Big U.S. banks are expected to reveal the impact of the Ukraine war and a drop in investment banking activity related to moribund capital markets when they provide first-quarter profit updates next week.

Hit by the slowest quarter for initial public offerings since 2016, efforts to curb business with Russia and jitters about an economic slowdown tied to inflation, the financial powerhouses faced headwinds in the three months ended March 31.

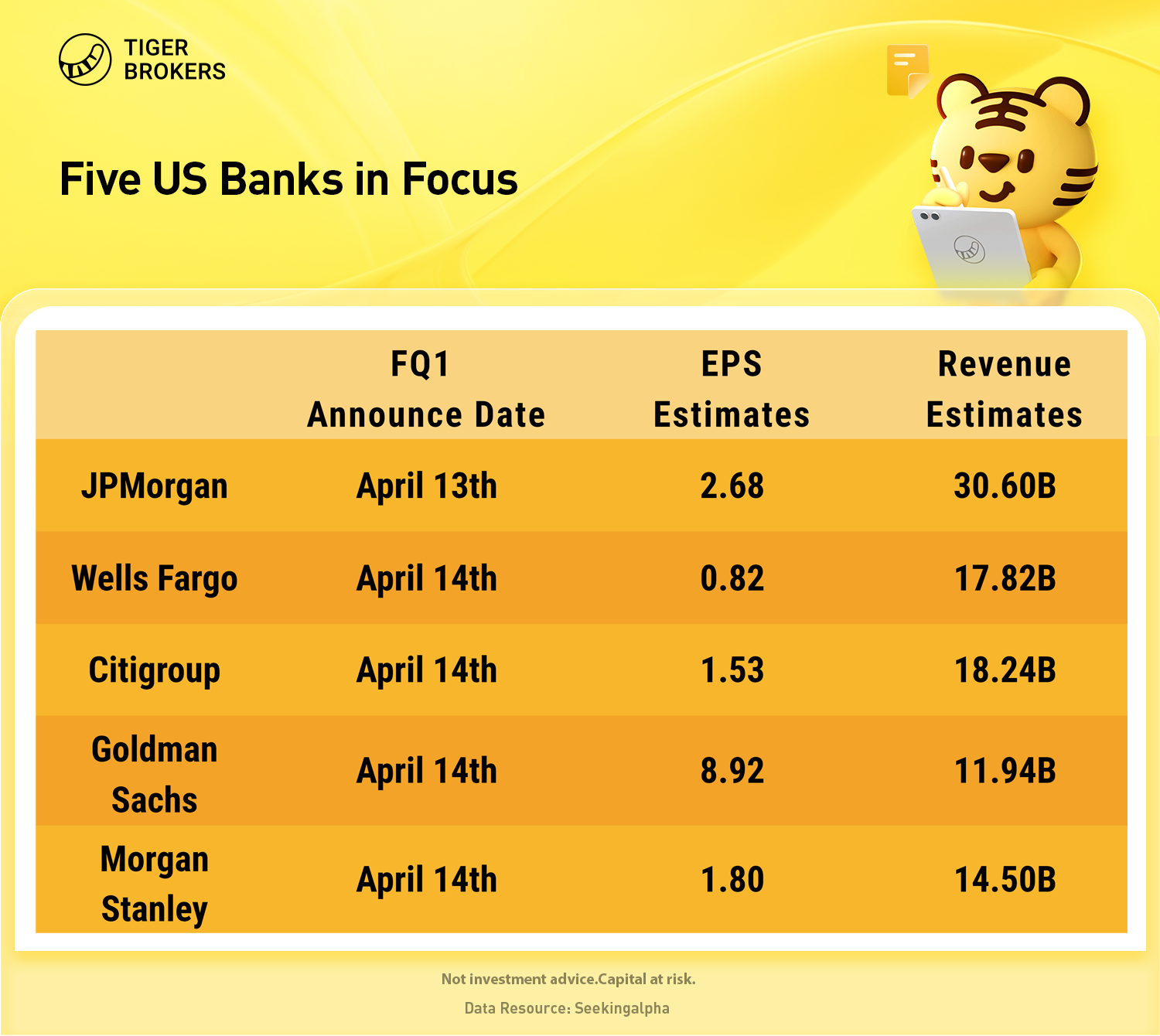

JPMorgan Chase kicks off the earnings season on April 13. Goldman Sachs, Morgan Stanley, Citigroup and Wells Fargo all report quarterly results on April 14.

Five US Banks Q1 Estimates

Big Banks Earning Expectations Are Reduced

Analysts have been reducing their earnings expectations for JPMorgan and Goldman, as well as Bank of America Corp. BAC, Morgan Stanley MS, Citigroup Inc. C, and Wells Fargo & Co. WFC.

While the current inverted yield curve between two-year and 10-year Treasurys signal a potential recession, the pricing dynamic is not expected to impact first-quarter results from banks.

But despite robust jobs numbers, the economic picture has been mixed amid moves to raise interest rates by the Federal Reserve to tame inflation, and banks recalibrating their overseas operations to inflict economic sanctions on Russia.

Bank stocks have been lackluster as investors sifted through a steady stream of mostly negative news headlines in 2022, with the Financial Select SPDR Fund XLF down 4.9% in the year to date.

Dow Jones Industrial Average components DJIA JPMorgan Chase and Goldman Sachs are both down nearly 19% in 2022, as of Thursday’s trades. The S&P 500 SPX is off by 6.1% and the Dow Jones Industrial Average has lost 5.7%.

Bank of America, Citigroup, Goldman Sachs and JPMorgan Still Got Overweight Ratings

Looking at the profit landscape for banks, Piper Sandler analyst Jeffrey J. Harte earlier this week reiterated overweight ratings on Bank of America, Citigroup, Goldman Sachs and JPMorgan as well as a neutral rating on Morgan Stanley.

He cut price targets on all five stocks and said he’s trimming his profit estimates on them as well to “reflect capital markets related revenue headwinds amid an increase in macro-uncertainty and market volatility.”

While the inverted yield curve may be telegraphing a coming recession, banks currently enjoy favorable conditions to boost net interest income based on the rising yield curve for six-month/five-year Treasury spreads, Harte said.

In the banking business, the six-month Treasury yield acts partly as a benchmark for interest rates banks pay for deposits, while the five-year yield provides a basis for interest rates they charge to borrowers. Currently, the so-called short-term yield curve remains in the bank’s favor.

A recession could impact banks but it’s not expected to kick in for 18 or more months based on past signals from inverted yield curves for long-dated Treasurys. Generally, banks tend to do better during the months leading up to a recession, Piper Sandler’s Harte said.

Meanwhile, the drop in investment banking revenue may quickly rebound because “the pipeline of deals is really robust in equity markets,” Harte said.

Piper Sandler issued its largest first-quarter earnings estimate reduction among the big banks to Goldman Sachs, which drew a 28% cut to reflect its relatively large exposure to investment banking and investment-related revenues.

Piper Sandler trimmed its Morgan Stanley and Citi earnings views by 11% and 10% respectively. The lower Citi forecast does not include impairment charges on its Russia exposure.

Harte said he would be focusing on management commentary on the outlook on quarterly conference calls with Wall Street investors.

Given heightened macro-uncertainty since Russia invaded Ukraine, Piper Sandler will focus on the banks’ outlook for capital markets activity and operating efficiency, plus early indications of credit deterioration in consumer or commercial portfolios and signs of confidence that loan growth can continue to accelerate.