Nvidia is slated to report its fourth-quarter and full-year results for fiscal 2022 (essentially the November 2021 through January 2022 period) after the market close on Wednesday, Feb. 16. An analyst conference call is scheduled for the same day at 5:30 p.m. ET.

Investors in the graphics chip specialist will probably be approaching the report with optimism. The company has beaten Wall Street's consensus earnings estimate in at least the past six consecutive quarters. In addition, investors will be eager to hear what management has to say on the earnings call about the Omniverse, which is Nvidia's platform for enabling companies to build out their metaverses.

Here's what to watch in the company's upcoming report.

Nvidia's key quarterly numbers

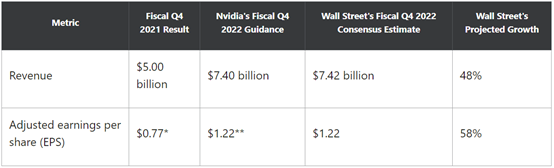

Here are benchmarks to use to gauge the tech company's results.

For context, in fiscal Q3, Nvidia's revenue jumped 50% year over year (and 9% sequentially) to a record $7.10 billion. Growth was driven by record revenue in the gaming, data center, and professional visualization platforms. EPS on the basis of generally accepted accounting principles (GAAP) soared 83% year over year to $0.97, and adjusted EPS surged 60% to $1.17.

Wall Street had been looking for fiscal Q3 revenue and adjusted EPS of $6.82 billion and $1.11, respectively, so Nvidia surpassed both expectations.

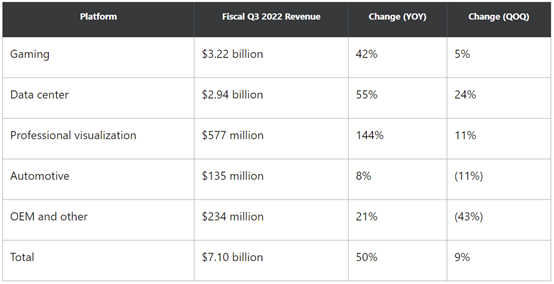

Platform performance

Here's how the platforms performed last quarter:

As always, investors should focus on the two largest platforms. Nvidia's overall results are driven by results in its gaming and data center businesses. In the first, second, and third quarters of fiscal 2022, these two platforms together accounted for 85%, 83%, and 87%, respectively, of the company's total revenue.

Don't sweat the results of the OEM and other category

In recent quarters, a contributor to Nvidia's OEM category has been sales of its cryptocurrency mining processor (CMP), which launched in early calendar year 2021. Reiterating what I wrote in last quarter's earnings preview, investors shouldn't pay much attention to results in OEM and other because this category's sales can be expected to fluctuate considerably due to the extreme volatility in the cryptocurrency market.

Putting some numbers next to the prior statement, last quarter, sales of the CMP added $105 million to Nvidia's coffers, down from $266 million in the prior quarter. And on last quarter's earnings call, CFO Colette Kress said, "We also expect our CMP product to decline quarter-on-quarter to very negligible levels in Q4."

But pay attention to the discussion about the metaverse

Nvidia's quarterly earnings calls (and its earnings releases, for that matter) put those of most other companies to shame, so I highly recommend that investors listen to these calls. It's a sure thing that the top management team will discuss the Omniverse, Nvidia's platform for enabling companies to build their metaverses.

Guidance

Management's guidance, relative to Wall Street's expectations, will likely be the biggest factor in the market's reaction to Nvidia's upcoming report.

So investors should know that for the first quarter of fiscal 2023 (essentially the February to April 2022 period), analysts are currently modeling for adjusted EPS of $1.17 on revenue of $7.28 billion, representing year-over-year growth of 29% and 29%, respectively.

Wall Street’s reaction to death of Nvidia-Arm deal

The news that Nvidia Corp. will drop its pursuit of chip designer Arm Ltd. came as no surprise to Wall Street.

The deal was widely regarded as dead back in January, and all that remained was for Nvidia to publicly admit it.

“We have consistently noted the deal was unlikely to be completed — a view that we believe was widely accepted — due to regulatory or competitive factors” since the deal was announced, Raymond James analyst Chris Caso wrote, a reaction that was repeated over many analyst notes.

Citi Research analyst Atif Malik, who has a buy rating and a $350 price target, also said Wall Street “largely expected that the deal would not pass regulatory muster,” while bringing up Nvidia’s plans to move into CPUs, which it had announced at about the same time as the Arm merger.

Analysts say investors gave up on deal long ago, expect that Nvidia will still be able to push into data-center CPUs with Arm’s help as a partner instead of a subordinate.

“Nvidia plans to launch its CPU, Grace, in 2023 and with the 20-year ARM license can pursue this strategy without owning Arm,” Malik said.

Others echoed that pursuing the deal showed Nvidia’s commitment to play more of a role in the CPU market dominated by Intel Corp. and Advanced Micro Devices Inc. with its “Grace” CPU, and that with a 20-year license from Arm, Nvidia didn’t need to own the chip designer to do that.

“We think the most important part of the initial announcement that Nvidia was pursuing Arm was that it signaled Nvidia’s intention to participate more fully in the CPU market, thereby increasing Nvidia’s [total addressable market],” said Raymond James’ Caso, who has a strong buy on Nvidia.

Bernstein analyst Stacy Rasgon, who has an outperform rating and a $360 price target, said he doubted anyone expected the deal to close at this point.

“As far as Nvidia goes, while owning Arm could have been wonderful, we don’t believe they had to have it either,” Rasgon said. “In our opinion, the impetus for the deal was to help create and drive a broader ecosystem for Arm particularly in the data center.”