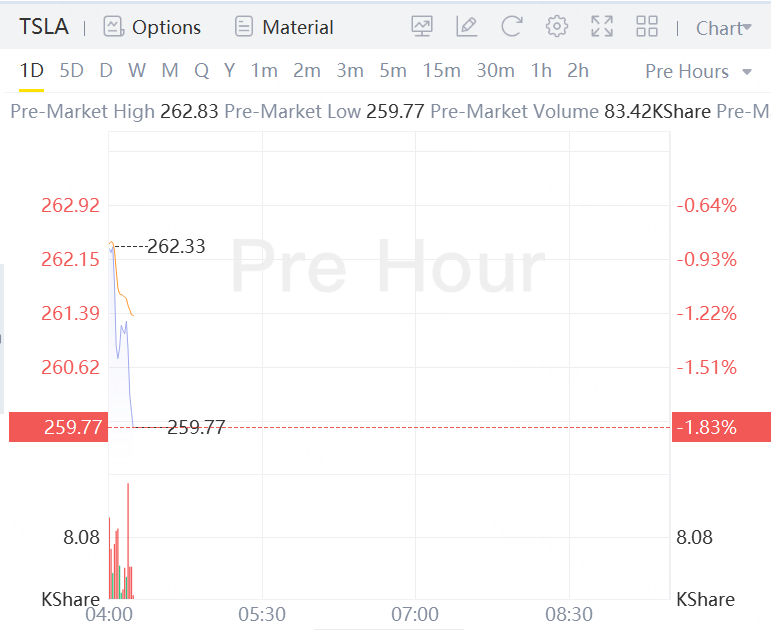

Morgan Stanley analysts downgraded Tesla shares to Equal Weight from Overweight. Tesla shares fell 1.8% in premarket trading.

They raised the price target to $250 per share from the prior $200. Tesla shares closed 5.5% lower Wednesday while they rallied nearly 2% on Thursday.

The analysts have been among the most vocal Tesla bulls on the Street in recent years. However, they are now stepping to the sidelines after a massive rally in Tesla shares pushed valuation to “fair” levels.

“I have to be up-front with you all. While the team has defended the Tesla OW rating all year, I did not see this 111% YTD rally coming (the S&P 500 is up 14% YTD, for context). We think it's understandable and are sympathetic to the changes in the market narrative around the name,” the lead analyst said in a downgrade note.

While the analysts made a move, they highlight that Morgan Stanley is “not trying to call 'the end' to the Tesla rally.”

Instead, conversations with investors resulted in “a significant degree of investor skepticism/lack of exposure around the name.”

With the downgrade call mostly based on the valuation, the analysts add that Tesla remains “a 'must own' company in any EV portfolio.” Given that Tesla stock has benefited from the ongoing AI frenzy on Wall Street, they say the EV company is “an AI beneficiary AND an auto company.”

“We see continued evidence that Tesla is emerging as an industrial 'standard bearer' for one of the greatest industrial changes we've witnessed in over a century - the electric transport and renewable energy economy. This goes well beyond supercharging deals with the likes of GM and Ford and look for other potential areas of collaboration (battery supply, operating system, FSD, etc.) to follow,” the analysts concluded.

This is the third downgrade for Tesla stock this month after Barclays and CFRA analysts also moved to the sidelines.