Nasdaq futures tumbled on Friday as elevated U.S. Treasury yields and Snap Inc's forecast of no revenue growth for the busy holiday quarter rattled shares of other social media companies.

Market Snapshot

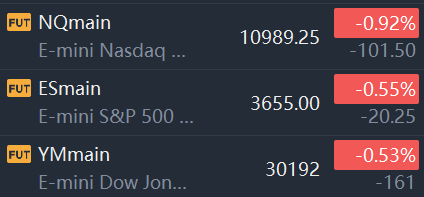

At 7:59 a.m. ET, Dow e-minis were down 161 points, or 0.53%, S&P 500 e-minis were down 20 points, or 0.55%, and Nasdaq 100 e-minis were down 101.5 points, or 0.92%.

Pre-Market Movers

American Express(AXP) – The financial services company reported a quarterly profit of $2.47 per share, 6 cents above estimates, with revenue also topping Wall Street forecasts. American Express also raised its full-year forecast, amid a surge in customer spending, and increased the amount in reserve for potential defaults. The stock fell 4.7% in the premarket.

Verizon(VZ) – Verizon earned an adjusted $1.32 for the third quarter, beating the consensus estimate by 3 cents, with revenue also better than expected. Verizon also reported a smaller number of postpaid net phone adds than expected, noting it had anticipated some negative impact from raising prices.

Snap(SNAP) – The Snapchat parent’s stock tumbled 28.2% in the premarket after forecasting no revenue growth for the current quarter. The slowdown in the digital ad market also took down the stocks of other companies dependent on ad revenue, withPinterest(PINS) sliding 7.5%,Meta Platforms(META) losing 3.5%,Alphabet(GOOGL) off 1.7% andTwitter(TWTR) sliding 6.9%.

CSX(CSX) – The rail operator’s stock rallied 5.2% in premarket trading following better-than-expected results for the third quarter, benefitting from higher shipment volumes and higher prices.

Tenet Healthcare(THC) – The hospital operator’s stock dropped 18% in premarket action after issuing a weaker-than-expected outlook. Tenet said it is working to recover from a cyber attack earlier this year and a Covid-19 spike among its workers.

Veris Residential(VRE) – The owner of New Jersey rental apartments is the object of an unsolicited takeover bid by rival Kushner Cos., according to a person familiar with the matter who spoke to the Wall Street Journal. The bid is said to be worth $16 per share, compared with yesterday’s $12.42 closing price. Veris rallied 13.5% in premarket trading.

Intercontinental Hotels(IHG) – The parent of Holiday Inn saw its stock fall 4.2% in the premarket following news that Chief Financial Officer Paul Edgecliff-Johnson is leaving to join bookmaking company Flutter Entertainment.

Whirlpool(WHR) – The appliance maker’s profit and revenue for the latest quarter came in below Wall Street forecasts. The company also gave a weaker-than-expected outlook amid softer demand and reduced production. Whirlpool fell 4.4% in premarket action.

Under Armour(UAA) – The athletic apparel maker’s stock lost 2.6% in the premarket after Telsey Advisory Group downgraded it to market perform from outperform. Telsey is basing its call on elevated inventory levels at rivals likeNike(NKE) and Adidas, although it noted that Under Armour’s inventories are leaner than its competitors.

Market News

Verizon profit drops 23% as pricier plans result in subscriber loss

Verizon Communications Inc(VZ.N)posted a 23% slide in third-quarter profit and missed market estimates for wireless subscriber additions on Friday, as several customers opted for cheaper plans from rivals AT&T Inc(T.N)and T-Mobile US Inc(TMUS.O).

Verizon lost 189,000 monthly bill-paying phone subscribers in its consumer business in the quarter after the U.S. carrier raised prices for its plans in June through additional charges, which was over and above its already pricier plans.

Schlumberger third-quarter profit jumps as drilling activity picks up

Top oilfield services provider Schlumberger Ltd(SLB.N)reported a 64.9% jump in third-quarter profit on Friday that topped Wall Street expectations as a surge in oil and gas prices led to more drilling activity.

Oil and gas producers are looking to increase production as crude prices stay near eight-year highs, boosting demand for Schlumberger's equipment, services and technology. Brent crude prices averaged $98.96 a barrel during the quarter, up 33%.

AmEx Adds Record Number of Platinum Customers, Boosts Profit Forecast

American Express Co.slumped after it set aside more for bad loans than analysts expected, suggesting rising interest rates could start crimping customers’ ability to pay their bills.

Provisions for souring loans were $778 million in the quarter, worse than the $573 million analysts in a Bloomberg survey were expecting. AmEx has warned investors for months that charge-offs would rise as consumers begin borrowing more in the wake of the pandemic. The net write-off rate jumped to 1.1% from 0.8% a year ago.

U.S. Weighs Security Reviews for Musk Deals, Including Twitter Buy

Biden Administration officials are discussing whether the United States should subject some of Elon Musk's ventures to national review including the deal for Twitter Inc and SpaceX's Starlink satellite network, Bloomberg News reported on Thursday, citing people familiar with the matter.

The SpaceX chief in recent times has taken to Twitter to announce proposals to end Russia's war in Ukraine, and also said SpaceX cannot indefinitely fund its Starlink internet service in Ukraine. He later backed down and said he would continue to bear the costs of the service.