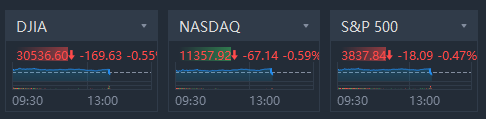

U.S. stocks turned down after Fed raised rates by another three-quarters of a percentage point.

U.S. Stocks Turned Down After Fed Raised Rates By Another Three-Quarters of a Percentage Point

Tiger Newspress2022-09-22

Disclaimer: Investing carries risk. This is not financial advice. The above content should not be regarded as an offer, recommendation, or solicitation on acquiring or disposing of any financial products, any associated discussions, comments, or posts by author or other users should not be considered as such either. It is solely for general information purpose only, which does not consider your own investment objectives, financial situations or needs. TTM assumes no responsibility or warranty for the accuracy and completeness of the information, investors should do their own research and may seek professional advice before investing.

170

Report

Login to post

- xiaochoochoo·2022-09-25[微笑]LikeReport

- Halomart·2022-09-24Stop printing money instead of raising ratesLikeReport

- KH321·2022-09-22OK1Report

- Jess261·2022-09-22Okay1Report

- GH_82·2022-09-22🤦🏻♂️🤦🏻♂️1Report

- Mccoy·2022-09-22Isn't this factored in by the market already? I think the market is being played down. Just hold to all my counters though my portfolio is in the red. No fear.2Report

- kctan·2022-09-22Like please1Report

- Seah CL·2022-09-22K1Report

- robot1234·2022-09-22Stocks fell in volatile trading Wednesday after the Federal Reserve raised rates by 75 basis points and forecast more sizable rate hikes ahead in its fight to tame surging inflation. The Dow Jones Industrial Average slid 1.7%, to close at 30,183.78. The S&P 500 shed 1.71% to 3,789.93, and the Nasdaq Composite slumped 1.79% to 11,220.19. The S&P ended Wednesday’s session down more than 10% in the past month and 21% off its 52-week high. Even before the rate decision, stocks were pricing in an aggressive tightening campaign by the Fed that could tip the economy into a recession. Stocks were volatile as traders parsed through the rate decision and the latest comments from Powell’s press conference. At its highs, the Dow was up more than 314 points. The Fed raised rates by the widely e73Report

- Xue91·2022-09-22Did1Report

- Xue91·2022-09-22Tell me your opinion about this news...1Report

- FrankieTok·2022-09-22Ok1Report

- chandra·2022-09-22Ok1Report

- AdelGYS·2022-09-22😔1Report

- jeffilim·2022-09-22Why red when most expected 75 basis point.. haizzz4Report