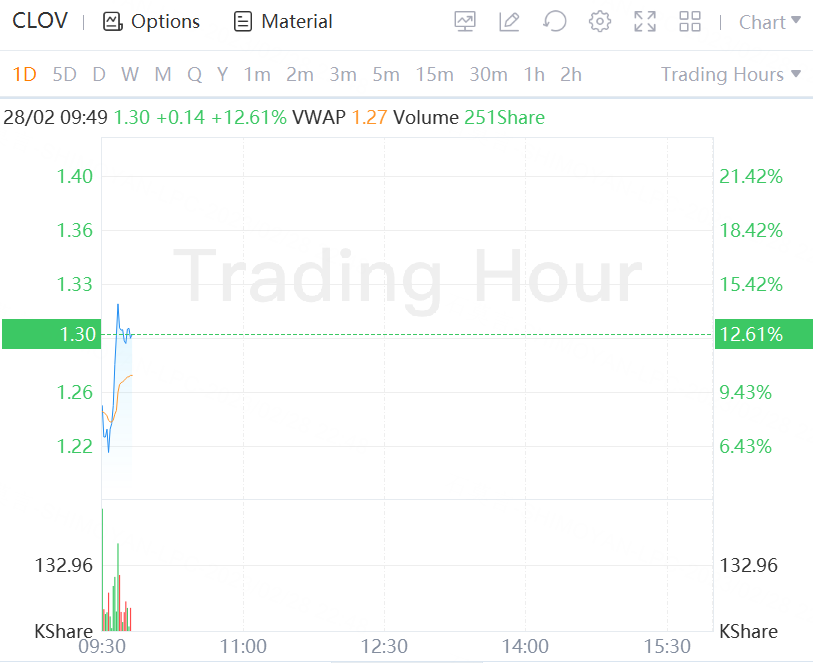

Health insurer Clover Health Investments added 12.6% in morning trading Tuesday after its revenue for Q4 2022 came well ahead of expectations, and the company highlighted its efforts to accelerate the path toward profitability this year.

Topline growth continued the upward trajectory as revenue for the quarter jumped ~108% YoY to $898.8M ahead of ~$787.5M in the consensus. Meanwhile, full-year revenue added ~136% YoY to $3.5B compared to ~$3.4B, in analysts' forecasts.

"In 2023, accelerating our path to profitability is our top priority," Chief Executive Andrew Toy said. "I am excited by Clover Assistant's role in helping physicians identify and manage chronic diseases earlier, which improves care for Medicare beneficiaries," Toy added, referring to a web application the company developed for physicians.

Quarterly and yearly net loss narrowed ~55% YoY and ~42% YoY to $84.0M and $338.8M even as total operating expenses jumped ~63% YoY and ~82% YoY to $1.0B and $3.8B, respectively, while the company benefitted from lower medical cost ratio (MCR).

Insurance and non-insurance MCR dropped 92.4% and 103.6% compared to 102.8% and 103.0% in the prior year quarter, while full-year MCR for insurance and non-insurance business stood at 91.8% and 103.4% compared to 106.0% and 105.7% in 2021.

"Fourth quarter and full year 2022 financial highlights include significantly improved Insurance MCR, strong Insurance revenue growth, and continued moderation of growth in SG&A," Clover's (CLOV) Chief Financial Officer Scott Leffler said.

In 2023, the company projects its insurance and non-insurance businesses to generate $1.15B – $1.20B and $0.75B – $0.80B in revenue, recording 89% - 91% and 98% - 100% in MCR, respectively.