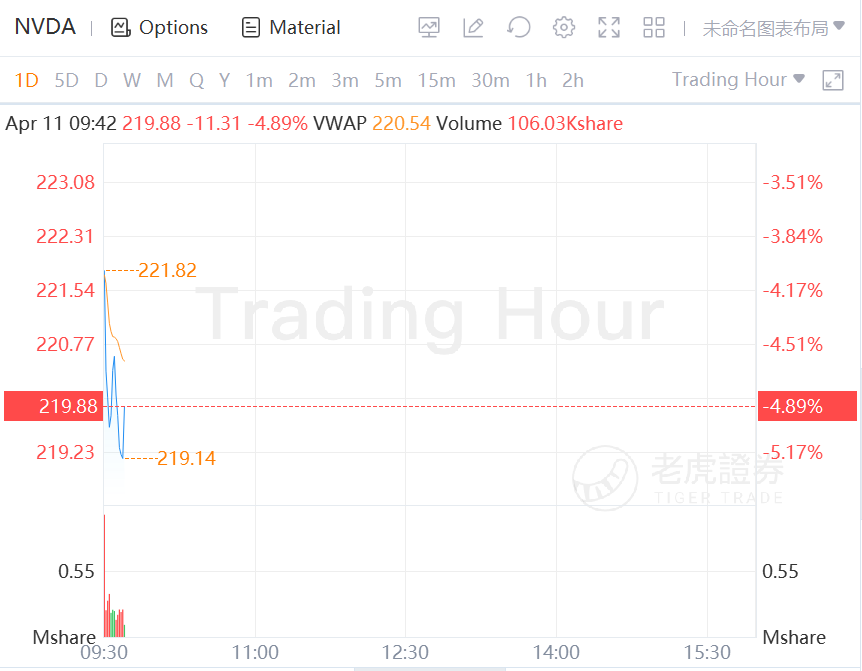

Nvidia shares fell nearly 5% in morning trading on Monday after investment firm Baird downgraded the stock and cut its price target, citing worries over order cancellations.

Analyst Tristan Gerra lowered the rating to neutral from outperform and slashed the price target to $225 from $360, noting that he believes order cancellations recently started for consumer GPUs, due to "excess inventories."

In addition, a slowdown in PC demand and the Russia embargo sanctions are likely to hurt the company more than the market currently believes.

Competitor Advanced Micro Devices fell in sympathy, with shares losing 1.5% to $99.46 in premarket trading.

Gerra added that the upcoming fork for cryptocurrency Ethereum could "compound the demand weakness."

The analyst noted, however, that data center trends are still "very strong," but it's likely that a peak in year-over-year revenue comes in the first half of 2022 and gaming-related revenue is likely to be weak for the rest of the year.

On April 5, investment firm Truist slashed price targets across the board in the semiconductor space, including Nvidia (NVDA) and AMD (AMD), telling investors it has found "hard evidence of order cuts."