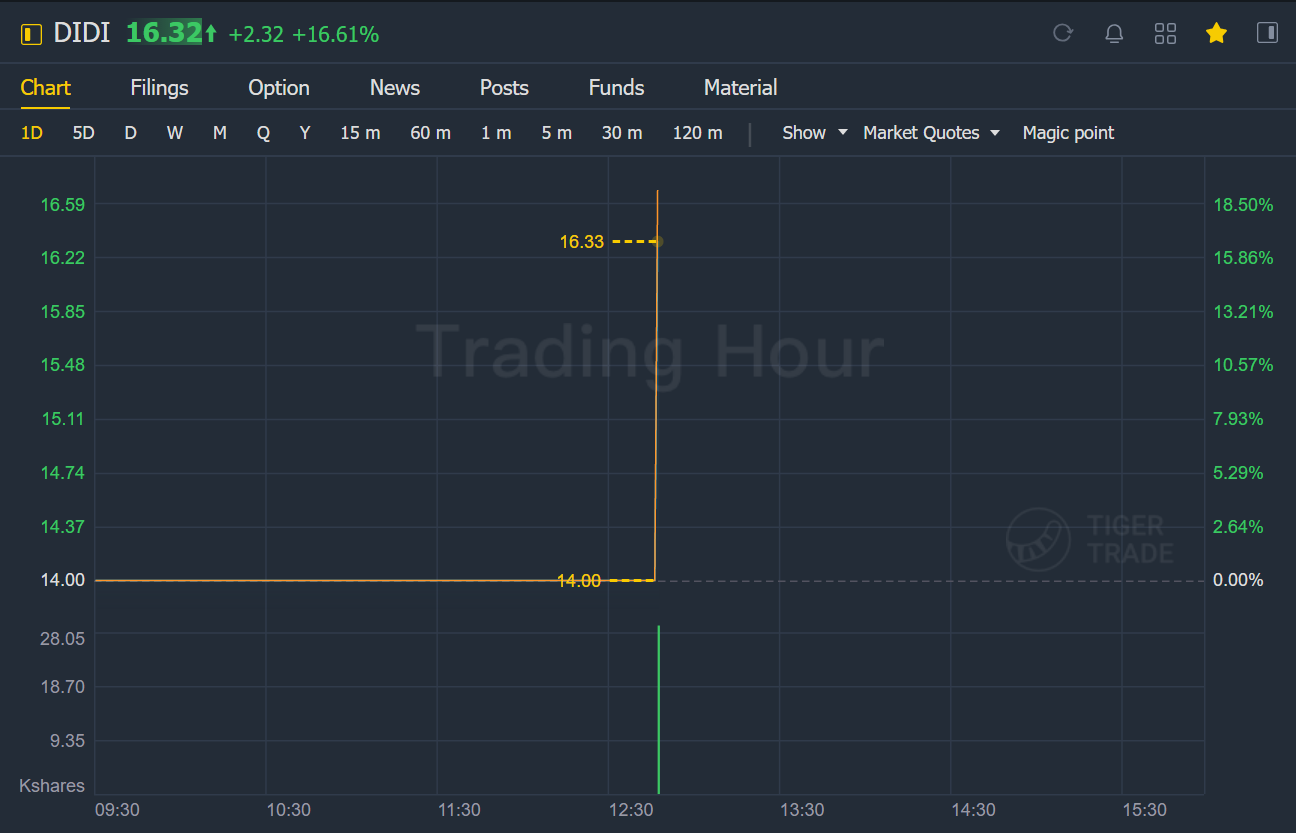

Chinese ride-hailing giant Didi Global Inc.opened at $16.32 each on Wednesday, about 16% higher than the company’s IPO price.

The Chinese ride-hailing behemoth on Wednesday said it sold 316.8 million American depositary shares at $14 each, the top of its $13 to $14 price range. Four such shares represent one class A ordinary share. The company announced on Wednesday morning that it had increased the size of the deal; it had planned on offering 288 million shares.

At $14 a share, Didi would have a $67 billion market capitalization. On a fully diluted basis, Didi’s valuation rises to about $73 billion

The Beijing company has raised $4 billion in the offering. The shares will start trading on Wednesday on the New York Stock Exchange under the ticker DIDI.

Goldman Sachs, Morgan Stanley, and J.P. Morgan are the underwriters on the Didi offering.

Didi provides a smartphone app that lets users connect with vehicles and taxis for hire. Founded in 2012, it operates in nearly 4,000 cities, counties, and towns across 16 countries,its prospectus said. It had more than 493 million annual active users as of March 31.

Its relationship with Uber is complicated

Comparisons between the world’s top two ride-hailing companies could become more frequent as Didi goes public in the United States.

In its filing, Didi said it has hundreds of millions of riders in China and operates in 16 countries and nearly 4,000 cities. Besides ride hailing, its new services include intra-city freight, community group buying and food delivery.

In its 2020 annual report, San Francisco-based Uber said that as of Dec. 31, 2020, it operated in 71 countries and about 10,000 cities. Uber offers rides, delivery and freight. Although it unloaded its autonomous-vehicle business last year, it has a partnership with self-driving company Aurora Technologies.

One thing Didi has in common with Uber (and smaller rival Lyft) is that it has also been mostly unprofitable. But it did turn a profit in the first quarter, reporting net income of 5.49 billion rembini ($837 million) on revenue of RMB 42.16 billion ($6.44 billion), up from a loss of RMB 3.97 billion on sales of RMB 20.47 billion the year before. That profit was largely due to its investments.

After a battle in which Didi and Uber lost a lot of money as they tried to undercut each other in China, Uber sold its Chinese business to Didi for $7 billion in 2016. Uber’s CEO at the time, Travis Kalanick, wrote in a blog post announcing the deal: “Uber and Didi Chuxing are investing billions of dollars in China and both companies have yet to turn a profit there.”

Uber retained a 12.8% stake in Didi, though, which will be reduced to a 12% stake after the IPO. That’s the second-largest stake in the company behind SoftBank Group’s 21.5% in equity ahead of the IPO. At the midpoint of Didi’s expected selling price, the number of shares Uber holds could be worth about $1.94 billion.

Didi sold all the shares it held in Uber last year for a gain of RMB 2.8 million ($427,417), according to its filing.

Insiders will have control

Following the trend of many recent IPOs, especially in the tech world, Didi will have a dual-class stock structure. Each Class A share (equal to four ADS) will have one vote, and each Class B share will have 10 votes.

Founder and Chief Executive Will Wei Cheng, co-founder and President Jean Qing Liu and CEO of the international business group Stephen Jingshi Zhu, who all sit on the board, will own all issued and outstanding Class B ordinary shares. These shares will comprise 9.8% of the company’s total issued shares and 52% of the voting power immediately after the public offering.

Cheng, 38, is also the chairman of the board. The former Alibaba and Alipay manager will have 6.5% equity in the company but 35.5% of the voting power after the IPO.

Cheng brought on Liu two years after he founded Didi. She will have 1.6% equity in the company after the offering.

The other top stakeholder in Didi besides its top executives, SoftBank and Uber is Tencent Holdings, which will have a 6.4% stake post-IPO.

‘Darkest days’

In summer 2018, two female passengers were killed by drivers on Didi’s Hitch platform. “These shook us to our core,” Cheng and Liu wrote in their founders’ letter under a section they called “Our darkest days.”

They said the company changed how it onboarded drivers and expanded background checks, as well as redesigned its technology with safety in mind. Didi also established what it calls a “SWAT team” to respond to safety incidents. In places where it is allowed, the company has installed video cameras in its ride-hailing vehicles.

The changes led to what the company said was “a massive drop in the number of criminal incidents per million rides on our platform as well as significant declines in the number of in-car disputes and traffic accidents.”

The company says that although the number of incidents have gone down, safety remains a risk factor.

Risk factors

Other big risk factors for the company include the Chinese government’s recently stepped-up antitrust crackdown on tech companies, including Didi. In its filing, Didi said that while it has completed a self-inspection and has tried to correct or improve in certain areas, it can’t be sure the government will be satisfied with that.

The company also said government regulators are concerned about driver income, pricing, and fairness to all platform participants, including riders and drivers. Like its biggest competitors, Didi treats its drivers as independent contractors, not employees. “Our business would be adversely affected if drivers were classified as employees, workers or quasi-employees,” Didi said in its filing.

As for how the COVID-19 pandemic has affected and continues to affect Didi’s business, the company said its core platform’s gross transaction value fell 4.8% in 2020 compared with 2019. In China, its mobility business’ GTV decreased 6.6% in the same period, while international GTV actually rose 11.4%. Didi cited increasing coronavirus cases in certain parts of the world as continuing risk factors.

Other businesses

Didi says it has the world’s largest network of electric vehicles on its platform: 1 million, including hybrids, as of the end of last year. Those EVs account for nearly 40% of the electric vehicle miles traveled in China, the company said, citing a study it commissioned. Didi has designed an EV itself, called the D1. It also says it has built China’s largest charging network, with more than 30% market share of total public charging volume in the first quarter of 2021.

As for autonomous vehicles, Didi says it has a team of more than 500 members working on Level 4 AVs for its fleet. The company said self-driving vehicles should help meet what it sees as increasing demand for ride-hailing services.

“The global mobility market is expected to reach $16.4 trillion by 2040, by which time the penetration of shared mobility and electric vehicles is expected to have increased to 23.6% and 29.3%, respectively,” it said in its filing, citing research it commissioned.