History suggests that the Nasdaq’s underperformance can continue. The Dow beat the Nasdaq by at least seven percentage points in 1978, 1980, and 1992, but most months of Dow dominance came during the popping of the dot-com bubble—a total of 12 from 1999 through 2002.

There’s nothing worse than kicking someone when they’re down—but sometimes it needs to be done. That’s the case with the Nasdaq Composite, which is on pace to lag behind the Dow Jones Industrial Average in October by the most in any one month since 2002, and could keep bringing up the rear.

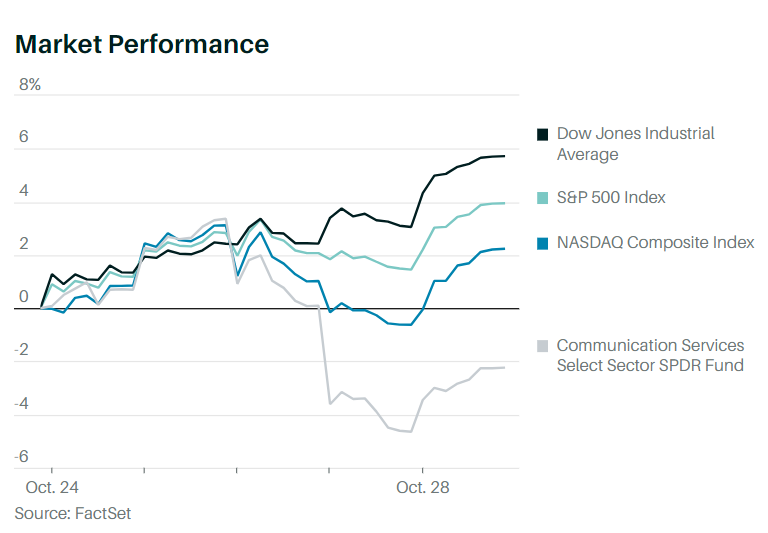

There’s no denying that the stock market did very well last week. The Dow gained 5.7%, while the S&P 500SPX –0.75% rose 4%, and the Nasdaq advanced 2.2%. It was the Dow’s fourth consecutive week of gains.

And what a four weeks it has been. The Dow has jumped 13.95% in October and is on pace for its best month since January 1976, when the blue-chip benchmark surged 14.41%. The other indexes have fallen short of those gains: The Russell 2000 has climbed 11%, the S&P 500 has gained 7.99%, and the Nasdaq Composite has risen a paltry 3.9%.

That kind of outperformance by the Dow against the Nasdaq doesn’t happen very often. The Dow has outperformed the Nasdaq by more than nine percentage points this month, the most since February 2002, when it outperformed by 12.35 percentage points, and the seventh-largest monthly gap in 45 years. Monday’s losses--the Dow is off

Blame the Nasdaq’s underperformance on its biggest stocks. This past week saw Meta Platforms shed 24% of its value, while Alphabet dropped 4.8%, Amazon.com fell 13%, and Microsoft slid 2.6%, all after reporting earnings. Only Apple, which rose 5.8% after reporting its results, finished the week higher, though it is down 1.1% on Monday.

“This really is the first time in 20 years that investors in technology have had their assumptions of effortless outperformance challenged to this degree,” writes Michael Shaoul, CEO of Marketfield Asset Management.

History suggests that the Nasdaq’s underperformance can continue. The Dow beat the Nasdaq by at least seven percentage points in 1978, 1980, and 1992, but most months of Dow dominance came during the popping of the dot-com bubble—a total of 12 from 1999 through 2002. Following one-offs in 1978, 1980, and 1992, the S&P 500 went on to rally by an average of 9.5% over the next six months. During the dot-com bust, the S&P 500 averaged a 9.9% decline following a month of Dow dominance.

The truth may be somewhere in between. Marta Norton, chief investment officer for the Americas at Morningstar Investment Management, says euphoria around tech resembles the dot-com boom, but just the fact that we call it Big Tech suggests a major difference in quality between now and then. Unfortunately, many of these stocks still look expensive. “We want to buy them,” Norton says. “But we want to buy them when they’re cheap, and not before then.”