U.S. stock index futures edged higher on Monday as markets braced for a Federal Reserve policy meeting during the week and earning reports from some of the biggest companies to gauge the impact of a strong dollar and soaring inflation.

Market Snapshot

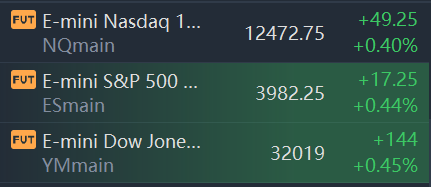

At 8:08 a.m. ET, Dow e-minis were up 144 points, or 0.45%, S&P 500 e-minis were down 17.25 points, or 0.44%, and Nasdaq 100 e-minis were up 49.25 points, or 0.40%.

Pre-Market Movers

Newmont(NEM) – The mining company’s stock slid 3.3% in premarket trading after it reported lower-than-expected second-quarter earnings. Profit was down nearly 41% from a year ago, hurt by a drop in gold prices.

Squarespace(SQSP) – The e-commerce platform provider tumbled 14.4% in the premarket after its full-year revenue guidance fell short of Street forecasts. Squarespace reported better-than-expected results for its latest quarter but said revenue is taking a hit from currency headwinds.

Philips(PHG) – Philips tumbled 10.4% in premarket trading after the Dutch medical equipment maker’s quarterly earnings fell short of analyst forecasts. Philips was affected by lockdowns in China and supply chain issues.

Public Storage(PSA) – Public Storage added 1.5% premarket action after the operator of self-storage facilities declared a special dividend of $13.15 per share. The distribution is related to the sale of PS Business Parks to affiliates ofBlackstone(BX) for $7.6 billion. Public Storage had been the largest shareholder in PS Business Parks, whose sale transaction closed last week.

JD.com(JD) – Morgan Stanley calls the Chinese e-commerce company a “catalyst driven idea”, helping its stock rise 2% in premarket trading. The firm thinks the catalyst could be better than expected revenue growth guidance when JD.com next reports earnings in August.

Tesla(TSLA) – Tesla rose 1.3% in premarket action following its latest 10-Q filing, which included an update on the value of its bitcoin holdings. Tesla said it took a $170 million impairment charge related to the carrying value of its bitcoin holdings during the first six months of 2022, but saw a $64 million gain from bitcoin sales during that period.

Ryanair(RYAAY) – Ryanair jumped 5.7% in the premarket after the airline reported better-than-expected quarterly results. Ryanair cautioned that a return to pre-Covid levels of profitability this year was not certain.

Farfetch(FTCH) – Farfetch shares gained 2.5% in premarket trading following reports that the online luxury fashion seller was close to a deal with Switzerland’s Richemont that would see it absorb Richemont-owned fashion retailer YNAP.

Uber Technologies(UBER) – The ride-hailing company admitted to not reporting a 2016 data breach that impacted 57 million drivers and passengers as part of a settlement agreement to avoid criminal prosecution. Uber added 1% in premarket trading.

Market News

Tesla Gets Second Subpoena over Musk's 2018 Go-Private Tweets

Tesla Inc has received a second subpoena from the U.S. Securities and Exchange Commission over its Chief Executive Elon Musk's tweets in 2018 about taking the company private, the electric automaker disclosed in a regulatory filing on Monday.

The company said it received the subpoena on June 13 and will cooperate with the government authorities. The regulator did not immediately respond to a Reuters request for comment.

WHO Declares Monkeypox a Global Health Emergency

The World Health Organization has declared that monkeypox is a public-health emergency of international concern, despite divisions among members of the committee of experts who advise the agency, as global case numbers surpass 16,000.

This is the first time the WHO has declared a global health emergency since the start of the Covid-19 pandemic in January 2020. In an unusual move, WHO Director-General Tedros Adhanom Ghebreyesus, went against the majority view of the emergency committee in making the declaration.

Philips Misses Q2 Forecasts, Cites Supply Chain Issues and China Lockdowns

Dutch medical equipment maker Philips on Monday reported a worse-than-expected drop in second-quarter core earnings to 216 million euros ($220 million), citing supply shortages and lockdowns in China.

Analysts had forecast adjusted earnings before interest, taxes and amortisation (EBITA) of 324 million on sales of 4.23 billion for the three months ended June 30, according to a company-compiled poll.

Kremlin Says Gas Flows Depend on Nord Stream Turbine Turnover

Flows of Russian natural gas to Europe via the Nord Stream link will depend on how quickly the pipeline equipment is repaired and returned toGazprom PJSC, a Kremlin spokesman said, as governments and businesses watch for any signals on the future of supplies.

Nord Stream, a key gas route between Russia and the European Union, has been operating at roughly 40% of its capacity, with Gazprom blaming the West for the capped flows. Only two out of six turbines at the Russian end of the pipeline are operating as western sanctions have limited maintenance options for the equipment, according to the Russian gas producer.