Qualcomm forecast fourth-quarter sales below market expectations on Wednesday and said it would likely cut jobs as consumer spending on gadgets like smartphones remained stubbornly weak amid slowing global economic growth.

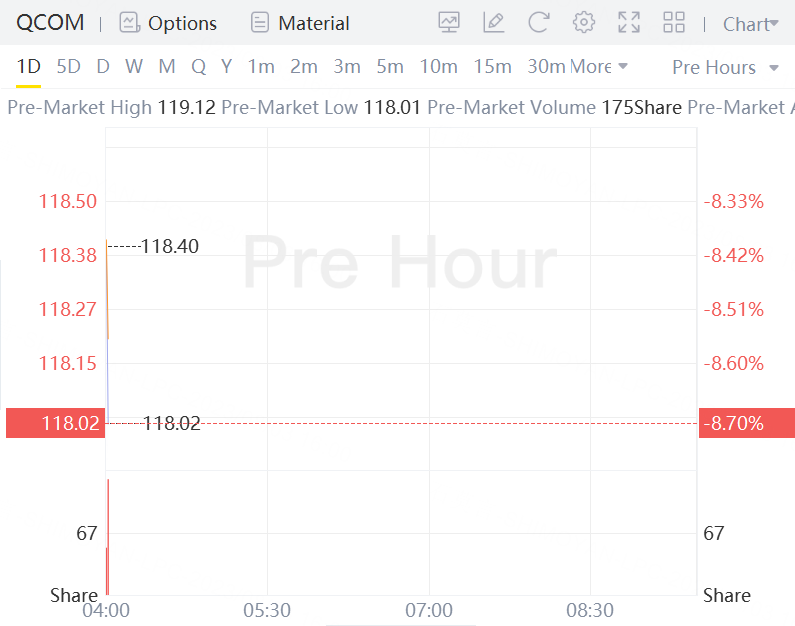

Qualcomm shares fell about 8.7% in premarket trading.

Qualcomm said its forecast also takes into account the impact of macroeconomic headwinds, weaker global handset units and the fact that phone makers are using existing inventory rather than putting in fresh chip orders.

The company estimated fourth-quarter revenue of $8.1 billion to $8.9 billion, while analysts polled by Refinitiv expected $8.70 billion. Qualcomm forecast a fourth-quarter adjusted earnings range with a midpoint of $1.90, in line with analysts' consensus estimate of $1.91 per share according to Refinitiv data.

Qualcomm warned of likely restructuring charges for job cuts.

"While we are in the process of developing our plans, we currently expect these actions to consist largely of workforce reductions, and in connection with any such actions we would expect to incur significant additional restructuring charge," the company said in a securities filing.

Qualcomm rival MediaTek last week warned that phone manufacturers are "cautious" about buying chips due to tepid end-user demand.

Qualcomm said on Wednesday it expected the use of existing inventory by phone makers "will be a factor through the end of the calendar year."

Qualcomm shares fell amid a broader sell-off in tech and chip stocks, with Philadelphia SE Semiconductor Index slipping 3.5%. Analysts are expecting Apple to report its largest fiscal third-quarter revenue drop since 2016 later this week as iPhone sales slow in the U.S. and elsewhere.

But other chip firms are seeing different results. Shares of Qorvo, which also supplies wireless chips to smartphone makers, rose 4% in extended trading after its forecast beat analysts' expectations and CEO Bob Bruggeworth said it had won more business with its "largest customer," which is Apple. Apple. NXP last week reported better-than-expected results partly on the strength Apple orders.

CEO Amon said the company will be supplying modem chips for Apple's next iPhone.

Kinngai Chan, analyst at Summit Insights Group, said Huawei is not a large Qualcomm customer and the U.S. company's stock declined because its outlook is "much weaker than expectations" amid flat Android handset sales.

Revenue at Qualcomm's mainstay handset chip business fell 25% to $5.26 billion in the third quarter. Adjusted overall revenue of $8.44 billion missed estimates of $8.50 billion.

It forecast adjusted fourth-quarter earnings per share of $1.80 and $2, compared to estimates of $1.91.

The automotive sector was a bright spot as Qualcomm seeks to diversify beyond smartphone chips. Revenue from the sector grew 13% on the increasing use of computer chips in vehicles.