The growth rate of CPI in the United States dropped significantly in July-will the Fed change its determination to tighten?

The ugliest three months (April-June) of CPI growth in the United States have passed, and it can be clearly seen that CPI growth declined in July. Even from life, we can feel that prices are returning to normal. For example, Uber's taxi fares are beginning to drop. Uber said in its quarterly report that the number of drivers increased by 30% in July, even if it didn't give drivers the same benefits as Lyft. With more drivers, the taxi price will be cheaper, which is a supply-side improvement. As for why the number of drivers began to increase, the mainstream media in the United States will not say it. In fact, the reason is very simple-the money given to ordinary people by the federal government in the early stage has run out.

According to the CPI data released by the US Department of Labor, there are annual growth (YOY) and quarterly adjusted monthly growth (MOM). For CPI, the growth after quarterly adjustment is more telling. When consumers go to the supermarket to buy food, they can remember the price of last week and last month at most, and the feeling of price change in about one month is the most obvious. Even consumers with good memories have difficulty remembering pork prices a year ago.

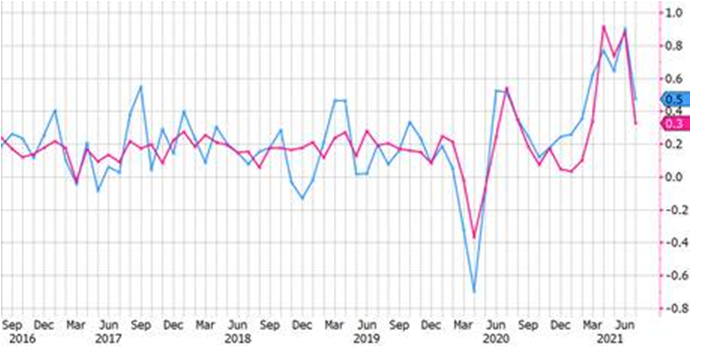

On the whole (below), the monthly CPI growth (blue) dropped to 0.5%, and the core CPI growth (red) dropped to 0.3% after food and energy were excluded. Before COVID-19, the monthly growth of core CPI in the United States was basically 0.1-0.3%. In other words, the 0.3% CPI core growth in July has returned to the edge of the normal range.

There is a saying on Wall Street that the new Delta variant has affected the consumption of American people, so it has lowered the CPI this time. I don't agree with this view. The impact of Delta variant on American consumers can only be counted as August at most, and American consumption in July was negligible. According to the number of passengers in the United States published by TSA, the number of passengers in July was basically stable at the level of 80% in the same period of 2019, and even exceeded the level of the same period in 2019 in some days in early July. The influence of Delta variant was hardly felt in July.

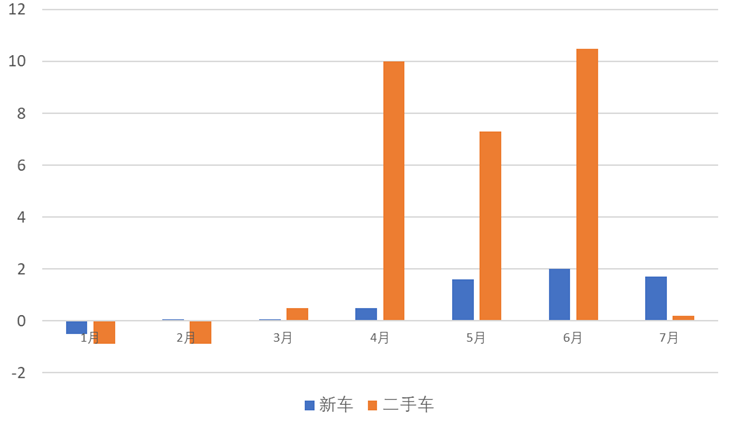

Looking closely at the CPI data this time, the most striking thing is that the price of used cars has dropped sharply. The following figure shows the monthly price increase of used cars and new cars after quarter adjustment since this year. The price of used cars fell to 0.2% in July from a monthly increase of 8-10% in the previous three months.

The price of cars in the world has risen because of chip shortage, but the price of used cars obviously exceeds the price of new cars, which is abnormal. The second-hand car market in the United States belongs to Dealer's highly controlled market. Because new cars are out of stock, these Dealers are stimulated to deliberately hoard goods and raise prices, which is very similar to domestic commodity prices because of hoarding and speculation. However, as long as the supply of new cars improves a little (the growth of new car prices began to fall in July), the prices of used cars will be crushed, and it is not excluded that the monthly growth of used car prices will become negative next month.

The CPI in the United States is gradually moving towards normal. Will this change the determination and pace of the Federal Reserve to tighten the currency? Absolutely not.

1. CPI is an indicator of the Federal Reserve's reference to monetary policy, but the Federal Reserve is now uncertain about the large amount of money left outside. Even if CPI falls, the Fed is still not sure whether too much money will cause problems at any time. During this time, the Federal Reserve quietly raised the reverse repo rate, hoping to lock up more currencies, which is a sign of uncertainty.

2. Infrastructure plans and welfare plans will be launched soon. If both plans are successfully implemented, it will be $4 trillion of liquidity release, and if only the infrastructure plan is implemented, it will be $0.5 trillion. Faced with the large spending of the US Treasury Department, the Federal Reserve must hedge.

3. The chairman of the Federal Reserve is now at a crucial time for re-election. His support politicians are * * politicians and left-center politicians, and his opposition politicians are extremely * * politicians. If he wants to be re-elected, he must keep the support of * * politicians, so he can't let the currency be too liquid.

Looking ahead, CPI data will fall further, but this will not shake the Fed's determination to tighten liquidity at all.