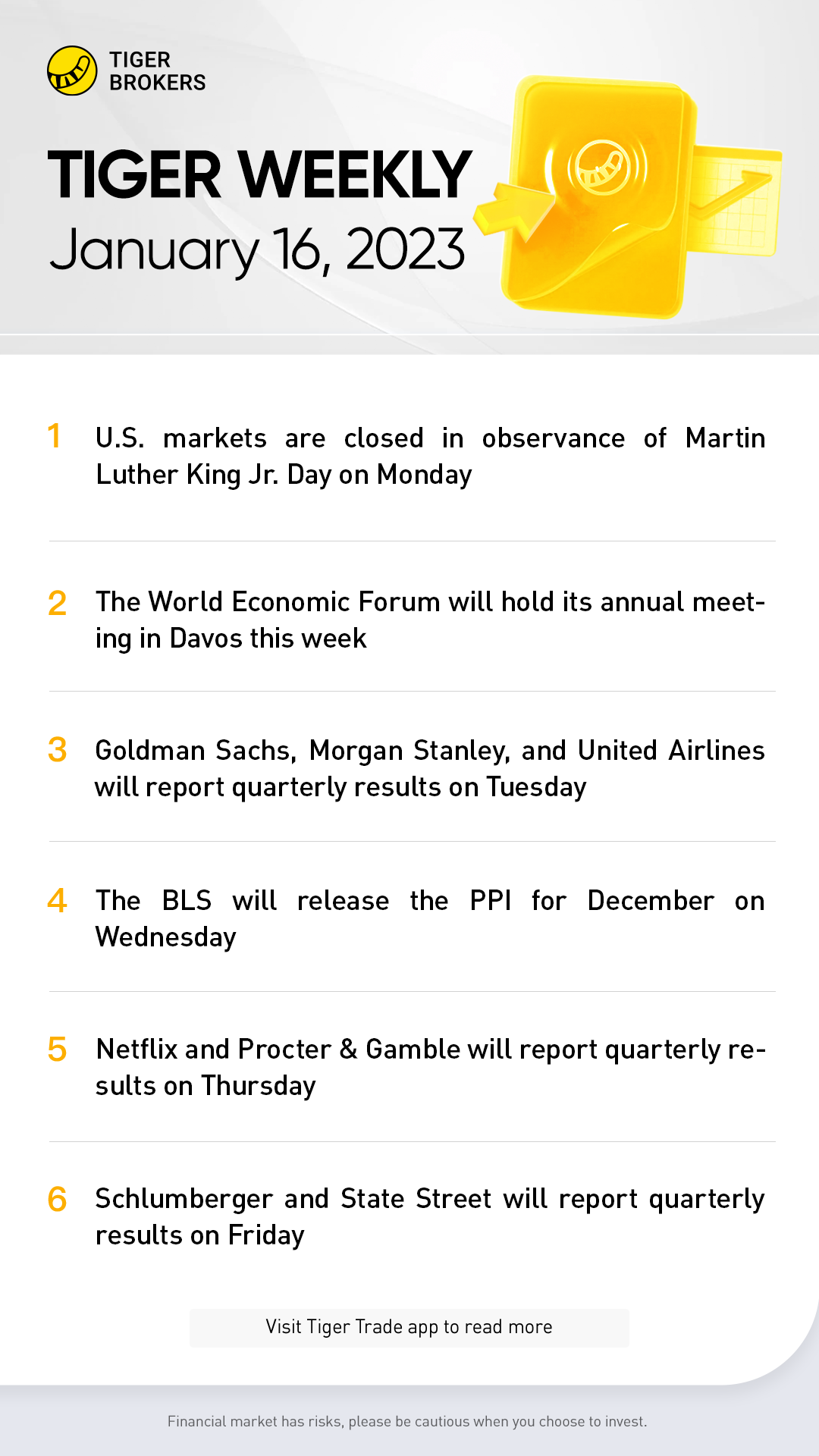

Stock and bond markets will be closed on Monday for Martin Luther King Jr. Day. It will be a busy week of fourth-quarter earnings season once Wall Street reopens.

Tuesday’s highlights will be results from Goldman SachsGroup, Morgan Stanley,and United AirlinesHoldings, followed by Charles Schwab, J.B. Hunt Transport Services,and Prologison Wednesday. Netflix, Procter & Gamble, and Fastenal report on Thursday.Schlumberger closes the week on Friday.

The main event on the economic-data calendar will be Wednesday’s release of the producer price index for December. Economists are expecting the headline PPI to be up 6.8% from a year earlier and for the core PPI to have increased 5.4%. Both would be lower than November’s inflation.

Other data out this week will include the Census Bureau’s retail sales data for December and the Federal Reserve’s first beige book of 2023, both on Wednesday. The Bank of Japan will also announce a monetary-policy decision on Wednesday. The central bank has been significantly more dovish over the past year than its developed-market peers.

Monday 1/16

Equity and fixed-income markets are closed in observance of Martin Luther King Jr. Day.

Tuesday 1/17

Citizens Financial Group, Goldman Sachs Group, Morgan Stanley, and United Airlines Holdings report quarterly results.

Monster Beverage hosts a virtual investor day.

Wednesday 1/18

The BLS releases the producer price index for December. Consensus estimate is for the PPI to rise 6.8% and core PPI to increase 5.4%, a moderation from November.

Charles Schwab, Discover Financial Services, J.B. Hunt Transport Services, Kinder Morgan, PNC Financial Services Group, and Prologis release earnings.

The Bank of Japan announces its monetary-policy decision. Traders are pricing in a 25% chance that the central bank will hike its key interest by 10 basis points, to zero from negative 0.1%, the level at which it has remained since early 2016. In December, the BOJ surprised the bond market by raising the cap on 10-year government bond yields. The yen has rallied about 15% against the U.S. dollar in the past three months as the last dovish major central bank is signaling it might finally tighten monetary policy.

The Federal Reserve releases the beige book for the first of eight times this year. The report summarizes current economic conditions through anecdotal evidence gathered by the 12 regional Federal Reserve banks.

The Census Bureau reports retail sales data for December. Economists forecast retail spending to decline 0.6% month over month, matching the November figure. Excluding autos, sales are seen dropping 0.4% compared to a 0.2% fall previously.

The National Association of Home Builders releases its Housing Market Index for January. The consensus call is for a 31 reading, even with the December figure, which was the lowest since the onset of the pandemic.

Thursday 1/19

Fastenal, Fifth Third Bancorp, KeyCorp, M&T Bank, Netflix, Northern Trust, Procter & Gamble, SVB Financial Group, and Truist Financial hold conference calls to discuss quarterly results.

The Census Bureau reports residential construction statistics for December. Housing starts are expected at a seasonally adjusted annual rate of 1.35 million, 77,000 less than in November. The 1.35 million would be the lowest total since June of 2020.

Friday 1/20

Huntington Bancshares, Regions Financial, Schlumberger, and State Street announce earnings.

The National Association of Realtors reports existing-home sales for December. Consensus estimate is for a seasonally adjusted annual rate of 3.98 million homes sold, about 100,000 less than in November.