U.S. stocks ended a choppy session slightly lower on Wednesday(Oct.12), after minutes from the last Federal Reserve meeting showed policymakers agreed they needed to maintain a more restrictive policy stance.

The Dow Jones Industrial Average fell 0.1%, the S&P 500 lost 0.33% and the Nasdaq Composite dropped 0.09%.

Options Broad View

A total volume of 34,277,912 contracts were traded on Wednesday, down 0.2% from the previous day. Call options account for 47% of total options trades.

There are 8.12 million SPDR S&P500 ETF Trust options traded on Wednesday. Put options account for 58% in overall option trades.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, IWM, VIX, AMZN, BABA, AMD, META

Options related to equity index ETFs are still top choices for investors, with 2.61 million Invest QQQ Trust ETF options contracts trading on Wednesday.

Alibaba also saw a rise in options trading volume, with 556.1K contracts trading on Wednesday, put options account for 85%. Particularly high volume was seen for the $180 strike put option expiring Jan 20, 2023, with 61,447 contracts trading on Wednesday.

On Wednesday, shares of BABA rose by 0.48% and closed the trading session at a price of $75.73.

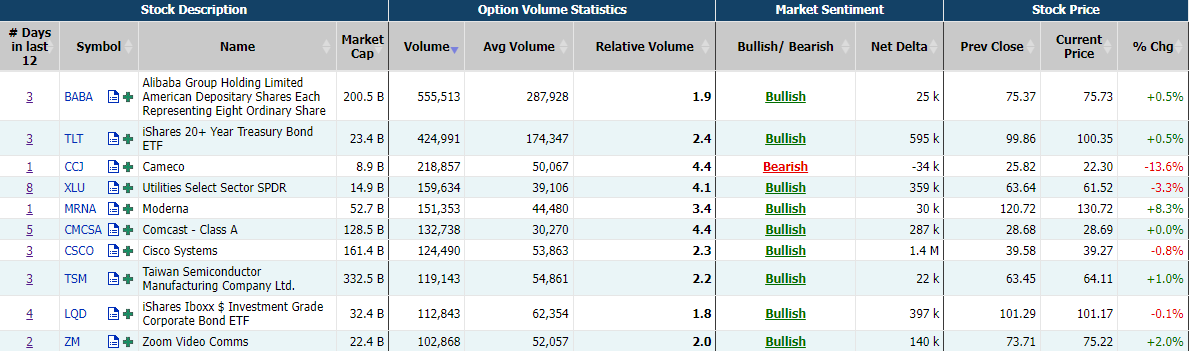

Unusual Options Activity

Moderna Rallied Over 8% on Wednesday after planning to develop a personalized cancer vaccine. Calls are slightly outnumbering puts, and the Oct.14 140.00 call is leading the way, volume is 9,109.

TSMC also saw usual options activity. There are 119,143 volume contracts trading on Wednesday, call options account for 46%. Particularly high volume was seen for the $65 strike call option expiring Oct.14, with 5,822 contracts trading on Wednesday.

TSMC posted an 80% surge in third-quarter net profit on Thursday, Reuters calculations showed, buoyed by strong sales of its advanced chips despite a slowdown in the global chip industry because of economic headwinds.

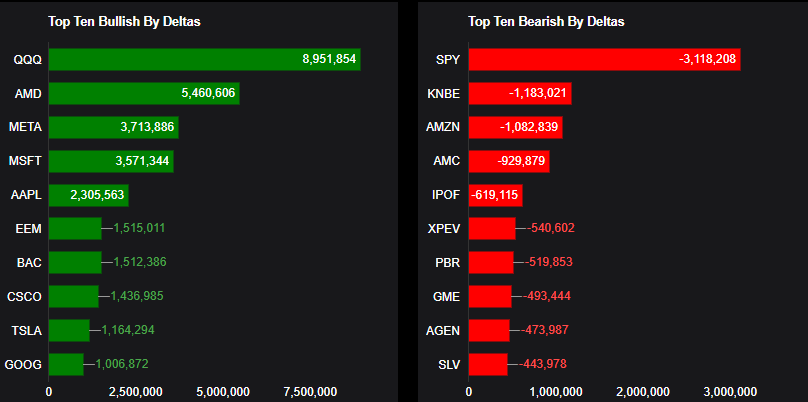

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: QQQ, AMD, META, MSFT, AAPL, EEM, BAC, CSCO, TSLA, GOOG

Top 10 bearish stocks: SPY, KNBE, AMZN, AMC, IPOF, XPEV, PBR, GME, AGEN, SLV

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club