Market Overview

Wall Street's main indexes slumped to close well down last Friday(Sep.23), as rattled investors continued repositioning themselves to reflect fears the U.S. Federal Reserve's hawkish rate policy to curb inflation will push the American economy into recession.

The Dow Jones Industrial Average fell 486.27 points, or 1.62%, to 29,590.41, the S&P 500 lost 64.76 points, or 1.72%, to 3,693.23 and the Nasdaq Composite dropped 198.88 points, or 1.8%, to 10,867.93.

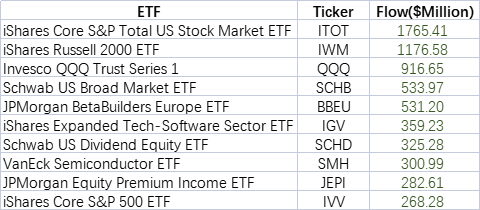

Top 10 ETF Creations(Sep.19-Sep.23)

iShares Core S&P Total U.S. Stock Market ETF and iShares Russell 2000 ETF saw large inflows of $1765.41 million and $1176.58 million respectively, while BBEU saw inflows of$531.2million, reflecting that investors began bottom-hunting for European stocks.

When talking about sector ETFs, iShares Expanded Tech-Software Sector ETF and VanEck Vectors Semiconductor ETF saw medium inflows of $359.23 million and $300.99 million respectively, showing an increase of investor enthusiasm for software and semiconductor stocks.

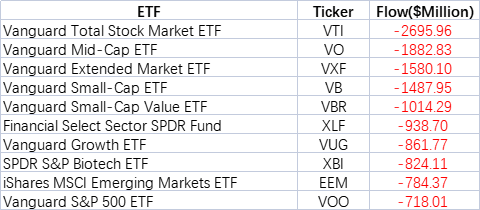

Top 10 ETF Redemptions(Sep.19-Sep.23)

Vanguard Total Stock Market ETF ranks first among Top 10 ETF outflow. It slid 1.73% last Friday and hit a three-month low. However, another cap-weighted index fund iShares Core S&P Total U.S. Stock Market ETF saw an inflow of $1765.41 million. As a whole, investors were trying to keep away from them last week.

Both Mid-cap ETFs and Small-Cap ETFs are not welcome last week. For the former part, a total amount of $1882.83 million of Vanguard Mid-Cap ETF outflowed last week. For the latter part, Vanguard Small-Cap ETF and Vanguard Small-Cap Value ETF saw a $2,502.24 million outflow last week.

Regarding sector ETFs, Financial Select Sector SPDR Fund, Spdr S&P Biotech Etf saw an outflow of $938.7 million and $824.11 million last week, meaning that investors were trying to dump Finance and Biotech stocks.