Market Overview

The S&P 500 closed out its best week since June as a report on Thursday showing slowing inflation raised hopes that the Federal Reserve would soon slow its tightening campaign.

The S&P 500 added 0.9%, to close at 3,992.93. The Nasdaq Composite added about 1.9% to end at 11,323.33. The Dow Jones Industrial Average gained 0.1%, closing at 33,747.86.

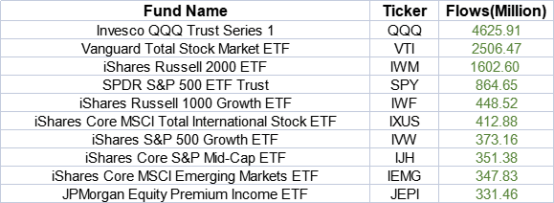

Top 10 ETF Creations (Nov.7-Nov.11)

Last week, Invesco QQQ Trust saw the largest inflow of $4,625.91 million, IWF, IVW also saw the inflow of $448.52 million and $373.16million separately. All of them showed that investors have shown great interest in growth stocks.

The more friendly CPI data sent expectations for Fed tightening lower, which enabledgrowth stockstorocket higher in this environment.

Meanwhile, IXUS, IEMG saw the inflow of $412.88 million and $347.83 million respectively, reflecting an increase of investor enthusiasm for non-U.S. equities, especially from the emerging markets.

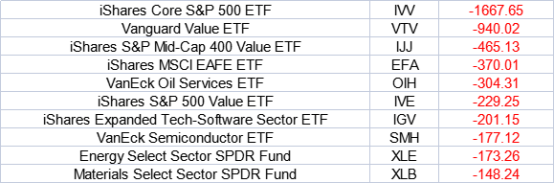

Top 10 Redemptions (Nov.7-Nov.11)

IVV ranks first among the Top 10 ETF outflow, with $1667.65 million running away. Another S&P500-related ETF IVE saw an outflow of $229.25 million.

Regarding sector ETFs, investors tried to stay away from the energy part as $304.31 million and $173.26 million outflowed from OIH, Energy Select Sector SPDR Fund. Meanwhile, IGV, SMH and Materials Select Sector SPDR Fund saw the outflow of $201.15 million, $177.12 million and $148.24 million respectively.