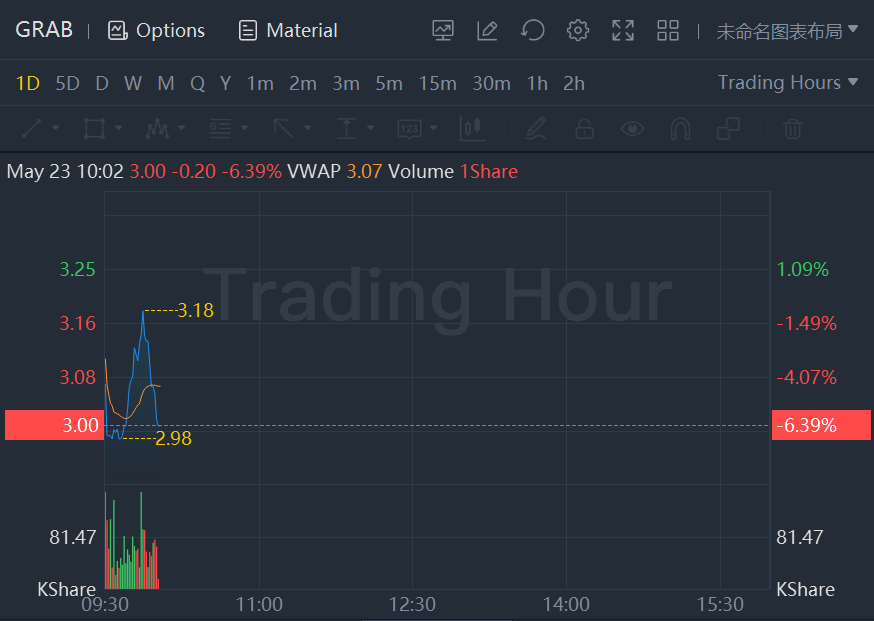

Grab stock slid more than 6% in morning trading.

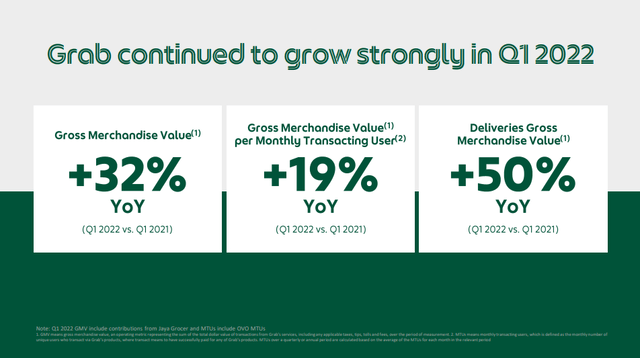

Grab (NASDAQ:GRAB) reported a very solid first quarter of 2022, with GMV up 32%. Particularly impressive was the deliveries segment, which saw growth of 50%, significantly above expectations. We had recently upgraded the shares to "Hold" based on the attractive valuation, but we're now upgrading the shares again given that profitability now looks more attainable in the medium term.

These results surpassed the previously given outlook by a good margin. For example, deliveries GMV has been guided to be between $2.4B and $2.5B and it was actually $2.56B. Mobility GMV has been guided to between $0.75B and $0.80B, and the actual result was $0.83B. But the one that gave the biggest surprise was financial services total payment volume, which has been guided to be between $3.1B and $3.2B, and the actual result was significantly higher at $3.6B.

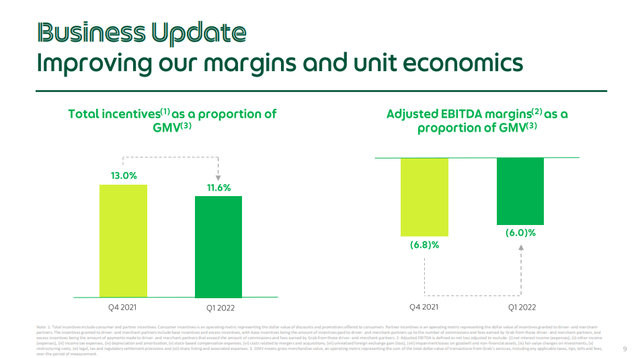

All these point to recovering growth, which is all fine and good, but we're still concerned with profitability. Here the company managed to make some improvements as well by reducing incentives as a proportion of GMV. Adjusted EBITDA margins as a proportion of GMV improved sequentially from -6.8% to -6%. Much of this improvement came from reduced losses in the deliveries segment. This is very encouraging, but it remains to be seen if the company can actually turn profitable before it runs out of funds.

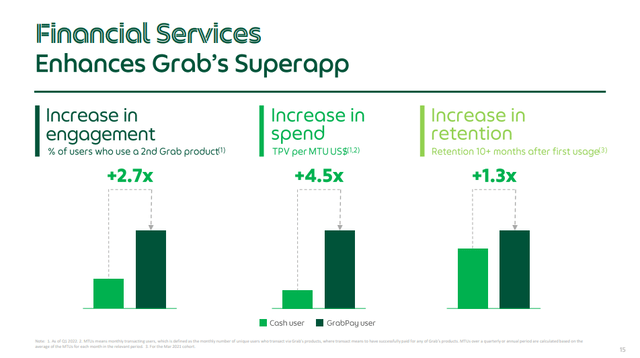

What makes us more optimistic about the company is the growth it's seeing in its financial services segment. We believe this is the part of the company that has the better chance of reaching solid profitability first, and maybe subsidize the rest of the company until they too become profitable. Year over year the company saw 5x growth in buy now pay later, and 3x growth in loans disbursed.

Even better, when its customers make use of Grab's financial services, they spend more and their retention on the platform improves.

Liquidity

The company reported that as of March 31, 2022, it had net cash liquidity of $5.97B, which should be enough to finance losses for a few more quarters. The investment case for Grab is that it will reach enough scale, and improve margins enough, to reach at least positive operating cash flow before its liquidity runs dry.

As of Dec. 31, 2021, the company had net cash liquidity of $6.79B. This means that in just one quarter its liquidity went down ~$800 million. At this pace it would mean the company has a runway of approximately eight quarters, but if Grab makes incremental improvements to its margins this could last a little longer. In any case, time of the essence for Grab to show that it has a sustainable business model, especially now with investors more focused on profits and less enthusiastic about unprofitable growth.

Valuation

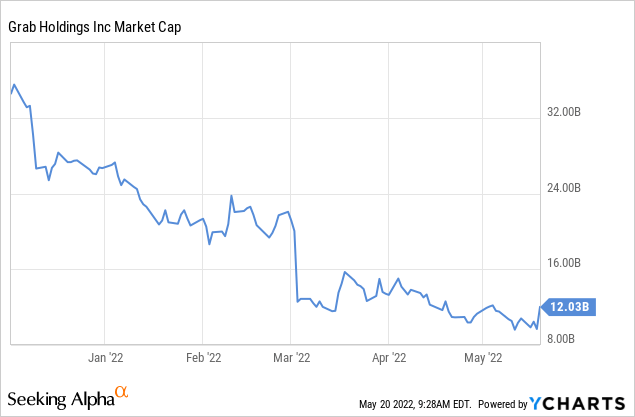

It's difficult to value Grab, since it does not yet have positive earnings or even EBITDA, and it's difficult to do a credible discounted cash flow model when it's difficult to tell what its profit margins can be in the future. What is clear is that this is a company growing at a very fast pace, and that it is one of Asia's "Super Apps." Based on this we believe that if the company finds a way to become profitable, that it can become a very valuable company. With a market cap of ~$12 B, there's room for the valuation to expand if the company proves it can become profitable.

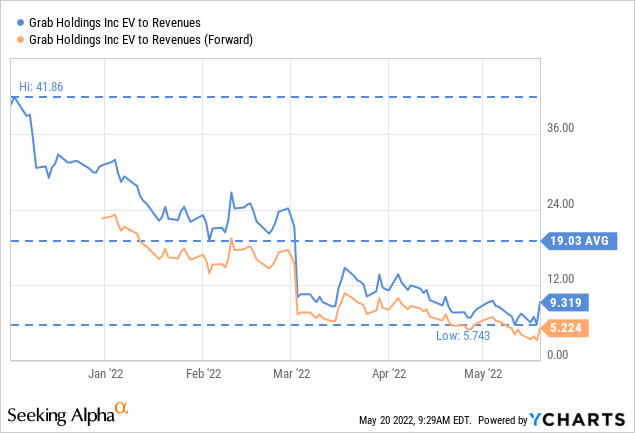

At least the company is no longer trading at an unrealistic multiple of revenues. Its EV/revenues multiple reached a high of more than 40x, but has since gone down to ~9x, and the forward EV/revenues stands at only ~5x. This tells us that investors are being a lot more realistic, and balancing the growth of the company with the profitability challenges, to come up with a valuation that leaves more room for error. Still, we would like to remind everyone that even if the risk/reward is a lot more attractive now that the company is seeing profitability improvements and that the valuation is a lot more reasonable, that this is still a company that could go bankrupt if it does not turn profitable in the next few quarters. We estimate the runway it has to become profitable at around eight quarters, but it could be more or less depending on how operating cash flow trends from here. There's also the possibility that the company will try to do another capital raise to extend its runway if it gets too close to running out of cash.

Outlook for 2022

For fiscal year 2022, Grab is guiding for revenue between $1.2B and $1.3B, and GMV growth of between 30% and 35%. This guidance is reassuring that growth is returning to the business, so the remaining concern is profitability. While we're seeing some green shoots there the company still has a lot to do to become sustainably profitable.

ESG

We would like to add a quick note saying that we're positively surprised by Grab's sustainability efforts. It's pledging to become carbon neutral as a platform by 2040, it is looking to expand the proportion of women in leadership roles to 40% by 2030, and it's seeking to double the number of economically marginalized individuals earning an income on Grab by 2025. These are very laudable goals and we hope the company manages to reach them.

Risks

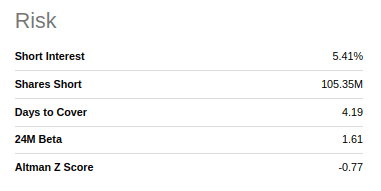

While the risk/reward has improved to the point that we now rate the company a "Buy," we would like to remind our readers that this is a speculative investment that could easily end up in bankruptcy. It seems bears have come to the same conclusion that the risk/reward has improve, given that the short interest is not that significant at ~5.4%.

The Altman Z-score is negative, which is a red flag, and is reflective of the profitability challenges the company has. It will have to optimize its business model to reach margins that let it operate profitability if it wants to eventually go out of business.

Conclusion

The most recent quarter was mostly a positive one, and shares reacted by going up in price. There are signs that high growth is returning, and that some steps toward becoming profitable are being taken. The company is being more prudent with the use of incentives, and EBITDA margins are moving in the right direction. The delivery segment showed impressive growth, and the finance segment is proving to be one of the most promising businesses for the company. That said, the company is still burning significant amounts of cash, and it will have to further improve margins and profitability if it wants to remain a going concern. Overall, we rate shares a "buy" given the positive risk/reward, but pointing out that risk is significant and that an investment in the company can easily result in total loss.