Market Overview

The S&P 500 ended higher on Monday(April 3), lifted by energy stocks following surprise cuts to the OPEC+ group's oil output targets, while Tesla tumbled after its electric vehicle deliveries for the first quarter disappointed investors.

Regarding the options market, a total volume of 34,185,369 contracts was traded, down 22% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; Tesla; QQQ; Apple; IWM; Cboe Volatility Index; Nvidia; Amazon; $iShares iBoxx High Yield Corporate Bond ETF; Advanced Micro Devices

Tesla Inc dropped 6.1% after disclosing March-quarter deliveries rose just 4% from the previous quarter, even after CEO Elon Musk slashed car prices in January to boost demand.

There are 2.53M Tesla Motors option contracts traded on Monday. Call options account for 65% of overall option trades.

Most Active Options

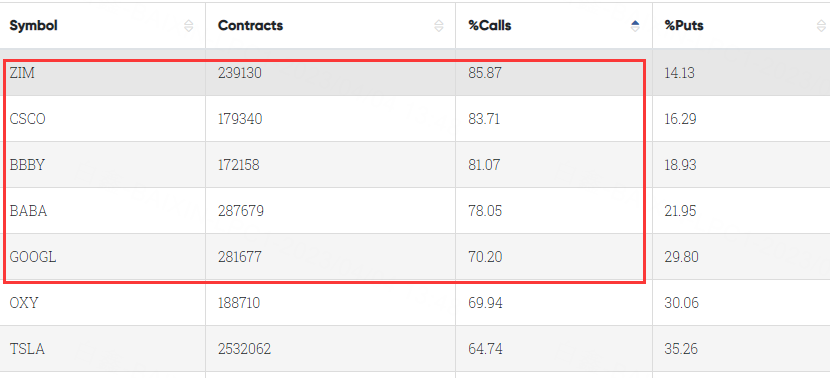

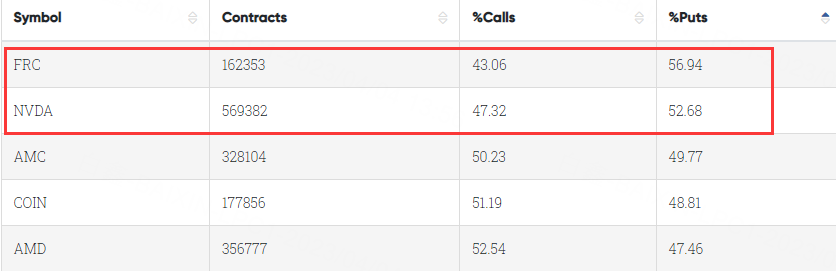

1. Most Active Trading Equities Options:

Special %Calls >70%: ZIM Integrated Shipping Services Ltd. ; Cisco ; Bed Bath & Beyond ; Alibaba ; Alphabet5

Special %Puts >50%: First Republic Bank ; NVIDIA Corp

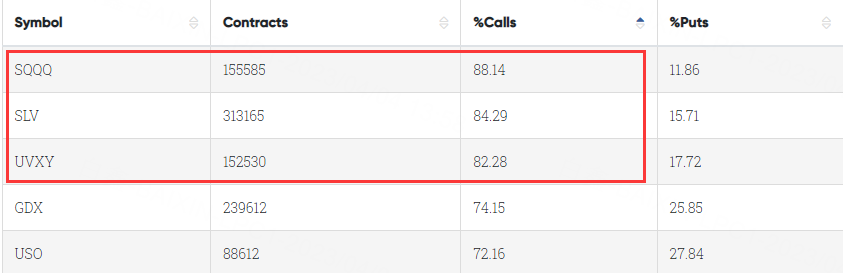

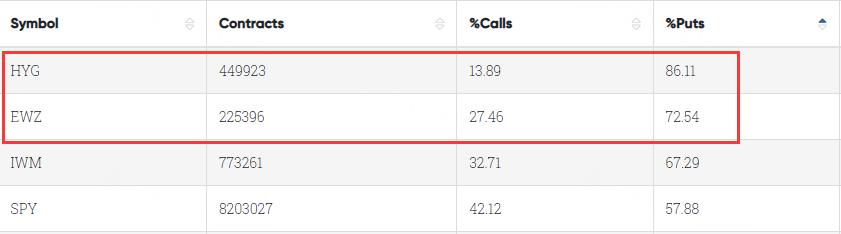

2. Most Active Trading ETFs Options

Special %Calls >80%: Nasdaq100 Bear 3X ETF ; iShares Silver Trust ; VIX Short-Term Futures 1.5X ETF

Special %Puts >70%: $iShares iBoxx High Yield Corporate Bond ETF ; iShares MSCI Brazil ETF

Unusual Options Activity

The S&P 500 energy sector index surged 4.9% after Saudi Arabia and other OPEC+ oil producers announced unexpected output cuts that could push oil prices toward $100 a barrel. Chevron Corp , Exxon Mobil Corp and Occidental Petroleum Corp all rallied more than 4%.

Exxon Mobil saw usual options activity. There are 251,625 volume contracts trading on Monday, call options account for 64%. Particularly high volume was seen for the $125 strike call option expiring June 16, with 12,166 contracts trading on Monday.

Occidental also saw usual options activity. There are 188,485 volume contracts trading on Monday, call options account for 70%. Particularly high volume was seen for the $66 strike call option expiring April 6, with 15,972 contracts trading on Monday.

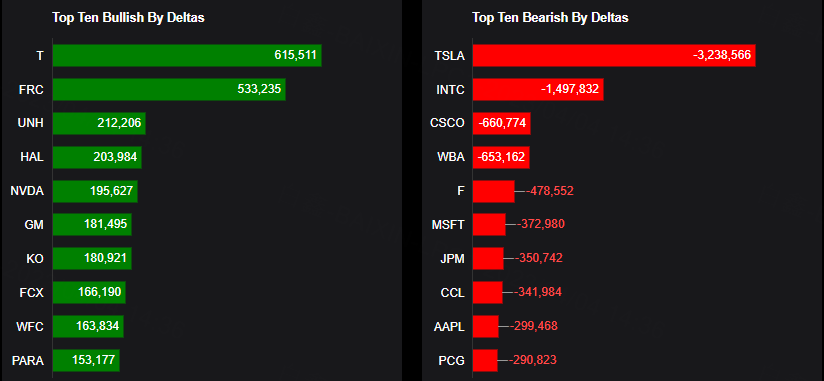

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: T, FRC, UNH, HAL, NVDA, GM, KO, FCX, WFC, PARA

Top 10 bearish stocks: TSLA, INTC, CSCO, WBA, F, MSFT, JPM, CCL, AAPL, PCG

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club