U.S. Prices rose 5% for the 12 months ended in March, down from 6% in February, the Bureau of Labor Statistics reported Wednesday. Annual CPI plunged to its lowest rate since May 2021, helped by year-over-year comparisons to a period when food and energy prices spiked amid Russia’s invasion of Ukraine.

Still, CPI showed some cooling on a monthly basis. The index, which measures price changes over time for a basket of goods, ticked up 0.1% from February, as compared to a previous 0.4% increase.

Economists were expecting an annual increase of 5.2% and a monthly gain of 0.2%, according to Refinitiv.

Stripping out the often-volatile components of food and energy, core CPI grew 0.4% for the month, resulting in a 5.6% annual growth rate. In February, core CPI accelerated 0.5% month on month and 5.5% year over year.

CPI is one of the major inflation gauges that’s being watched like a hawk by the Federal Reserve, which is in the throes of a yearlong campaign to battle inflation through monetary tightening and stark interest rate hikes.

It usually doesn't take long for Wall Street's "hot takes" to come flooding in after the CPI report, and today was no exception. Below we have collected some of the fastest reactions to the headline CPI.

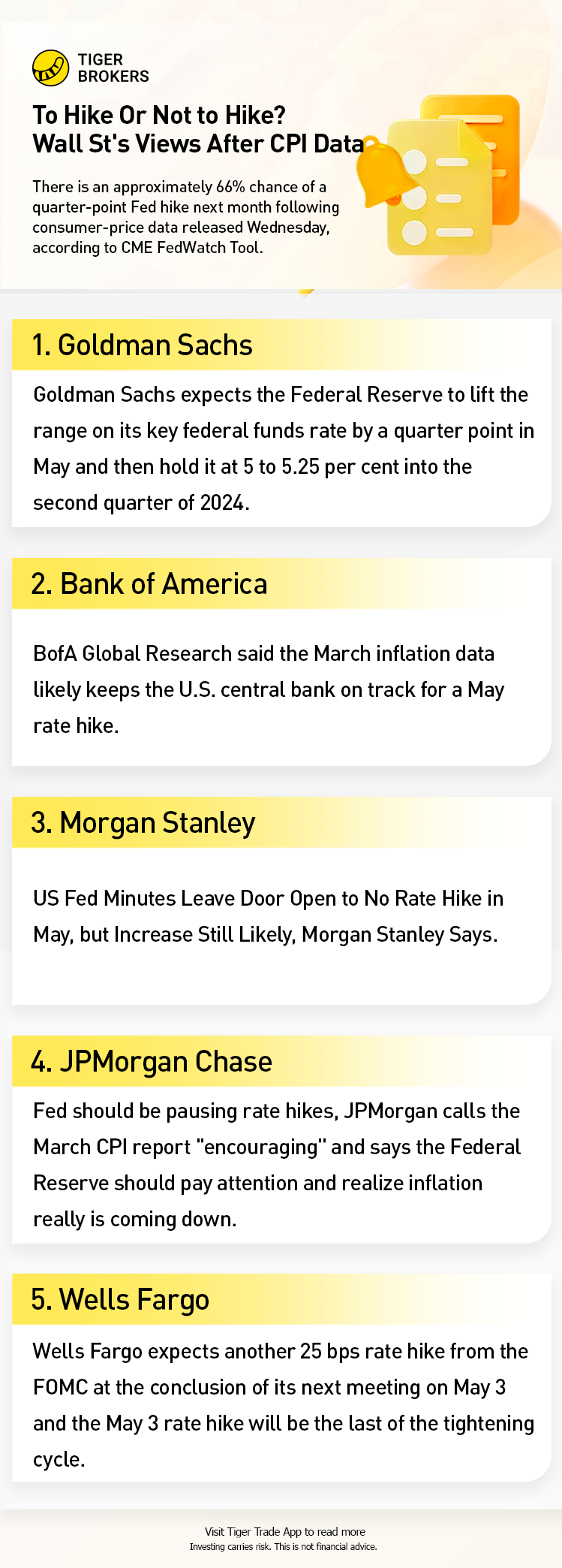

There is an approximately 66% chance of a quarter-point Fed hike next month following consumer-price data released Wednesday, according to CME FedWatch Tool.

1. Goldman Sachs

Goldman Sachs economist Jan Hatzius said he expects the Federal Reserve to lift the range on its key federal funds rate by a quarter point in May and then hold it at 5 to 5.25 per cent into the second quarter of 2024.

“We think the [Fed’s policy] committee is now in the home stretch as we no longer forecast a hike at the June 13-14 meeting,” Hatzius said.

“The economic data are likely to be too soft to persuade the committee to both deliver a hike in May and signal an upward revision to the terminal rate implied in the March dot plot.“

Hatzius said the risks around this baseline forecast are clearly tilted toward rate cuts “but, in our view, not by as much as implied by market pricing”.

As for how investors should position, Hatzius said “our rates strategists expect higher yields and our equity strategists see little or no upside from current levels.

“However, our credit strategists see further room for spreads to normalise in the near term as banking stresses abate, and our commodity strategists expect the rebound in oil prices on the back of the OPEC+ production cut to continue.”

2. Bank of America

BofA Global Research said the March inflation data likely keeps the U.S. central bank on track for a May rate hike.

"Despite the improvement in March, inflation is still likely much too high from the Fed's perspective," BofA economists wrote.

3. Morgan Stanley

US Fed Minutes leave door open to no rate hike in May, but increase still likely, Morgan Stanley says.

4. JPMorgan Chase

Fed should be pausing rate hikes, JPMorgan's Kelly says. JPMorgan Asset Management Chief Global Strategist David Kelly calls the March CPI report "encouraging" and says the Federal Reserve should pay attention and realize inflation really is coming down. He speaks with Jonathan Ferro on "Bloomberg The Open."

5. Wells Fargo

Analysts at Wells Fargo see one more interest rate hike coming from the Federal Reserve, following Wednesday’s US Consumer Price Index report. According to them, inflation remains too hot for Fed’s liking.

Key quotes:

“The core CPI has been above 5% on a year-over-year basis for 16 consecutive months, and over the first three months of 2023, core consumer prices have risen at an equally hot 5.1% annualized rate. This is not to say there has been no progress towards taming inflation. Energy prices have outright fallen over the past year, food inflation is slowing and prices for certain goods that surged during the pandemic, such as used vehicles, have declined. But, directional progress should not be confused with mission accomplished.”

“We expect another 25 bps rate hike from the FOMC at the conclusion of its next meeting on May 3.”

“We think the May 3 rate hike will be the last of the tightening cycle. Our view is that the FOMC will hold the target range for the federal funds rate at 5.00%-5.25% for the foreseeable future in order to assess the effectiveness of their accumulated policy tightening.”