A broad sell-off sent U.S. stocks reeling on Tuesday after a hotter-than-expected inflation report dashed hopes that the Federal Reserve could relent and scale back its policy tightening in the coming months.

All three major U.S. stock indexes veered sharply lower, snapping four-day winning streaks and notching their biggest one-day percentage drops since June 2020 during the throes of the COVID-19 pandemic.

The Labor Department's consumer price index (CPI) came in above consensus, interrupting a cooling trend and throwing cold water on hopes that the Federal Reserve could relent after September and ease up on its interest rate hikes.

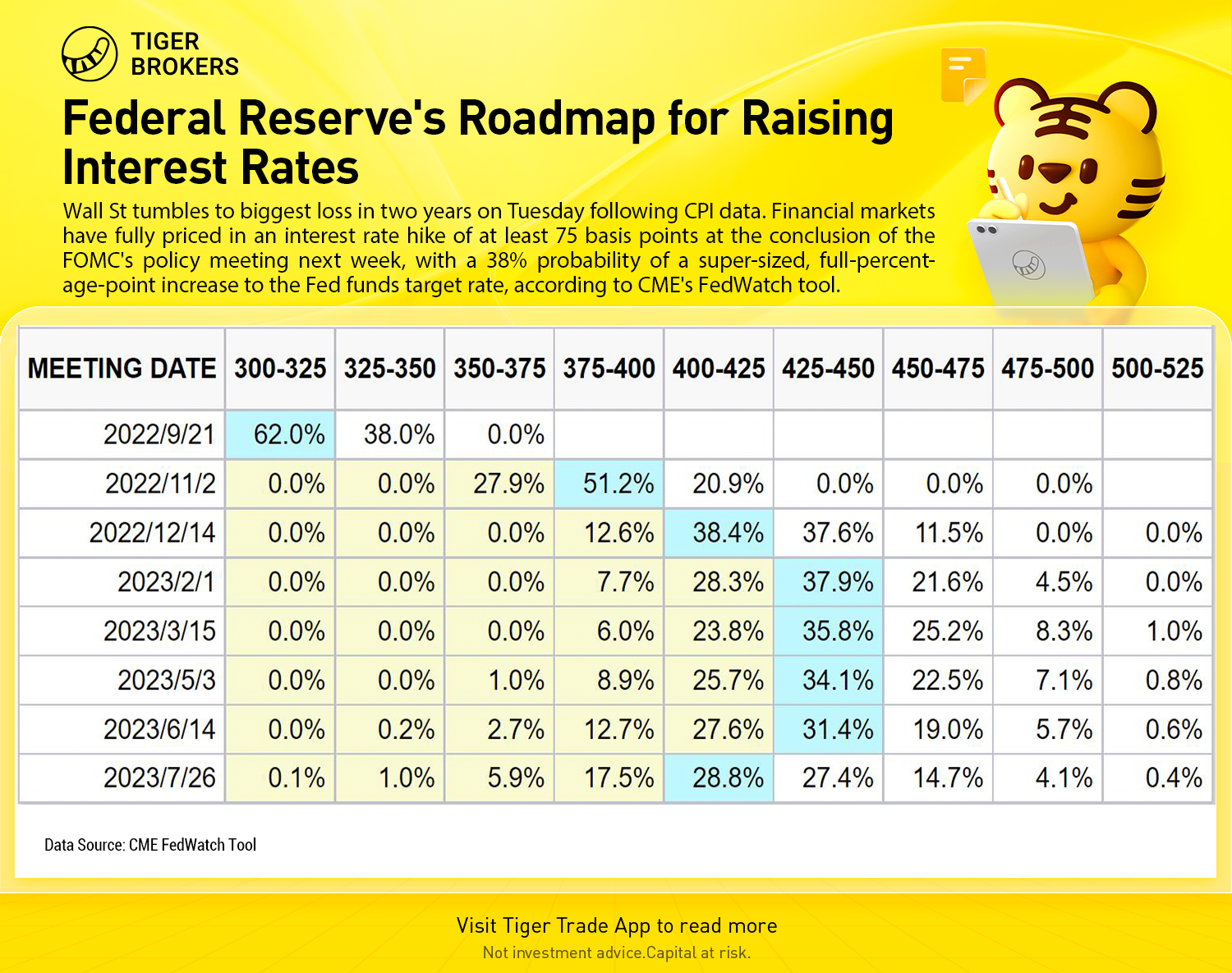

Financial markets have fully priced in an interest rate hike of at least 75 basis points at the conclusion of the FOMC's policy meeting next week, with a 38% probability of a super-sized, full-percentage-point increase to the Fed funds target rate, according to CME's FedWatch tool.

‘They Should Do 100’: Wall Street Debates the Fed’s Next Rate Move

Most investment professionals doubted that an unexpectedly high inflation reading would push the central bank off course to raise rates at their September meeting by an amount not seen since 1984.

“The Fed will want to follow what the market expects and the market is really expecting a 75 basis points move -– so that’s what the Fed will do,” said Tom Di Galoma, managing director at Seaport Global.

But on Tuesday, Nomura economists changed their forecast for the Fed’s September meeting from a 75 to 100 basis points, writing that “a more aggressive path of interest rate hikes will be needed to combat increasingly entrenched inflation.”

Larry Summers, former Treasury Secretary and the President Emeritus of Harvard University, tweeted that if he was a Fed official, he would pick “a 100 basis points move to reinforce credibility.”

And Scott Buchta, head of fixed-income strategy at Brean Capital, said that if the Fed needs to raise rates sharply, it would be best to do so quickly and get it over with.

“Seventy-five is most likely, but they should do 100,” he said.

Here’s what other Wall Street strategists said:

Steve Sosnick, chief strategist at Interactive Brokers:

“Markets would hate it. Just a couple of days ago we were debating whether 50 or 75 would be sufficient,” he said. “100 bp would be perceived as a panic move.”

Andrew Lekas, head of FICC trading at Old Mission Capital:

“Oddly enough, I think the market might rally,” he said. “They want to see the Fed take things seriously on the inflation front, and the sooner we get to the end of these hikes the better.”

“The knee-jerk reaction is probably lower in all risk assets, and there’s the obvious funding impact on anyone who is using leverage, but for the medium term health of the market I think 100 might make sense.”

Steven Englander, head of Group-of-10 currency research at Standard Charter:

“If you are on the FOMC and believe that the market needs shock and awe to lower inflation expectations, then maybe you argue for 100bps. I think it’s more sensible for the FOMC to say ‘we can keep raising rates as far as we have to but don’t have to do it at once.’”

Ian Shepherdson, chief economist at Pantheon Macroeconomics:

“Eleven Fed officials have made it very clear that they will not slow the pace of rate hikes until they see convincing evidence that core inflation pressure is easing on a sequential basis. These data mean that the chance of a 50bp hike next week has gone,” he said. “But the 20% chance of a 100bp hike now priced-in looks over the top.”

Kate Moore, BlackRock Head of Thematic Strategy for Global Allocation:

“We haven’t changed our call (75bp) but I think it’s really wise to adjust expectations around the forward path especially to the year end,” she said. “The fact that 100bps is starting to get somewhat priced into the market, it’s a bit destabilizing for the equity market.”

Nisha Patel, director and portfolio manager of fixed income at Parametric:

“Don’t be surprised if the Fed’s hand is forced to do 100bps. The idea that inflation had peaked has been dispelled and now the likelihood of that soft landing for the economy has only decreased. Expect long-bond yields likely to come down leading up to the September meeting as recessionary risk increases.”

Seema Shah, Chief Global Strategist at Principal Global Investors:

“Until the Fed can tame that beast, there is simply no room for a discussion on pivots or pauses.”

Alex Chaloff, co-head of investment strategies at Bernstein Private Wealth Management:

“Powell has been more careful with his communications. If we go for 100bps, I would expect we would get the same tipping of the hand as we have gotten when we did 75bps.”