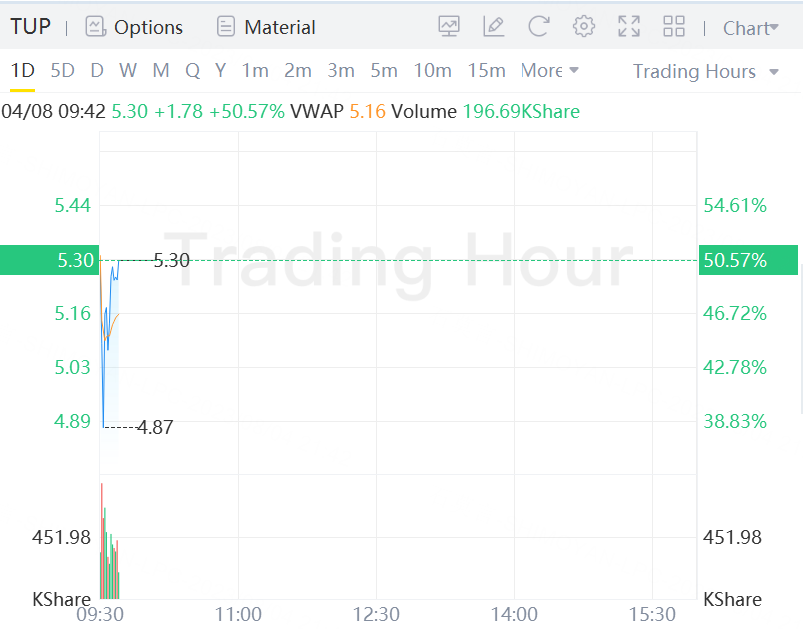

Tupperware Brands said on Thursday it has finalized an agreement with its lenders to restructure its debt obligations in an effort to turnaround its business, sending its shares soaring more than 50% in morning trading on Friday.

The agreement will help the company to reduce or reallocate about $150 million of cash interest and fees, and would give it immediate access to a revolving borrowing capacity of about $21 million.

Known for its plastic airtight storage containers and bowls, Tupperware has seen a sharp drop in demand recently as consumers limit discretionary purchases amid higher prices and fears of recession.

The company had on April 7 raised doubt about its ability to continue as going concern after failing to improve its business for about three years. The company reported $705.4 million in total debt for 2022.

In May, it signed investment bank Moelis & Co to help explore strategic options and said it has found additional prior period misstatements in its financial reporting.

The agreement also paves the way for the extension of the maturity of about $348 million of principal and reallocated interest and fees to 2027 with payment-in-kind interest.

It is also expected to aid a reduction of amortization payments required to be paid through 2025 by about $55 million.

Despite the going concerns, the company's shares have gained nearly 541% between July 21 and July 31, mirroring the moves seen in financially challenged companies like Bed Bath & Beyond and other "meme" stocks known for their popularity with retail investors.