- Stock futures traded mixed Wednesday morning as investors awaited a key monetary policy decision and updated economic outlook from the Federal Reserve.

- 10-year Treasury yield hits fresh 13-month high of 1.65% ahead of Fed decision.

- Lands' End, CrowdStrike, Plug Power & more making the biggest moves in the premarket.

(March 17) Stock futures traded mixed Wednesday morning as investors awaited a key monetary policy decision and updated economic outlook from the Federal Reserve. Treasury yields climbed, and the yield on the benchmark 10-year Treasury note jumped to more than 1.65%.

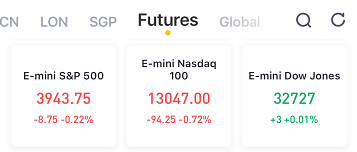

At 7:44 a.m. ET, Futures for the Dow Jones Industrial Average rose 3 points to 32,727.00, while the Standard & Poor’s 500 index futures fell 8.75 points at 3,943.75. Futures for the Nasdaq 100 index fell 94.25 points to 13,047.00.

A day earlier, the S&P 500 and Dow each ended lower to retreat from record closing highs notched earlier this week. The S&P 500's loss was its first in five days. The Nasdaq ended marginally higher as technology stocks outperformed. TheCBOE Volatility Index, or VIX, fell to a pandemic-era low of 19.3

Investors are looking ahead to the Federal Reserve's March monetary policy decision Wednesday afternoon, along with Fed Chair Jerome Powell's press conference later in the day. The commentary will elucidate the central bank's assessment of the economy in recovery, and help signal to investors how soon a tweak to the current monetary policy posturing might take place. For now, the Fed has signaled it will keep monetary policy loose, with benchmark interest rates near zero and asset purchases at a clip of $120 billion per month, as the economic recovery takes place.

Stocks making the biggest moves in the premarket

1) Lands' End(LE) – The apparel retailer reported quarterly earnings of 60 cents per share, topping the 56 cents a share consensus estimate. Revenue also topped analysts' forecasts. Lands' End forecast a smaller-than-expected loss for the current quarter and full-year earnings that exceed consensus. Its shares jumped 6.7% in premarket trading.

2) Lennar(LEN) – Lennar reported quarterly earnings of $2.04 per share, beating the consensus estimate of $1.71 a share. The homebuilder's revenue beat estimates as well, helped by low interest rates and solid demand. The company said that demand remains strong despite a recent rise in rates. Lennar added 1% in the premarket.

3) Coupa Software(COUP) – Coupa earned 17 cents per share for its latest quarter, compared to expectations of an 11 cents per share loss. The provider of financial management software's revenue came in above forecasts, in spite of what the company calls a difficult macroeconomic environment. Coupa shares rose 2% in premarket trading.

4) CrowdStrike(CRWD) – CrowdStrike beat estimates by 5 cents a share, with quarterly earnings of 13 cents per share. Revenue came in above estimates as well. The security software company also issued an upbeat outlook. Its shares gained 4.9% in premarket action.

5) Uber Technologies(UBER) – Uberwill grant its U.K. drivers employment statusthat will entitle them to vacation pay and pension contributions, after the ride-hailing service lost its final appeal of a case involving driver classification. Uber shares fell 1.6% in premarket trading.

6) Plug Power(PLUG) – Plug Power shares plunged 18.6% in the premarket after it said it will restate its financial results for 2018 and 2019, as well as some recent quarterly filings. The maker of fuel cells said it detected errors in how it accounted for a variety of non-cash items, but added that it did not find any misconduct.

7) Coherent(COHR) – The laser maker saidit had received a revised takeover bidfrom optical components makerLumentum(LITE) for $6.9 billion in cash and stock. This is the eighth bid for Coherent in a takeover contest involving Lumentum,II-VI(IIVI) andMKS Instruments(MKSI). Coherent's stock jumped 3.7% in premarket trading.

8) Pinduoduo(PDD) – The China-based e-commerce company reported a 146% surge in quarterly revenue that beat analysts' estimates. Pinduoduo also overtookAlibaba(BABA) as China's largest e-commerce company, with 788.4 million active users in 2020 compared to Alibaba's 779 million. Its stock initially surged in the premarket on the news, but then fell 5.8%.

9) Baidu(BIDU) – Baidu is set to raise about $3.1 billion from the China-based internet search company’s Hong Kong listing, according to people with direct knowledge of the matter who spoke to Reuters. Baidu had previously been expected to raise about $3 billion from the listing. Baidu shares fell 1.9% in the premarket.

10) Micron Technology(MU) – Micron plans to sell a Utah chip factory that made a type of memory chip called 3D Xpoint, which it jointly developed withIntel(INTC) in 2012. It plans to exit the 3D Xpoint market due to low demand from customers.

11) Catalent(CTLT) – Catalent plans a major expansion of Covid-19 vaccine production in Europe, according to people familiar with the matter who spoke to The Wall Street Journal. The contract drug manufacturer will double production ofJohnson & Johnson’s(JNJ) vaccine by starting a new production line at an Italian plant during the fourth quarter.

12) FirstEnergy(FE) – First Energy confirmed that the utility had struck a deal with activist investor Carl Icahn, giving him two seats on the board and avoiding a potential proxy fight. The agreement had earlier been reported by The Wall Street Journal. FirstEnergy rose 1.4% in premarket trading.

Big News

1、Powell needs to tamp down inflation concerns while defending policy

As bond yields rise on concerns about inflation,Powell needs to convince tradersthat easy current Fed monetary policy won’t overheat a recovering economy that just got another Covid stimulus boost. Central bankers get a new batch of housing data to consider at 8:30 a.m. ET. Economists expect February housing starts to drop 2.5% following a 6% decline in January. Building permits for February are seen falling 7% after January’s 10.4% gain. The Fed concludes its two-day March meeting Wednesday afternoon, with no one expecting any change in rates from near zero or any shift in the extraordinary measures designed to support growth during the coronavirus pandemic.

2. 15% of U.S. adults fully vaccinated; Trump touts shots to supporters

New dailyCovidcases in the U.S., down about 80% from early January, continued to fall as immunity protection increases from vaccinations and high levels of prior infection. More than 15% of the U.S. adult population has been fully vaccinated,according to the Centers for Disease Control and Prevention. However, while heading in the right direction, health officials say those vaccination numbers need to go much higher to stomp out the disease, which killed an average of 1,285 people in America over the past seven days, according to Johns Hopkins University data.

Former PresidentDonald Trumpurged people to be vaccinated against the coronavirus,saying he would recommend itto “a lot of people that don’t want to get it, and a lot of those people voted for me.” However, in a Fox News interview Tuesday night, Trump acknowledged that people were free to decide for themselves whether to get shots.

3、 White House sets low bar for Thursday’s U.S.-China meeting

The White Houseis setting low expectationsahead of Secretary of State Antony Blinken and national security advisor Jake Sullivan’s first face-to-face meeting with their Chinese counterparts in Anchorage, Alaska, on Thursday. According to a senior Biden administration official, the two sides won’t deliver a joint statement and no major announcements are expected.

Reflecting Washington’s concern about the erosion of Hong Kong’s rights, the U.S.sanctioned an additional 24 Chinese and Hong Kong officialsover Beijing’s ongoing crackdown on political freedoms in the semi-autonomous city. China said the new sanctions expose America’s “sinister intention to interfere in China’s internal affairs, disrupt Hong Kong and obstruct China’s stability and development.”

4. Uber grants UK drivers worker status after losing labor battle

Uberwill reclassify all U.K.-based drivers as workers, in the wake of losing a major labor battle there earlier this year.Under the new designation, more than 70,000 drivers in the U.K. will get some benefits, including a minimum wage, holiday time and pension contributions. However, they won’t receive full employee benefits. In a SEC filing, Uber said its U.K. ride-hailing business accounted for 6.4% of all mobility gross bookings in the fourth quarter of 2020. Shares of Uber fell 1.5% in U.S. premarket trading.

These are the main moves in markets:

Currencies

The Bloomberg Dollar Spot Index jumped 0.2%.The euro dipped 0.1% to $1.1896.The British pound gained 0.1% to $1.39.The onshore yuan was little changed at 6.505 per dollar.The Japanese yen weakened 0.2% to 109.20 per dollar.

Bonds

The yield on 10-year Treasuries advanced four basis points to 1.66%.The yield on two-year Treasuries increased one basis point to 0.16%.Germany’s 10-year yield gained two basis points to -0.32%.Britain’s 10-year yield jumped five basis points to 0.835%.Japan’s 10-year yield decreased less than one basis point to 0.1%.

Commodities

West Texas Intermediate crude dipped 0.9% to $64.23 a barrel.Brent crude fell 1.1% to $67.65 a barrel.Gold weakened 0.2% to $1,728.29 an ounce.