Market Overview

Major U.S. stock indexes ended lower on Friday (Feb. 3th) after surprisingly strong jobs data sparked concerns about aggressive Federal Reserve action, while investors digested a mixed bag of megacap company earnings reports.

Regarding the options market, a total volume of 55,297,127 contracts was traded, down 12.3% from the previous trading day.

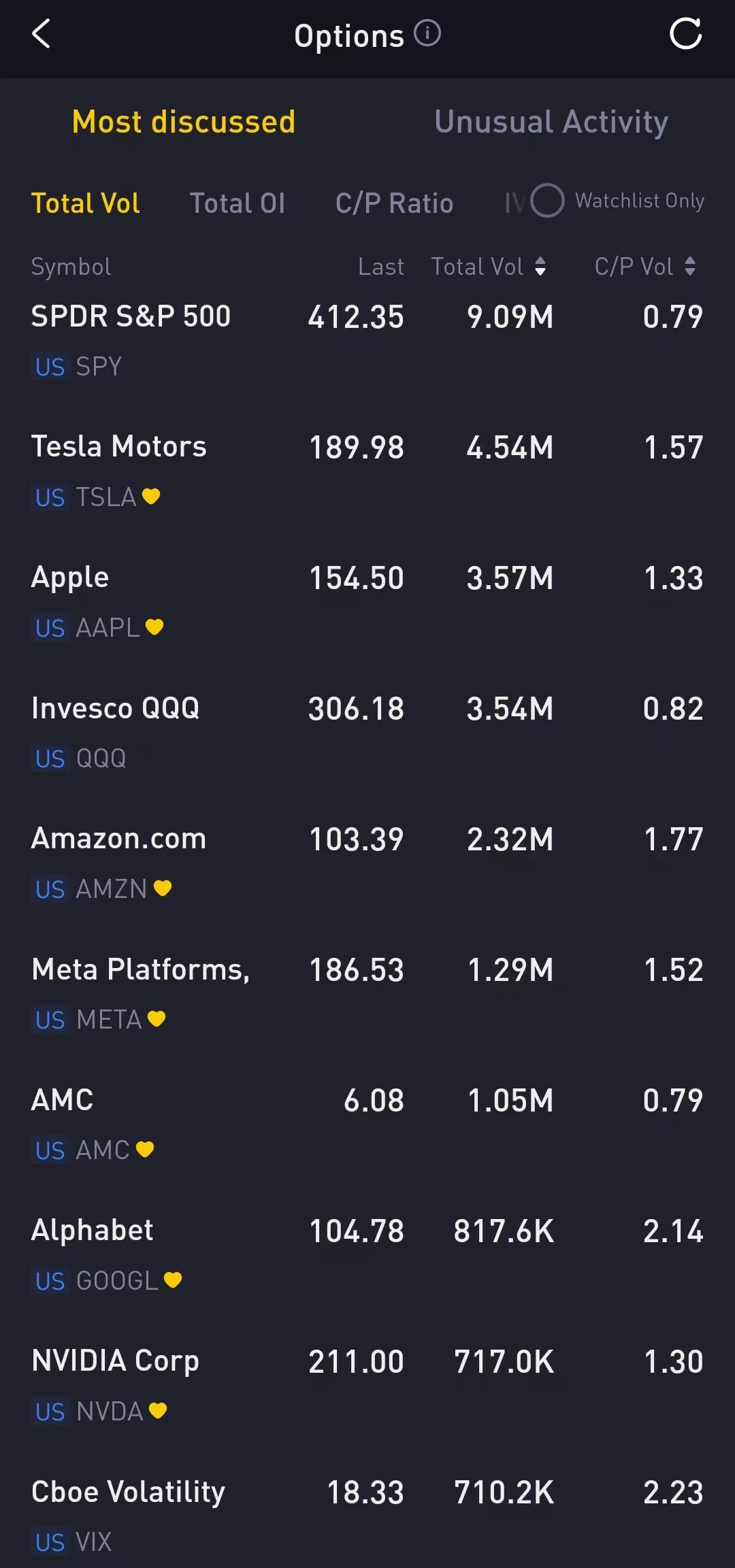

Top 10 Option Volumes

Top 10: SPY, TSLA, AAPL, QQQ, AMZN, META, AMC, GOOGL, NVDA, VIX

Options related to equity index ETFs are still popular with investors, with 9.09 million SPDR S&P500 ETF Trust and 3.54 million Invest QQQ Trust ETF options contracts trading on Friday.

Total trading volumes for SPY and QQQ were down about 0.3% and 5.6%, respectively, from the previous day. 56% of SPY trades bet on bearish options.

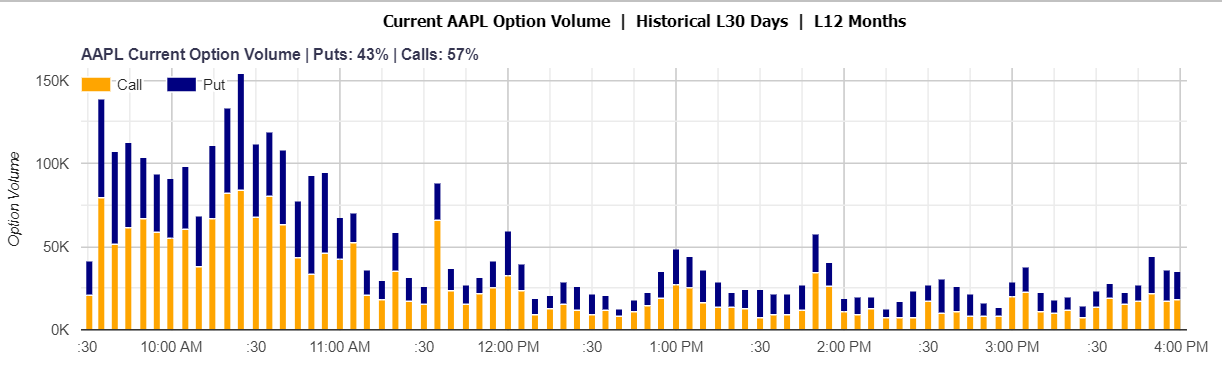

Shares of Apple, the largest U.S. company by market value, rose 2.44% to $154.5. The company forecast that revenue would fall for a second quarter in a row but that iPhone sales were likely to improve as production had returned to normal in China.

There were 3.57 million Apple options trading on Friday, of which call options accounted for 57%. A particularly high volume was seen for the $160 strike call option expiring February 10, with 107,194 contracts trading on Friday.

Shares of Amazon slumped 8.4% to $103.39 as the company said operating profit could fall to zero in the current quarter as savings from layoffs do not make up for the financial impact of consumers and cloud customers clamping down on spending. A particularly high options trading volume was seen for the $100 strike put option expiring February 10, with 62,394 contracts trading on Friday.

Alphabet shares dropped 2.75% to $104.78 after Google parent posted fourth-quarter profit and sales short of Wall Street expectations. A particularly high options trading volume was seen for the $106 strike call option expiring February 10, with 37,504 contracts trading on Friday.

Unusual Options Activity

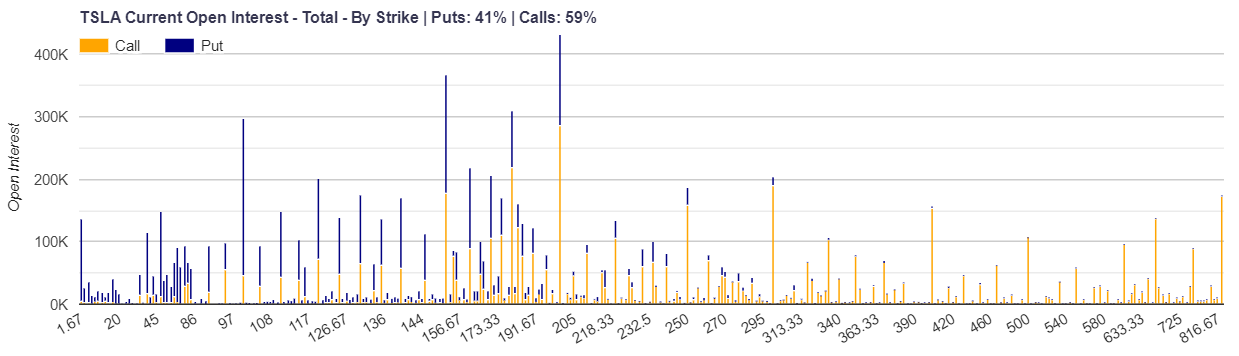

Tesla stock climbed on Friday on news of a wider US tax credit for electric vehicles and a sales spike in China. Shares jumped as much as 5% to an intraday high of $199 while closing up 0.91% on Friday. There were 4.54 million Tesla options trading on Friday, up 35% from the previous tradng day. Call options account for 59% of overall open interest. A particularly high options trading volume was seen for the $200 strike call option expiring February 10, with 119,412 contracts trading on Friday.

Ark Innovation ETF also saw a rise in options trading volume, with a total volume of 511,095 options trading on Friday. Call options account for 54% of overall options trading volume. A particularly high options trading volume was seen for the $43 strike call option expiring February 10, with 92,674 contracts trading on Friday.

Cathie Wood’s funds had a scorching start to the year. A rebound for beaten-down tech shares benefits Cathie Wood's flagship fund. The ARKK rose 37.16% as of Feb. 3th this year, while the Nasdaq 100 is up 14.72%.

Among top 10 holdings of ARKK, Coinbase performs best with a 110.88% YTD return. ARK Innovation ETF’s top holding —Tesla Inc.— is also a top stock in the Nasdaq. Her flagship fund’s other big positions are concentrated in smaller, newer companies like Zoom and cancer-test maker Exact Sciences.

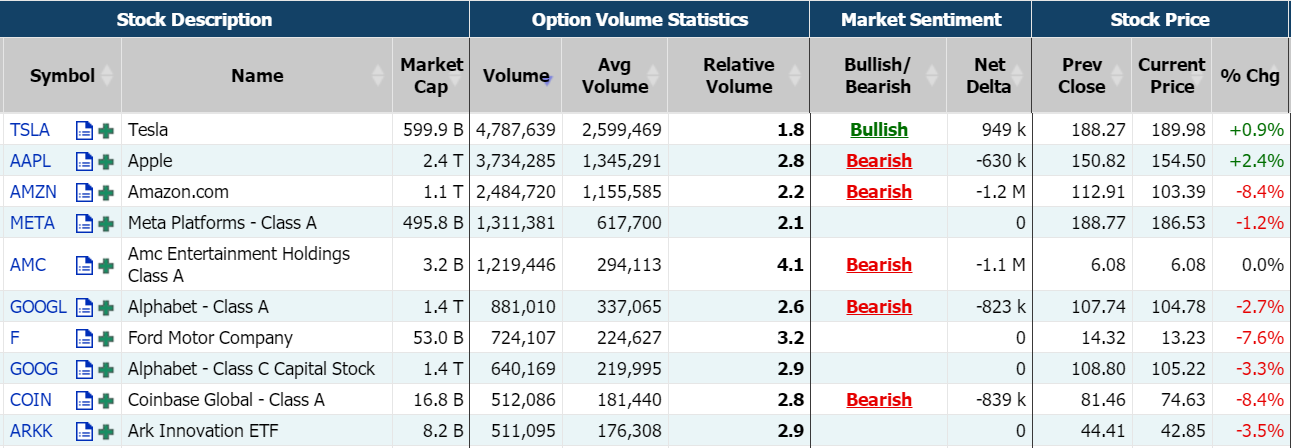

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: MULN, BAC, TSLA, AI, VOD, INTC, SOUN, BHC, META, NFLX

Top 10 bearish stocks: ET, F, GOOG, BBBY, WE, AMZN, MSFT, AMC, RIOT, COIN

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club