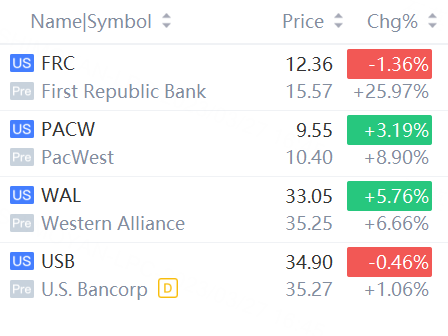

First Republic Bank rose over 25%; PacWest rose 9%; Western Alliance rose over 6%; U.S. Bancorp rose 1%.

According to Bloomberg, US authorities are considering expanding an emergency lending facility for banks in ways that would give First Republic Bank more time to shore up its balance sheet, according to people with knowledge of the situation.

Officials have yet to decide on what support they could provide First Republic, if any, and an expansion of the Federal Reserve’s offering is one of several options being weighed at this early stage. Regulators continue to grapple with two other failed lenders — Silicon Valley Bank and Signature Bank — that require more immediate attention.

Even short of that step, watchdogs see First Republic as stable enough to operate without any immediate intervention as the company and its advisers try to work out a deal to shore up its balance sheet, the people said, asking not to be named discussing confidential talks.

US officials have been keeping close tabs on the firm’s health and progress — aiming to stay vigilant in case the situation unexpectedly changes.

Behind the scenes, they have concluded the bank’s deposits are stabilizing and that it isn’t susceptible to the kind of sudden, severe run that prompted regulators to seize Silicon Valley Bank within just a few days, the people said.

Though First Republic has structural problems with its balance sheet, it has cash to meet client needs while it explores solutions, the people said. That includes $30 billion deposited by the nation’s largest banks this month.

First Citizens BancShares Inc said on Monday it will acquire the deposits and loans of failed Silicon Valley Bank , closing one chapter in the crisis of confidence that has ripped through global financial markets.

The Federal Deposit Insurance Corporation (FDIC), which took control of SVB earlier this month, said in a separate statement it has received equity appreciation rights in First Citizens BancShares stock with a potential value of up to $500 million as part of the deal.

First Citizens said the transaction was structured to preserve its solid financial position and the combined company remains resilient with a diverse loan portfolio and deposit base.

Under the deal, unit First–Citizens Bank & Trust Company will assume SVB assets of $110 billion, deposits of $56 billion and loans of $72 billion.