U.S. stocks gained ground on Monday as market participants parsed mounting expectations of interest rate cuts from the Federal Reserve in the coming year and looked ahead to a week of crucial economic data.

A broad but modest rally boosted the S&P 500 and the Nasdaq to solid gains, while the Dow ended flat.

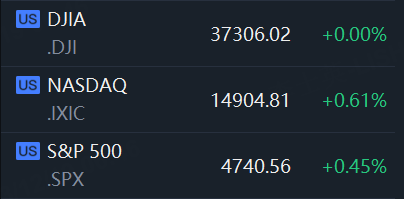

Market Snapshot

The Dow Jones Industrial Average held steady at 37,306.02, the S&P 500 gained 21.37 points, or 0.45%, to 4,740.56 and the Nasdaq Composite added 90.89 points, or 0.61%, to 14,904.81.

Market Movers

U.S. Steel (X) - U.S. Steel was rising 26.1% to $49.59 after reaching an agreement to be acquired by Nippon Steel for $55 a share in cash or $14.9 billion including debt. U.S. Steel closed at $39.33 on Friday. The deal, if approved by regulators, is expected to close in the second or third quarter of next year. Nippon Steel has committed to maintaining U.S. Steel’s relationships with the United Steelworkers union, the companies said.

Apple (AAPL) - Apple was down 0.9% after the technology giant said it would be halting sales of the Apple Watch in the coming days as it prepares to comply with a U.S. import ban.

NIO (NIO) - U.S.-listed shares of NIO were rising 4.6% after the Chinese electric-vehicle maker said it received a $2.2 billion investment from CYVN Holdings, an investment vehicle based in Abu Dhabi. The latest investment raises CYVN’s holding in NIO’s total issued and outstanding shares to 20.1%.

Adobe (ADBE) - Adobe said it was terminating its deal to acquire after design tools maker Figma for $20 billion. Adobe rose 2.5%.

SunPower (SPWR) - Shares of SunPower were sinking Monday 31.3% after the solar company issued a “going concern” warning on the heels of a potential default.

VF Corp (VFC) - VF Corp, the parent company of Vans and The North Face, said a security breach it detected last week could have a “material impact” on its business. The stock declined 7.8%.

Illumina (ILMN) - Gene-sequencing company Illumina said it plans to sell Grail, its unit that makes cancer blood tests, after a federal appeals found the U.S. government had the right to challenge the $7.1 billion acquisition made in 2021. Illumina said the divestiture will be made through a third-party sale or capital markets transaction with the goal of finalizing the terms by the end of the second quarter of 2024. Illumina shares rose 1.6%.

FuelCell Energy (FCEL) - FuelCell Energy fell 0.7% after the producer of units that make electricity from hydrogen announced a partnership with Exxon Mobil aimed at reducing carbon dioxide emissions.

Affirm (AFRM) - Affirm was falling 0.6% to $43.70 after shares of the buy-now-pay-later operator were downgraded to Underweight from Equal Weight at Morgan Stanley. The price target was raised to $20 from $15.

Uber Technologies (UBER) - Uber Technologies was down slightly as shares of the ride-hailing app made their S&P 500 debut on Monday. Jabil (JBL), down 2%, and Builders FirstSource (BLDR), off 1.5%, also joined the index on Monday.

Market News

Apple to Halt US Sales of Smartwatches After Patent Loss

Apple Inc. will stop selling the latest versions of its smartwatch in the US due to a patent dispute, taking some of its best-selling devices off the market during the busy holiday season.

Sales of the Apple Watch Series 9 and Ultra 2 will be halted on the company’s online store on Dec. 21 and at its physical retail locations beginning on Christmas Eve, it said in a statement Monday.

The company is preparing for a looming ban of Apple Watch models with a blood oxygen sensor — a feature first added to the lineup in 2020 — that Masimo Corp. says it invented.

China's Nio to Get $2.2 Bln Investment From Abu Dhabi's CYVN

Electric vehicle maker Nio has signed a pact for an investment of $2.2 billion from CYVN Holdings, an investment vehicle based in Abu Dhabi, the Chinese company said on Monday.

The investment comes as Nio, with its EV sales and profitability under pressure in a price war started by Tesla, has sought to boost efficiency by cutting a tenth of the workforce and deferring non-core projects.

The deal, expected to close in the final week of December, would take CYVN's shareholding to 20.1% of Nio's total issued and outstanding shares, following an investment of $1 billion in July, Nio said in a statement on its website.

That would make CYVN the largest single shareholder of Nio, although founder and chief executive William Li retains the most voting power, with his ownership of Class 'C' ordinary shares.