U.S. stocks closed higher on Thursday (May 18) on mounting optimism that a U.S. debt ceiling deal could be reached within days, with discount retailer Walmart Inc providing additional support after an upbeat annual sales forecast.

Regarding the options market, a total volume of 44,341,156 contracts was traded, up 6.6% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; Tesla; NVIDIA; VIX; PLTR; AMZN; AAPL; AMD; IWM

Palantir shares jumped another 14.5% on Thursday after surging 8% on Wednesday amid optimism that lawmakers in Washington would reach a deal to raise the U.S.'s debt ceiling.

Palantir goes back to Cathie Wood's flagship fund. Cathie Wood-led ARK Investment Management bought over 1.26 million shares of Palantir Technologies Inc at an estimated valuation of about $13 million based on Wednesday's closing price.

Earlier this month, the data software company reported first-quarter results and guidance that topped expectations. During the period, Palantir generated $236M in commercial revenue, including $107M from U.S. commercial revenue. Government-related revenue rose 20% year-over-year to $289M, including $230M from the U.S. federal government.

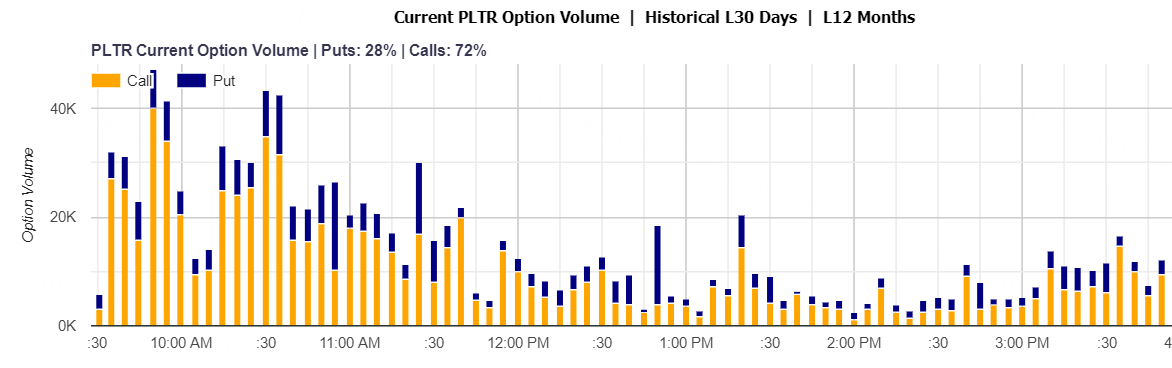

A total number of 1,140,923 options related to Palantir was traded, of which call options accounted for 72%.

Following the strong results, however, some Wall Street analysts expressed caution for Palantir. Citi analyst Tyler Radke, who has a sell rating and a per-share price target of $5 on Palantir, noted the revenue outperformance in the first-quarter was driven by special purpose acquisition companies that went out of business and the revenue was pre-paid and pulled forward as a result of the bankruptcies.

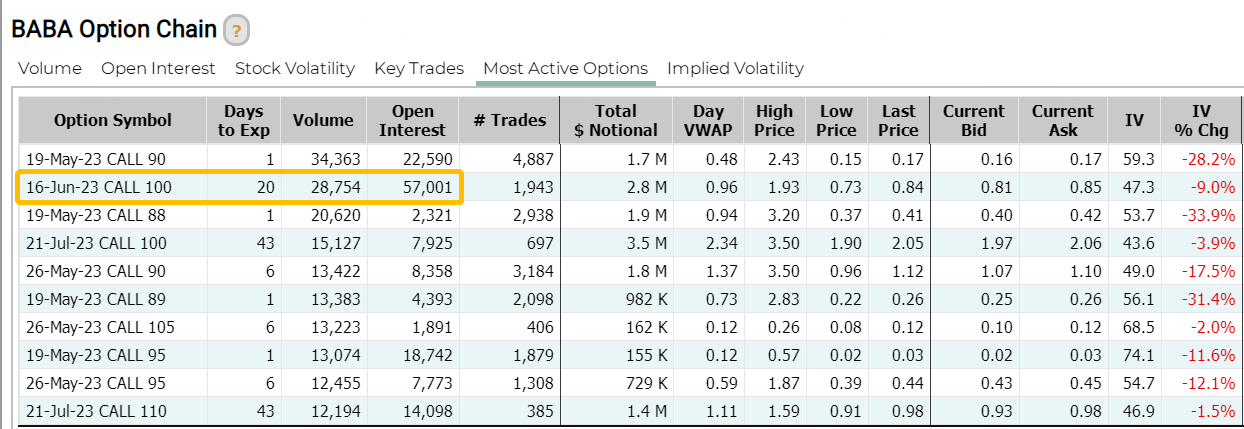

Most Active Options

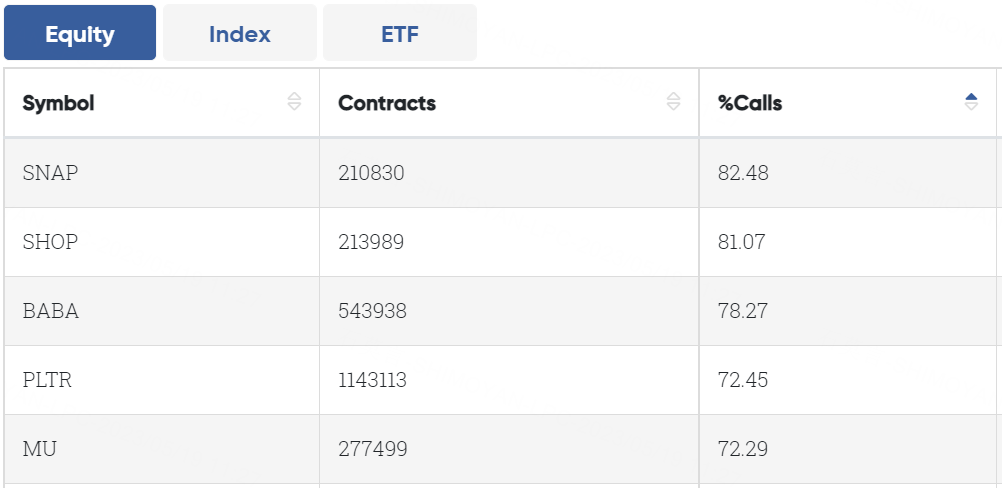

1. Most Active Trading Equities Options:

Special %Calls >70%: Snap; Shopify; Alibaba; Palantir; Micron Technology

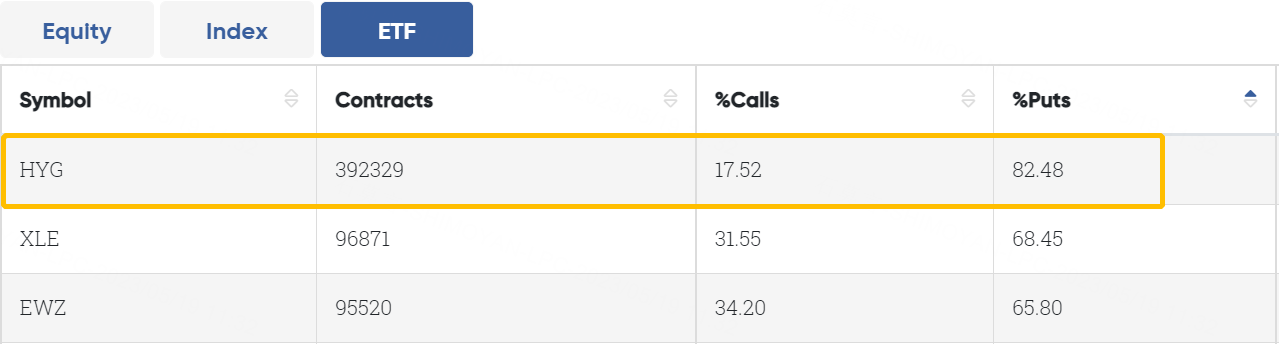

2. Most Active Trading ETFs Options

Special %Calls >70%: Nasdaq 100 Bear 3X ETF; VIX Short-Term Futures 1.5X ETF; United States Natural Gas Fund

Special %Puts >80%: $iShares iBoxx High Yield Corporate Bond ETF

Unusual Options Activity

Alibaba posted a 2% rise in quarterly revenue that missed expectations and said its board has approved a spinoff of its cloud-computing business. Alibaba shares slid 5.4% after its quarterly results.

The company logged revenue of 208.20 billion yuan ($30.12 billion) for the three months ended in March, compared with a Refinitiv consensus estimate of 210.3 billion yuan drawn from 26 analysts.

Earlier this year, Alibaba announced plans to restructure into six units, a move that followed a two-year regulatory crackdown on China's tech sector. It expects all of its units except for its China-facing e-commerce division to seek outside funding and go public.

A total number of 542,920 options related to Alibaba was traded, of which call options accounted for 78%.

A particular high open interest was seen for the 100 strike call option expiring June 16, with 57,001 open interest as of Thursday.

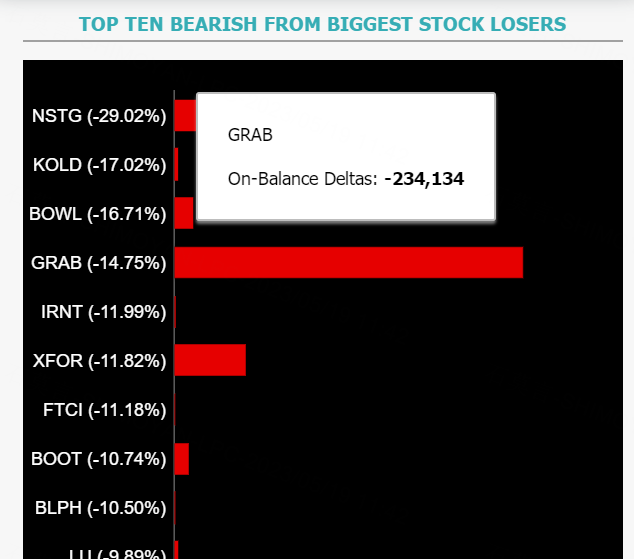

Grab Holdings Ltd said on Thursday that an early Ramadan weighed on sales at its delivery business, taking the shine off an otherwise positive quarter and sending the Southeast Asian company's shares down 14.75% on Thursday.

A total number of 234,134 options related to Grab was traded. Sea's net imbalance totalled up to -234,134, implying the highest volume of bearish activity from the biggest stock losers by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

Total platform sales at Grab's delivery business - its biggest - fell 9% in the March quarter due to the early start of the Ramadan fasting period and the first Chinese New Year without mobility restrictions since the pandemic.

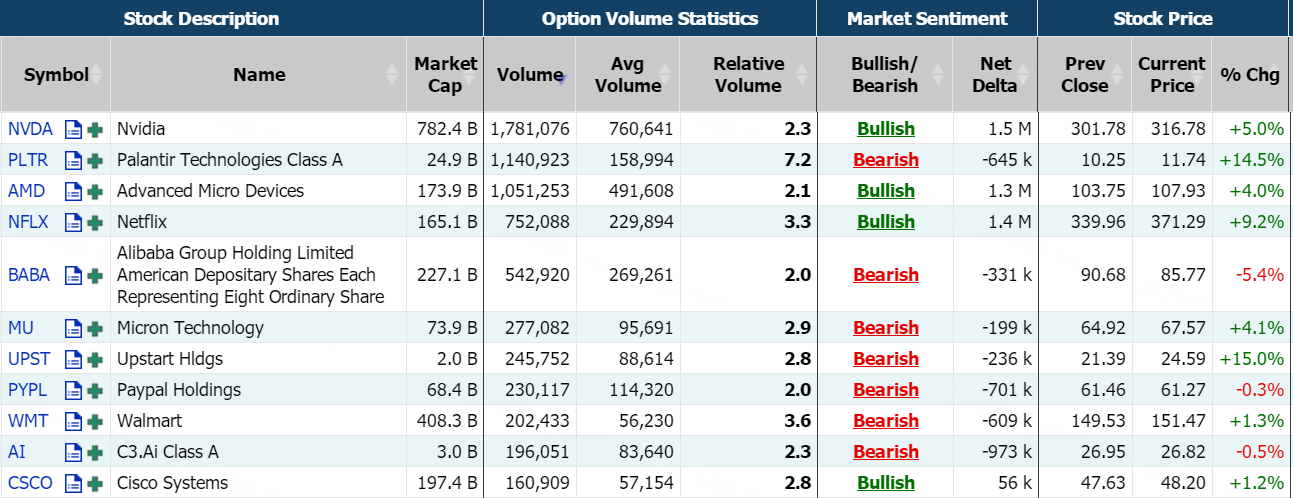

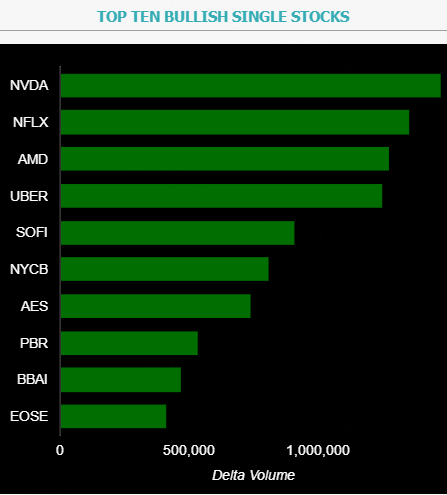

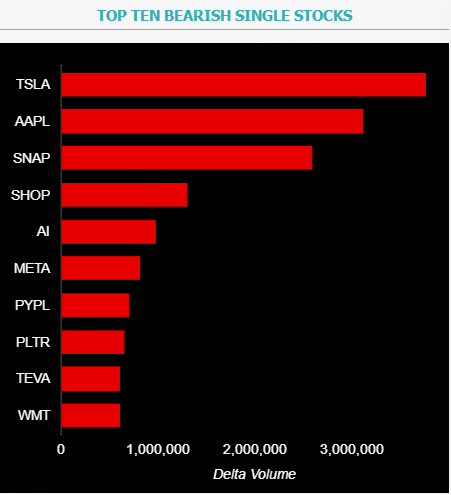

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: NVDA; NFLX; AMD; UBER; SOFI; NYCB; AES; PBR; BBAI; EOSE

Top 10 bearish stocks: TSLA; AAPL; SNAP; SHOP; AI; META; PYPL; PLTR; TEVA; WMT

Shares in Nvdia Corp, Advanced Micro Devices on Thursday provided the biggest boosts to the chip sector, which outperformed the broader market as investors looked for ways to invest in artificial intelligence and in Japan. AMD shares were up 4.0% while Nvidia, which is up 116% so far in 2023, is due to report quarterly results on May 24.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club