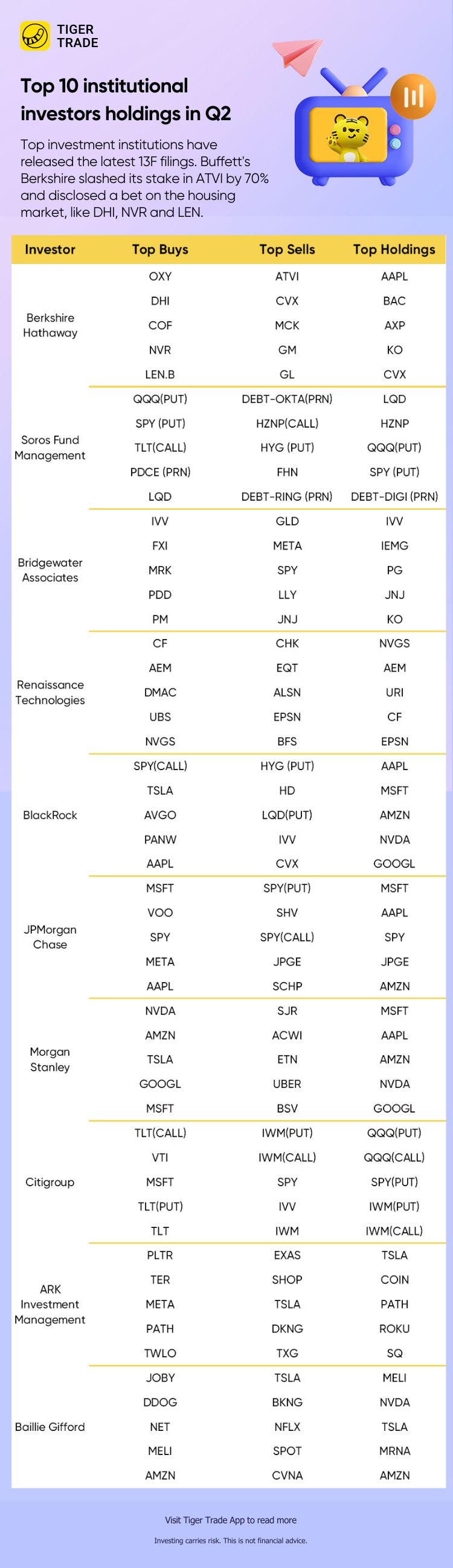

Hedge funds and institutional investors have released their holdings through 13F disclosures. Warren Buffett’s Berkshire Hathaway Inc. slashed its stake in Activision Blizzard Inc. by 70% during the second quarter amid the video-game maker’s prolonged effort to merge with Microsoft Corp. and disclosed a bet on the housing market.

Billionaire investor George Soros loaded up on shares of AI chip makers while dumping stakes of some large cloud software names, according to a Securities and Exchange Commission filing late Friday.

Bridgewater Associates, the 50-year-old hedge fund founded by billionaire investor Ray Dalio, started new positions in AT&T(T) with 1.98M shares, Spotify Technology with 68.8K shares, Micron Technology with 218.6K shares, DoorDash with 368.3K shares, and Cummins (NYSE:CMI) with 39.5K shares, during the second quarter, according to its latest 13F filing.

Let's check what “smart money” are buying over the past quarter: