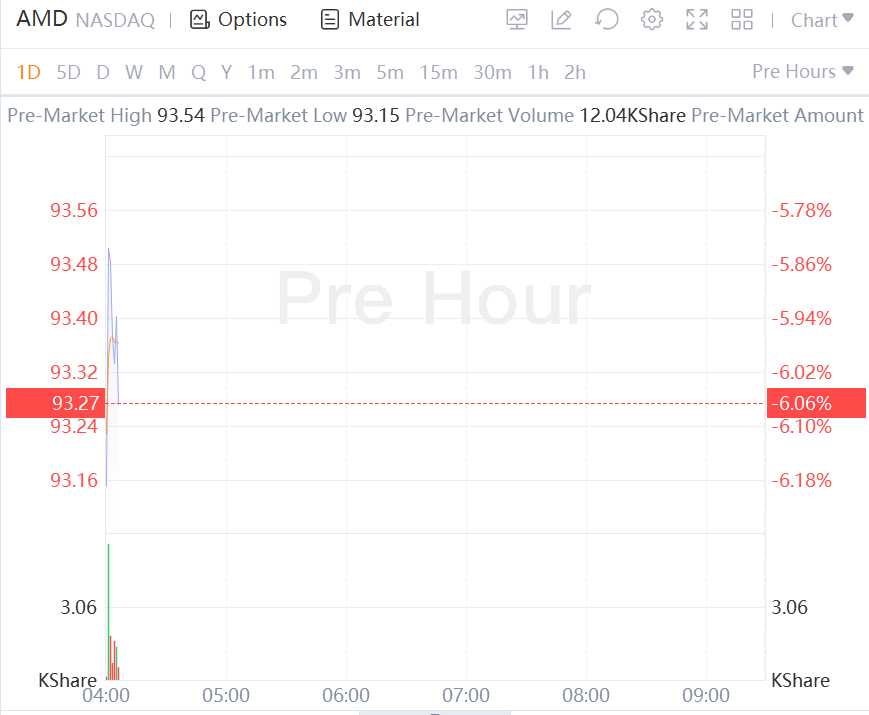

AMD Stock Slips 6% Premarket as Revenue Forecast Dips below Street Consensus.

"Taking a step back, while there has been additional softness in the PC market in recent months, we believe we're very well positioned to navigate through the current environment based on the strength of our existing product portfolio and upcoming product launches," Lisa Su, AMD's chief executive, told analysts on a conference call.

"Despite the current macroeconomic environment, we see continued growth in the back half of the year, highlighted by our next-generation 5-nanometer product shipments and supported by our diversified business model," Su told analysts.

AMD forecast third-quarter revenue of $6.5 billion to $6.9 billion, and restated its revenue forecast of $26 billion to $26.6 billion for the year.

Analysts surveyed by FactSet were estimating revenue of $6.84 billion for the third quarter, and $26.21 billion for the year. The company also backed its gross margin forecast to 54% for the year. Back in February, AMD forecast gross margins of 51% for 2022, and revenue of about $21.5 billion. At that time, Wall Street analysts had a consensus of $19.29 billion in revenue.

Su told analysts on the call that the third-quarter outlook implies data-center sales to lead revenue growth, with PC sales down in the mid-teens. In the fourth quarter, Su said that dynamic should remain but that AMD will be releasing its new 5-nm products in that quarter.

Nanometers, or "nm," denotes the size of each transistor that goes on a computer chip, the general rule being that smaller transistors are faster and more efficient in using power. As AMD moves to its 5-nm chip, Intel has struggled to release its 7-nm chip

In-depth: Are chip stocks set up for a short squeeze, or just more declines? Wall Street doesn't seem sure

AMD $(AMD)$ reported second-quarter net income of $447 million, or 27 cents a share, compared with $710 million, or 58 cents a share, in the year-ago period. Adjusted earnings, which exclude stock-based compensation expenses and other items, were $1.05 a share, compared with 63 cents a share in the year-ago period.

The company reported record revenue for an eighth straight quarter: Revenue surged 70% to a record $6.55 billion from $3.85 billion in the year-ago period.

Analysts surveyed by FactSet had forecast $1.03 a share on revenue of $6.53 billion, based on AMD's forecast of $6.3 billion to $6.7 billion.

AMD reported sales based on new product categories, including breaking out its data-center revenue for the first time. Revenue from data center surged to $1.49 billion from last year's $813 million, a gain of 83%.