Hasbro cut its annual revenue forecast for the second time on Thursday, joining rival Mattel in warning of choppy toy sales into the crucial holiday quarter as price-conscious shoppers cut back on non-essential spending.

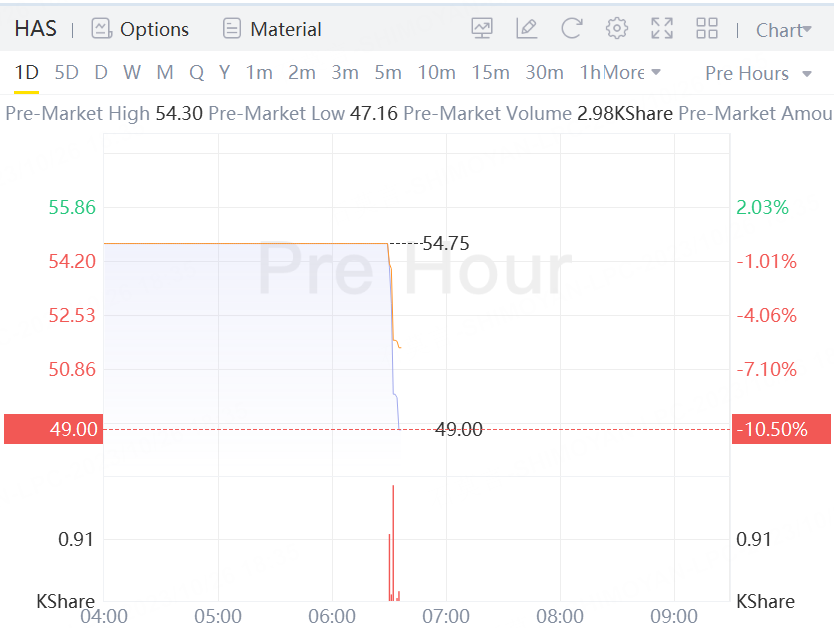

Shares of the company fell over 10% in premarket trading as it also missed third-quarter revenue estimates.

The company now expects fiscal 2023 revenue to fall 13% to 15%, compared with prior expectations of a 3% to 6% decline.

Demand across the toy industry has come down since a pandemic surge, as consumers remain under pressure from higher borrowing costs, re-allocating their budget to cover for household essentials and services instead of leisure spending.

The maker of Transformers action figures expects its toy business to decline in mid- to high-teens for the year compared with mid-single digits decline it forecast earlier.

At a September conference, Hasbro had said its toy sales struggled in July and August and warned that the current quarter sales could be hit if trends did not improve in September.

Mattel's shares fell 10% in premarket trading after the Barbie maker held its annual sales forecast unchanged on Wednesday, citing challenging macroeconomic environment.

The Monopoly maker's net revenue fell 10% to $1.50 billion in the third quarter ended Oct. 1. Analysts on average expected $1.64 billion, according to LSEG data.